Do you need to know how metal prices have changed nowadays? You can use this API with metal information to discover it!

Despite the current situation in Ukraine, skyrocketing prices, and mounting contractionary concerns, most traders remain focused on gold. There are many changes in different metals nowadays.

Gold And Silver

The actual direction of the dollar impact significantly in the cost of gold. The financial system of the US Federal Reserve is likely to remain mostly unchanged in 2023. And besides, inflation is likely to keep declining, and financial institutions will be closely watching the faltering US industry.

If the Federal Reserve maintained or even decreased interest rates, the value of gold can persist. A high for the metal in euro terms is very possible if the spot price reacts more positively than the dollar price to these indicators. Gold surpassed its record high in March 2022, trading at nearly 1,870 euros per troy ounce.

A slight increase in phone consumption may assist in maintaining silver’s value. By 2023, purchases of devices with 5G capabilities will rise, which must boost the growth of silver. Furthermore, the photovoltaics industry can continue to grow in 2023. On the other hand, the market for silver rings may decrease as a result of the previous year.

Because of the mine’s capacity to gradually increase production, the value of silver’s rising prospect may be difficult. However, if the Federal Reserve makes the predicted adjustment to its aggressive bank rate approach, this should undermine the value of the dollar and increase the cost of silver, just as it does for gold.

Platinum And Palladium

Probably, the industrial platinum sector would be in oversupply. The main output would increase by 10% in 2023. But maybe will be a little decrease in secondary supply. The old vehicle market is still fairly strong as a result of the semiconductor crisis, thus platinum extraction from catalytic converters for old cars may also slow down. On the other side, platinum will ultimately be utilized more frequently in the hydrogen economy as more PEM electrolyzers are deployed.

The palladium industry ought to be oversupplied the following year. The need in the auto industry, which has a customer base that accounts for further than 80% of the industry, will hardly change because the increase in the manufacture of light cars will be offset by the reduction of market share in petrol cars for electric vehicles powered by batteries.

Palladium will be replaced by platinum more rapidly since platinum is substantially more costly. Consumption will decline in the chemical, electrical, and dental sectors. Russia provides over 40% of the world’s palladium supply, so any sanctions imposed on it or its exporters of goods might affect pricing.

Pay Attention To Metal Rates Changes

You’ll find that these are a few metals that, by themselves, demonstrate the many market forces at play. Due to this, you should be informed of the rates and any potential changes if you wish to join.

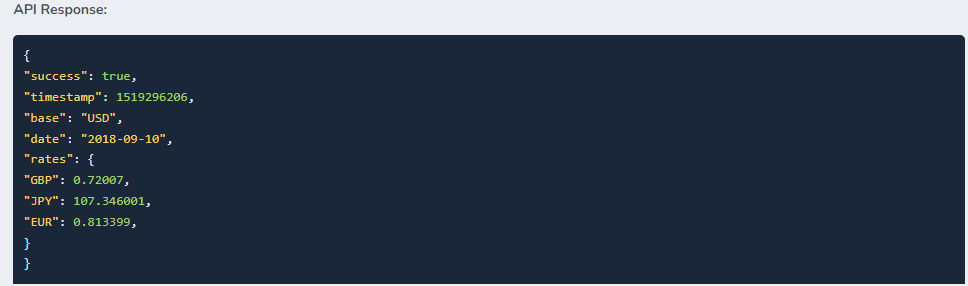

With so much unstructured data available online, it is not simple. As a result, you must accomplish it with trustworthy sources. Therefore, we wish to provide an API that not only contains current data, but you may also use it to share with your customers for advice. This is the Metals-API, which provides answers like these:

Why Metals-API?

Metals-API is distinguished by its ability to deliver data. You may also use it to add historical metal data and statistics on market volatility to your website. However, because the API obtains this information from the most significant financial institutions, you must believe it.

By reading it every day, you may become an expert investor. Because you will be ready to give your investment customers access to a wealth of data using this API, you will also be capable of advising them much more effectively. Rates for these metals as well as others are available.