The World Indices API offers an essential solution, providing seamless access to global stock market indices. Whether you’re a seasoned trader or a beginner, this powerful API allows you to track international markets efficiently, make informed decisions, and refine your trading strategies.

How to Use the World Indices API

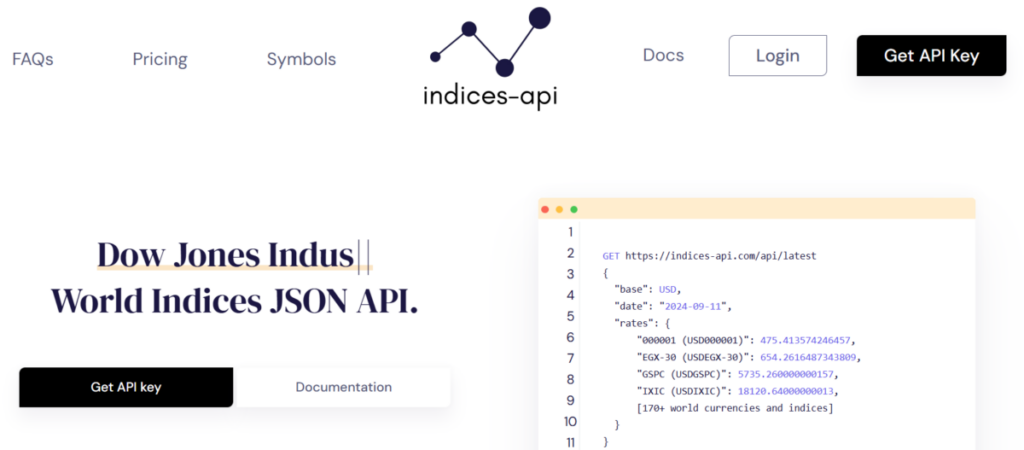

Using the World Indices API is simple and straightforward. First, you need to register for an API key, which will allow you to access the market data. Once you have the key, you can integrate the API into your trading platform or financial tools. The API provides real-time data, including stock index values, market changes, and historical performance. By calling specific endpoints, you can pull data for various international indices like the Dow Jones, FTSE 100, Nikkei 225, and many more.

This real-time data is crucial for traders who rely on up-to-date information to make quick decisions. By using the World Indices API, you can track market fluctuations as they happen, giving you an edge in dynamic and volatile trading environments.

Why Real-Time Market Data Is Essential for Traders

In the world of financial trading, time is money. Delays in accessing market data can lead to missed opportunities or poor decision-making. That’s why real-time data is critical for traders. The World Indices API offers up-to-the-minute updates on global stock indices, ensuring that investors always have the latest information at their fingertips. With access to accurate, live data, traders can adjust their strategies quickly and respond to market changes in real time.

For instance, a sudden drop in the Dow Jones Industrial Average or an unexpected rally in the FTSE 100 could influence traders’ decisions on buying or selling positions. Without real-time access to such updates, traders risk making decisions based on outdated or incomplete information, which can significantly impact their profitability.

The Benefits of the World Indices API for Enhanced Trading Strategies

The World Indices API is more than just a tool for accessing market data. It empowers traders to build and refine their trading strategies by offering several key benefits:

Comprehensive Coverage: The API covers a wide range of global stock market indices, from the US and Europe to Asia and emerging markets. This broad coverage allows traders to monitor multiple markets and diversify their portfolios effectively.

Customizable Alerts: Traders can set up alerts based on specific market conditions, such as when an index reaches a certain threshold. This feature helps traders stay ahead of the curve without constantly monitoring the markets manually.

Historical Data: In addition to real-time data, the World Indices API provides access to historical index data. This allows traders to analyze long-term trends, identify patterns, and make data-driven predictions about future market movements.

Scalability: The API is designed to scale with your needs, whether you’re managing a small portfolio or trading on a large institutional level. Its flexibility ensures that it remains a valuable tool as your trading activities grow.

By integrating the World Indices APIs into your trading workflow, you can enhance your strategies with reliable, timely, and accurate market data. Whether you’re developing algorithms, monitoring trends, or adjusting your trading approach, this API gives you the tools you need to succeed.

Conclusion

In a world where market conditions can change in an instant, having access to reliable and real-time market data is essential for successful trading. The World Indices API offers a powerful solution for investors who want to stay informed about global markets. By providing accurate index data, customizable alerts, and historical insights, it helps traders make better decisions and improve their overall trading strategies. Whether you’re a novice or an experienced trader, the World Indices API can give you the edge you need in the fast-paced world of international finance.

Meta Description: