In this post, we discover why it is essential to validate the vat number of your customers to legitimate the transaction process.

The value-added tax, abbreviated as VAT, is a tax that applies to all countries in the European Union. VAT is a consumption tax that applies to almost all goods and services purchased and sold in Europe, whether for consumption or use.

However, the impact of this tax is not as simple to calculate as it may appear at first glance. The European Union establishes a minimum of 15% for the general rate, which applies to almost all goods and services sold on EU territory, but also considers the possibility of creating reduced rates (minimum of 5%) and special rates (super-reduced, zero, or intermediate) for certain basic products such as food, medicines, or books.

The sum of all of them, taking into account the number of transactions to which each one applies and the possible exemptions, yields the effective rate of VAT, which is the most precise and allows for a more accurate comparison of how it is taxed. in the European Union’s consumption

According to the companies’ current situation, it is necessary to seize any opportunity that may arise as new European clients. The first thing to remember is that most goods purchased in Europe are subject to VAT, which must be applied and accrued. Other operations, such as non-EU exports, are not subject to VAT because it is applied and accrued in the importing country.

Because it is a tax that is generally paid on final products and then the company must prove it legally, it is the final consumer’s responsibility to be able to collect this tax. For this reason, the commercial process must be legitimate and valid for the company that produces and passes the product through several transactions until it is the final product is a valid process. That is why it is critical to verify the validity of VAT numbers.

Use An API

Because of this, it is necessary to be able to validate the VAT numbers in the transaction process. Unfortunately, many people falsify them in order not to comply with their taxes. And that not only brings a problem for the country because they cannot collect the necessary amount of money according to the transactions in the population, but it can complicate the process for companies that have to pay VAT.

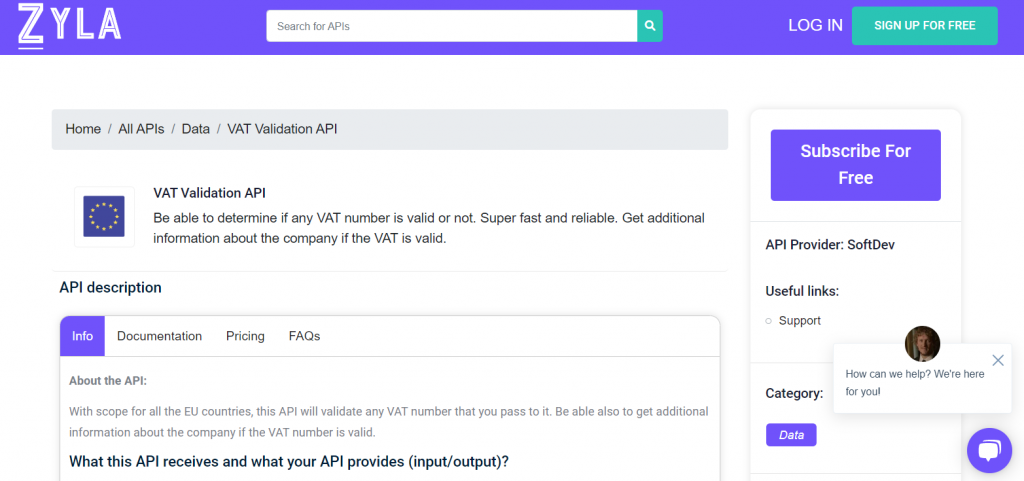

For this reason, you should use an API that is a programming interface. Thanks to its software development, it can work in different places at the same time and update information. And how is this related to VAT? An API like VAT validation API allows you with a simple scan to validate VAT numbers by providing information such as location and company name, to show that it is legitimate, or the opposite.

About VAT Validation Number

It’s a VAT Validator API is an essential tool to guarantee a legitimate transaction process within the European Union zone. The API scans each number giving you an immediate response. If you work in a company or the government and you need to validate these transactions or discover if they are false, this API will help you speed up your task.