Did you know that many companies in the United States use a Tax Calculator API? These types of services are essential for any American company that wants to correctly calculate its taxes. If you are interested in implementing this API for your company, then keep reading this post.

American companies must calculate taxes correctly to ensure compliance with the law. Accurate tax reporting avoids legal consequences and financial penalties. It promotes transparency and upholds public trust in businesses. Proper tax calculations prevent undue burdens on the IRS and government resources. Compliance demonstrates corporate responsibility and ethical business practices.

Misreporting taxes could lead to reputational damage and loss of investor confidence. It ensures a fair contribution to society and the funding of public services. Correct tax calculations help maintain a level playing field among businesses. Avoiding tax evasion allegations preserves a company’s integrity and credibility. Ultimately, precise tax calculations contribute to a stable and thriving economy.

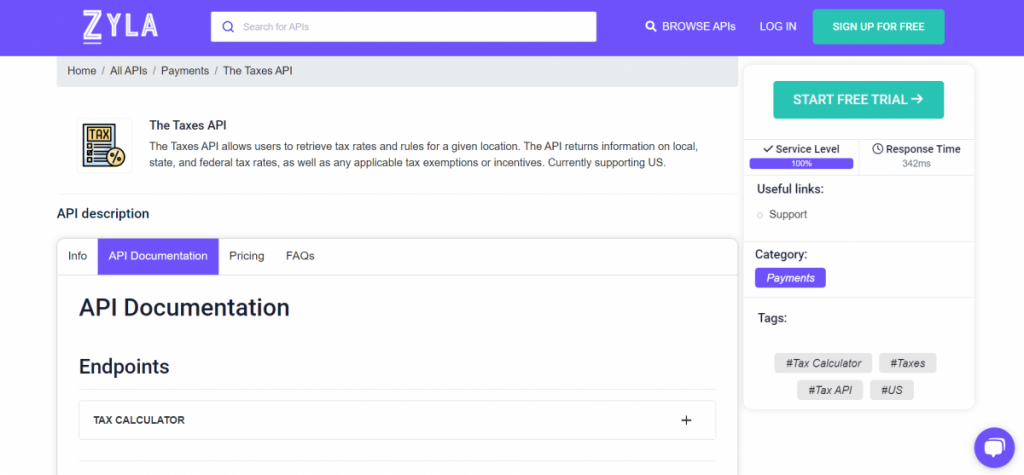

There are many services that will help you calculate a company’s taxes. We recommend using APIs, especially a Tax Calculator API. These services, as the name suggests, accurately calculate taxes. In Zyla API Hub (API Marketplace) you will find an interesting platform called The Taxes API. This API is widely used by many American companies for many reasons. It offers many benefits!

Why Do Companies Use The Taxes API?

In the fast-paced world of business, American companies need efficient tools to streamline their operations, and The Taxes API by Zyla Labs is the ideal solution. This robust API empowers companies with accurate tax calculations, simplifying their financial processes and ensuring compliance with ever-changing tax regulations. Companies can effortlessly calculate their tax liabilities in real-time, removing the complexity of manual calculations and potential errors. This automation not only saves valuable time but also reduces the risk of tax-related penalties and audits.

One of the standout features of The Taxes API is its ability to adapt to the dynamic nature of tax laws. It updates in real-time to incorporate the latest tax code changes, ensuring that businesses remain fully compliant. This adaptability helps companies stay ahead in a constantly evolving tax landscape.

Furthermore, The Taxes API simplifies tax reporting for American companies. With just a few API calls, businesses can generate accurate and detailed tax reports, making the process significantly more efficient than traditional manual methods. This feature is especially valuable during tax season when companies need to meet deadlines promptly. Also, Zyla Labs employs robust security measures to safeguard sensitive financial information, giving companies peace of mind while handling their tax data.

In this video, we’ll show you how to use this API to calculate taxes:

In conclusion, The Taxes API by Zyla Labs is a game-changer for American companies. Its ability to accurately calculate taxes in real-time, provide up-to-date compliance, simplify reporting, and offer tax optimization insights makes it an invaluable tool. Definitely, the best tool for American companies.

You can also take a look at this interesting article: Top Rated Taxes API For Worldwide Companies