Online transactions have become an essential aspect of many people’s and businesses’ everyday lives in an increasingly computerized environment. However, the risk of fraud and internet fraud has grown. To avoid fraudulent transactions, many organizations utilize technologies such as credit card verifiers.

But which credit card checker API provides the most detailed information? In this essay, we’ll go into the realm of API credit card verifiers to see which is the most thorough and effective right now.

How Does A CC Checker API Work?

A CC Checker API is a tool that is used to validate credit card information online. In layman’s words, a CC Checker API accepts credit card details such as card number, expiration date, and CVV code and then verifies that the data is authentic and from a legitimate credit card.

To do this, the CC Checker API employs sophisticated algorithms that evaluate card data in real-time and determine if it corresponds to the patterns and procedures established by credit card providers. If the card is legitimate, the API provides a good answer, indicating that it is ready for usage. If the card is invalid, the API returns an error, indicating that the card cannot be used for the transaction.

Online shops and payment service providers utilize CC Checker APIs to prevent fraudulent transactions and safeguard their customers. These technologies can help detect and prevent the use of stolen or counterfeit credit cards. Furthermore, CC Checker APIs may assist firms in meeting credit card industry rules and security requirements.

Which CC Validator API Is The Best On The Market?

We can certainly declare that after examining different market alternatives, we have identified one that, due to its functionality and ease of use, is one of the best current options.

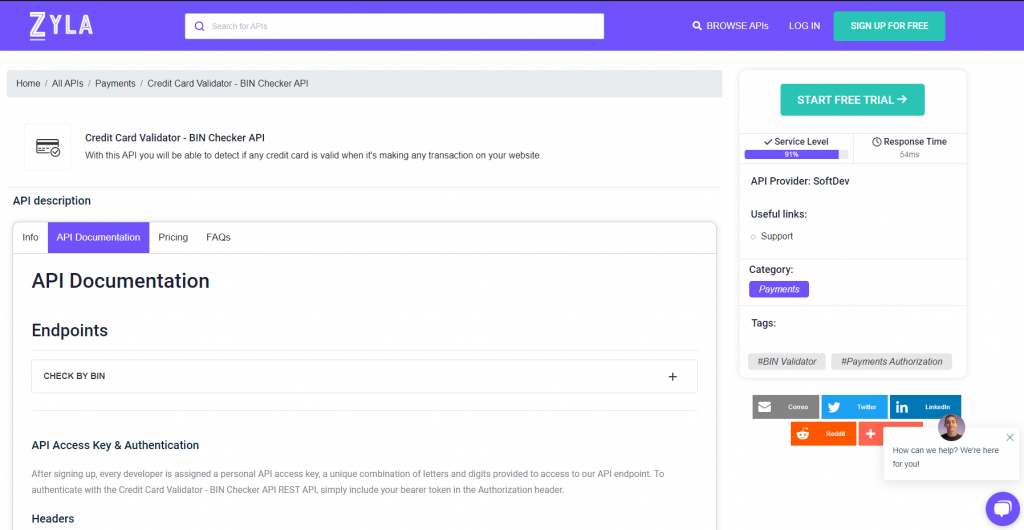

This choice is the Zylalabs Credit Card Validator – BIN Checker API since, as previously said, it is an API that has worked quite well for us and is rather simple to use even if you don’t know much about it.

The consumer will send the credit/debit card (Bank Identification Number) or IIN (Issuer Identification Number) to acquire the whole data set.

You must input a BIN (Bank Identification Number) – the first 6 digits of a credit/debit card – to access the entire data of this BIN/IIN in JSON format.

The validity of the card, whether it is a VISA or MASTERCARD, the issuing bank, and the card’s issuing location will be sent to you.

For example, if we use this endpoint to enter the BIN number “448590,” the API will return the following:

{

"success": true,

"code": 200,

"BIN": {

"valid": true,

"number": 448590,

"length": 6,

"scheme": "VISA",

"brand": "VISA",

"type": "CREDIT",

"level": "PURCHASING WITH FLEET",

"currency": "USD",

"issuer": {

"name": "JPMORGAN CHASE BANK, N.A.",

"website": "http://www.jpmorganchase.com",

"phone": "1-212-270-6000"

},

"country": {

"country": "UNITED STATES",

"numeric": "840",

"capital": "Washington, D.C.",

"idd": "1",

"alpha2": "US",

"alpha3": "USA",

"language": "English",

"language_code": "EN",

"latitude": 34.05223,

"longitude": -118.24368

}

}

}How Can I Get This API?

1- Navigate to Credit Card Validator – BIN Checker API and click the “START FREE TRIAL” button to begin using the API.

2- You will be issued your unique API key after registering in Zyla API Hub.

3- Check the BIN number using the API endpoint.

4- When you’ve reached your endpoint, perform the API request by hitting the “run” button and viewing the results on your screen.

Related Post: Most Common Uses Of A Transaction Validation API