Ever wondered exactly how the metals market works? In this article I’ll introduce you to what the market is and how you can track its information with an API.

XAU/USD is the abbreviation for the spot gold price quoted in U.S. dollars. The XAU/USD price represents the price of one troy ounce of gold in U.S. dollars. Gold is often quoted in this way because it is a widely traded commodity and the U.S. dollar is a widely accepted currency. The XAU/USD price can be affected by various factors, including changes in the value of the U.S. dollar, global economic conditions, and investor demand for gold.

Gold is often considered a safe haven asset, as it has a long history of maintaining its value over time. This makes it an attractive investment for people looking to preserve their wealth or hedge against market instability. Gold has traditionally been used as a medium of exchange, and many central banks around the world hold gold reserves to back their national currencies. It also has a number of important industrial uses, including electronics, dentistry, and medicine. It is used in the production of jewelry, which is a significant contributor to the global demand for metal.

Gold plays an important role in the global economy due to its unique properties and widespread use in various industries. This is why many related businesses need to track its price daily in order to take decisions. The price of gold also affects the price of other metals in the market. The price of XAU/USD can be tracked on financial markets, such as the London Bullion Market Association (LBMA) and the New York Mercantile Exchange (NYMEX).

Tools like APIs have contributed to integrating real-time information into digital platforms. Nowadays it is really easy for businesses. There are Metal APIs that allow the integration of information about the metals market and tracking it. But, how do they work, and why are they important?

What Is A Metal API And Why Are They Important?

Precious metals are often used as investments and are valued for their rarity and beauty. They are often used as a hedge against inflation and as a way to diversify an investment portfolio. Industrial metals, on the other hand, are used primarily in the manufacture of products and are valued for their usefulness in industry. Companies should follow the price of these metals, either to trade or to buy and sell at updated prices.

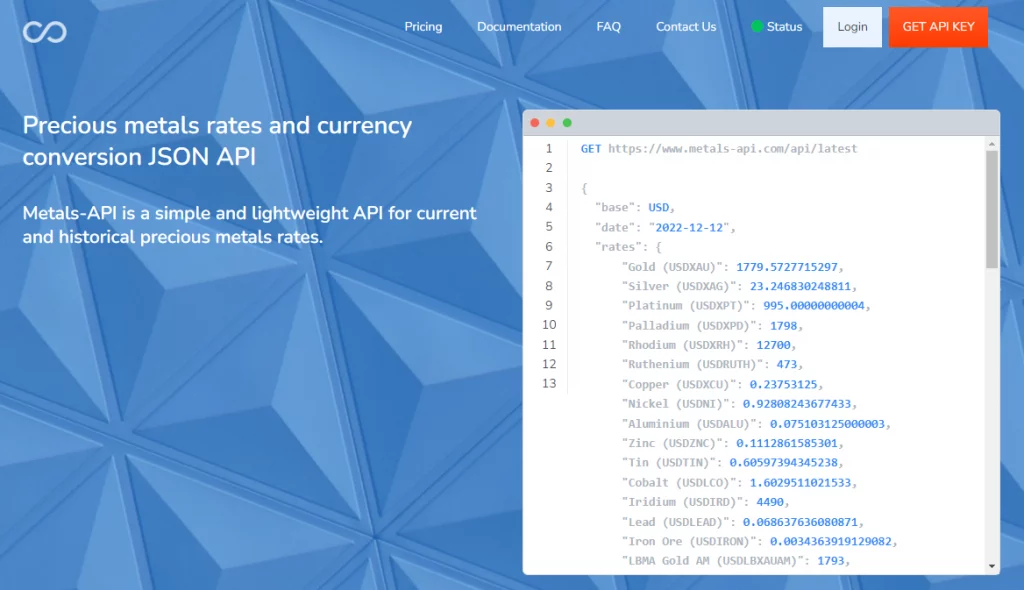

A Precious Metals API can provide access to real-time metals prices, and enable integrations with other applications, such as technical analysis or portfolio tracking platforms. As there are several such APIs on the market, we suggest you try MetalsAPI, a tool that contains first-hand global information.

More About MetalsAPI

MetalsAPI is a digital tool of the highest quality. It is known in the market for providing accurate and reliable information. This is thanks to the fact that it provides a connection to reliable sources of the world’s major markets such as World Bank or LBMA. This API provides a wide variety of information, such as the spot price or pricing of metals. You can also find historical market information.

This is a very easy-to-use tool, with a friendly interface, and easy to integrate into all types of platforms as it is compatible with most programming languages. It has some unique attributes such as the possibility to compare prices from different historical dates. Still haven’t decided to work with MetalsAPI? Don’t waste your time.