In the intricate realm of financial markets, real-time access to a CME Group Rates API emerges as a pivotal asset for professionals navigating the labyrinth of trading and investment. This article embarks on a comprehensive journey, shedding light on the significance of these rates and delving into the realm of Application Programming Interfaces (APIs) as indispensable tools for acquiring and leveraging such data.

Understanding The Essence of a CME Group Rates API

This API is a stalwart in the financial landscape, and plays a multifaceted role as a leading derivatives marketplace. Its prominence extends to a diverse array of rates, spanning interest rates to the nuanced realm of commodity prices. These rates, akin to the heartbeat of financial markets, pulsate with real-time data, influencing decisions and strategies across the spectrum.

For traders and investors, the accuracy of rate information becomes crucial in the dynamic financial ecosystem. Understanding how prices rise and fall—whether in the erratic world of Arabica Coffee futures or the steady world of Brent Crude Oil rates—enables market players to take well-informed positions and make wise judgments.

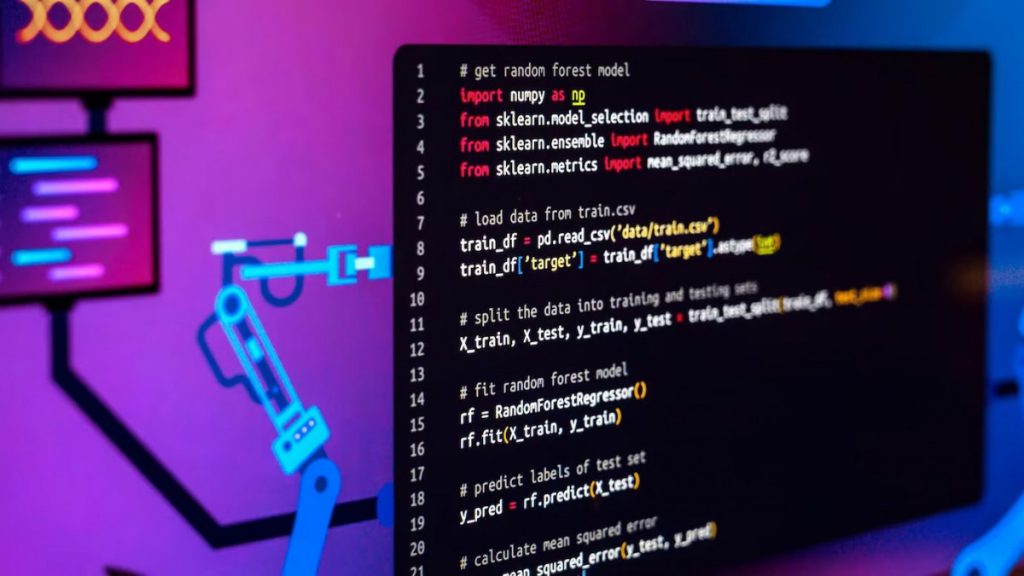

Real-time data in abundance can be accessed through this CME Group Rates API. Its architecture is made to offer both developers and financial experts a smooth and effective experience. The procedure of integrating the tool into current systems is efficient. For customers looking for dependability and simplicity of integration, the extensive documentation and assistance offered make it a compelling offer.

Selecting the most fitting API involves a nuanced evaluation of various factors. Understanding the intricacies of pricing models and subscription structures is paramount to aligning an API with budgetary constraints and usage patterns. Ensuring that the chosen API seamlessly integrates with different programming languages and platforms is essential for a cohesive workflow.

As we conclude, the encouragement echoes – delve into the world of APIs, explore their nuances, and implement the recommended solutions. In this dynamic landscape, the power of real-time data is a beacon guiding financial professionals towards success.

Commodities API

Commodities-API ensures millisecond response times, scalable volumes, and availability. The API provides real-time data along with separate endpoints for converting a single currency. Because of its well-defined structure, understandable code samples, and comprehensive documentation, you may implement the API in less than ten minutes. You can access a plethora of information by just passing one of the five primary API Endpoints your unique Access Key as a query argument.

The Only Thing You Have To Do To Use It Is:

You can use the Commodities API immediately after enrolling by clicking this link! utilizing the search criteria and symbols that the API provides to find the exact endpoints. Click “run” to initiate the API request and view the results on the screen after you’ve reached the required endpoint.

The Commodities API provides real-time commodity data at intervals of up to 60 seconds, with accuracy to two decimal places. Among the features are the ability to deliver exchange rates for almost any commodity, convert precious metals, retrieve time-series data, and provide volatility statistics.