Precious metal prices? If you are looking to get accurate precious metal price rates, you should know that you are in the right place. In the next post, you will find more information about an API that will help you in this goal, an API that is the best precious metals API.

Precious metals investments are a traditional component of a diversified portfolio. In times of financial market instability, it serves as a haven value and offers stability and liquidity to investors. Metals like gold are not subject to country inflation and are not governed by any government, in contrast to other forms of money. Investors typically purchase metals like gold with the following goals in mind: decorrelation, future investment, financial security, diversification, protection against inflation, preservation of purchasing power, liquidity independent of market conditions, etc.

Since it has been used as money for at least 4,000 years, gold is the finest option for maintaining value through time. Silver would be the younger sister of gold, although it has a wider range of industrial uses. The other metals, such as platinum, palladium, rhodium, and ruthenium, are more speculative because they are rarer and in higher demand by the industry. However, these metals are generally used a lot in jewelry. But since pure gold is too soft for jewelry, an alloy is made by mixing it with other precious metals. For instance, yellow gold is a mixture of silver, copper, and gold.

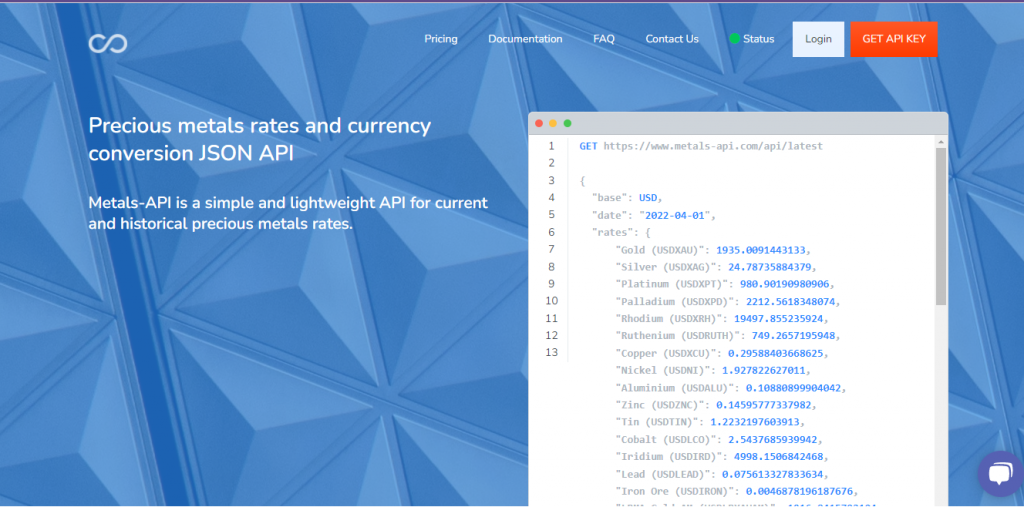

However, it is not always easy to obtain the precious prices of precious metals. Especially with the chaos in the economy. Many precious metals, such as gold or silver, are changing their prices every hour. But don’t worry, Metals-API is here to give you that precision you need.

Why Metals-API?

You may be wondering “why Metals-API?” and “What makes it special? Due to the high caliber of the information sources, it receives, this service is renowned for its dependability. The London Metal Exchange (LME), the Chicago Stock Exchange (CBOT), the New York Mercantile Exchange (NYMEX), and other metals-focused financial institutions are some of the partners it currently has. Prices for precious metals will be displayed accurately in any legal tender you choose, including dollars, euros, yuan, Chinese dollars, Japanese yen, and Indian rupees.

The fact that all precious metals data is acquired in real-time, with a precision of two decimal places, and at frequencies of up to once every 60 seconds is another crucial aspect of Metals-API.

“I agree that it’s excellent, but how much does it cost?” Your inquiry has two solutions. There is an uncharged version available, however, there are usage restrictions. In this version, you can access precious metals prices without spending anything. But there are annual payment options as well, which will provide you with better benefits if this does not work for you. These plans have annual costs ranging from $49 to $4800. It is important to note that the prices are annual, but if you regret the plan you chose, don’t worry, you can correct this and choose a more expensive or cheaper plan.

Remember that there is an online handbook for this system’s operation if you have any questions. However, there is a virtual chat available 24/7 from 9 a.m. to 6 p.m. (GMT+1) if there is anything you don’t understand.