Did you know that the city of Coimbatore has a great relationship with the gold trade? Learn more about how to invest in Coimbatore gold through this precious metals API!

There are a lot of individual investors in Coimbatore who prefer to have a variety of investing possibilities. However, when it comes to gold or mutual funds, many investors are perplexed. To comprehend and make a decision, one must first comprehend how both systems operate.

Mutual funds and gold are not the same thing. If the economy is steady, mutual funds are vulnerable to market risk, and gold will not generate any returns. So, to have a better understanding of both investing alternatives, let’s start with mutual funds. A mutual fund is a type of investment vehicle in which a corporation receives money from a group of investors and invests it in a variety of stocks, bonds, and securities. The corporation will invest according to the strategy, just like mutual funds do.

The corporation will invest according to the plan, similar to how mutual funds have alternatives and plans where investors may choose from a variety of portfolios to invest in. When compared to mutual funds, investing in gold is straightforward.

Following market swings, gold news, and other indicators, one may obtain a general notion of how gold rates in Coimbatore will move and invest appropriately. It is preferable for an investor to invest in a variety of alternatives rather than focusing on a single one. However, it is up to the investor to decide what he wants to invest in.

In terms of IT firms, Coimbatore is ranked second. Individual investors from Coimbatore choose to invest in gold for this reason. They aren’t subjected to any one type in particular. They put money into gold in both electronic and physical forms. We’re all familiar with gold’s physical shape.

Physical gold refers to gold coins, bars, or jewelry, whereas electronic gold refers to a variety of investment choices, one of which is an ETF. For that, we recommend you the use of Metals-API which is a platform that works with an API and provides you with metals exchange data for you to get started in investing in Coimbatore Gold.

What Is Metals-API?

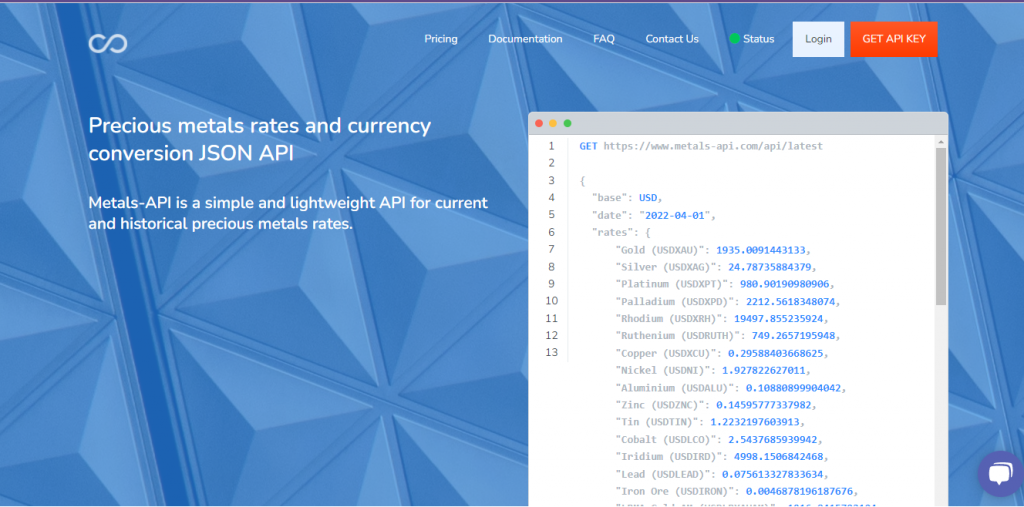

Metals-API It’s a simple software with a straightforward user interface that allows you to look at current and historical precious metals pricing from banks. Thanks to its robust back-end architecture, the Metals-API can provide precious metals exchange rates, convert single currencies, and provide Time-Series and Fluctuation data.

How Can You Sign Up In The Website?

Metals-API It’s quite easy to use. All you have to do now is follow the instructions below:

1- Create an account and generate an API Key; this code must be kept private since an API request requires it.

2- Pick a coin and a metal that appeals to you.

3- Make an API request from the dashboard, and the app will respond with an API response, and you’re done!

Looking For A Secure Platform?

Metals-API gets its monetary data from a number of places, including financial data providers and institutions like the European Central Bank. The connection is safe to the level of a bank since it is protected with bank-grade 256-bit SSL encryption.

Are Any Benefits For The Subscription?

Your Metals-API membership comes with unfettered access to a team of professionals who are solely responsible for assisting you with any issues or problems you encounter while developing or using the API. Check out these resources if you’re still not convinced if the Metals-API API is correct for you:

- Plans & Features

- Customer Service & Sales

- Documentation for APIs