Online financial transactions are growing more common, which has increased the need for transaction security. Validation of credit cards used in these transactions is one method of ensuring security.

This is where the Transaction Validation API comes in, a service that allows developers to integrate credit card validation into their applications and websites.

In this post, we’ll look at the benefits and reasons why businesses should consider incorporating a Transaction Validation API into their systems, as well as our recommendation for the finest alternative on the market. This API might help firms in a range of industries, from fraud protection to improving user experience. In addition, several common use cases for this API will be investigated, as will certain business opportunities.

What Are The Benefits Of Using An API To Validate Transactions?

There are various reasons why organizations and developers should use an API to validate a credit card. Some of these causes are as follows:

Fraud Protection: A credit card validation API can help organizations protect themselves from fraud by ensuring that the credit card used in a transaction is real and not being used illegally.

PCI Compliance: Payment Card Industry Data Security Standards (PCI DSS) compliance is required to ensure the security of credit card transactions. Businesses can achieve these standards with the use of a credit card validation API.

Improved User Experience – Credit card validation is a critical stage in the online shopping process. A credit card validation API can enhance the user experience by offering rapid and easy card verification.

Reduced Errors: Manually validating credit cards can be error-prone. The number of mistakes that occur while inputting credit card information may be considerably decreased by employing a credit card validation API.

Time savings – By automating the credit card validation process, businesses may save time, allowing consumers to finish the checkout process more quickly.

In conclusion, employing a credit CC checker API may give a lot of significant advantages for organizations and developers, ranging from fraud prevention to improved user experience and time savings.

So, Which Transaction Validation API Is The Most Recommended?

After reviewing various alternatives on the market, we can confidently state that we have found one that, owing to its functionality and ease of use, is one of the best current solutions.

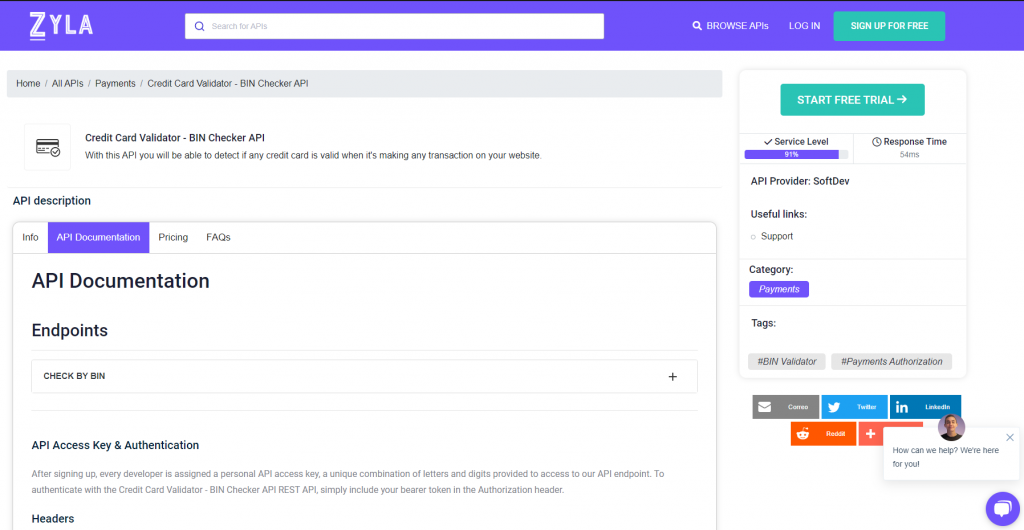

This option is the Credit Card Validator – BIN Checker API from Zylalabs since, as previously stated, it is an API that has worked incredibly well for us and is pretty straightforward to use even if you don’t know much about it.

To obtain the entire data, the consumer will transmit the credit/debit card (Bank Identification Number) or IIN (Issuer Identification Number).

To access the whole data of this BIN/IIN in JSON format, you must enter a BIN (Bank Identification Number) – the first 6 digits of a credit/debit card.

You will be notified of the card’s validity, whether it is a VISA or MASTERCARD, the issuing bank, and the card’s issuing location.

If we use this endpoint to enter the BIN number “448590,” for example, the API will return the following:

{

"success": true,

"code": 200,

"BIN": {

"valid": true,

"number": 448590,

"length": 6,

"scheme": "VISA",

"brand": "VISA",

"type": "CREDIT",

"level": "PURCHASING WITH FLEET",

"currency": "USD",

"issuer": {

"name": "JPMORGAN CHASE BANK, N.A.",

"website": "http://www.jpmorganchase.com",

"phone": "1-212-270-6000"

},

"country": {

"country": "UNITED STATES",

"numeric": "840",

"capital": "Washington, D.C.",

"idd": "1",

"alpha2": "US",

"alpha3": "USA",

"language": "English",

"language_code": "EN",

"latitude": 34.05223,

"longitude": -118.24368

}

}

}

But, of course, the most important issue is… how can I get it?

1- To begin using the API, navigate to Credit Card Validator – BIN Checker API and select the “START FREE TRIAL” button.

2- After registration in Zyla API Hub, you will be given your own API key.

3- Use the API endpoint to check the BIN number.

4- Once you’ve arrived at your endpoint, execute the API call by clicking the “run” button and viewing the results on your screen.

Related Post: How To Use A Transaction Validation API To Secure Your Business