Did you know that there is a tool that will help you correctly calculate your taxes? Many Americans have trouble calculating their taxes, but luckily, this Taxes API will help! If you are interested in knowing more about this API, take a look at this post.

Taxes are compulsory payments made to governments by citizens and businesses. They serve as the primary source of revenue to fund various public services, infrastructure, and government operations. Taxation is a crucial mechanism that ensures the functioning and development of societies. Individuals and entities pay taxes based on their earnings, profits, and transactions.

Different types of taxes exist, such as income tax, sales tax, property tax, and corporate tax. The government uses tax revenue to support education, healthcare, defense, transportation, and social welfare programs. Effective taxation plays a vital role in promoting economic stability and social equity. It enables governments to address public needs and invest in the betterment of communities, ultimately contributing to a well-functioning society.

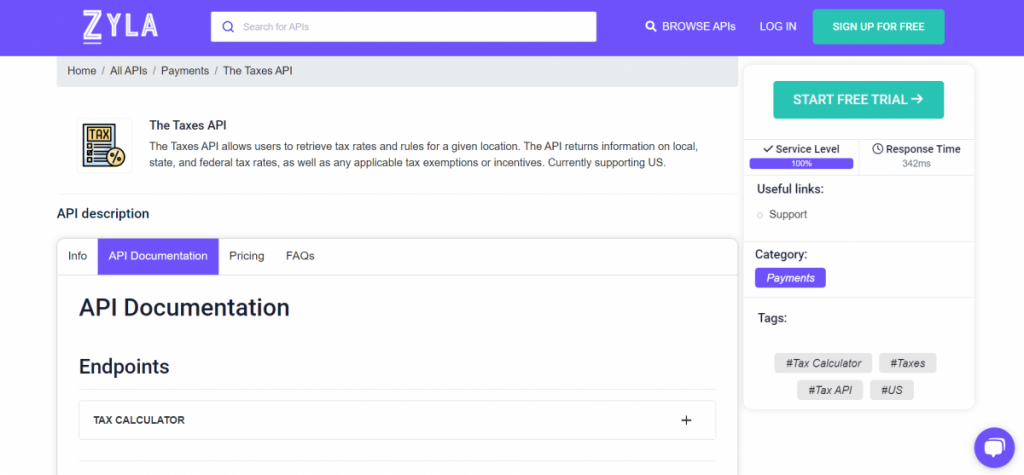

However, in the United States, many people have trouble calculating their taxes. To avoid having problems with the IRS (Internal Revenue Service), our recommendation is to use The Taxes API. This API available on the Zyla API Hub, returns information on local, state, and federal tax rates, as well as any applicable tax exemptions or incentives.

What Is The Taxes API And How Can It Help You?

The Taxes API from Zyla Labs is a tool designed to handle tax-related functionalities seamlessly. It simplifies tax calculations and provides real-time rates for different regions and items. With easy integration, developers can access accurate tax data for their applications. The API ensures compliance with tax laws and minimizes errors. It enables businesses to calculate taxes on transactions accurately.

The Taxes API also supports multiple tax types, including sales tax and value-added tax (VAT). It offers flexibility to customize tax settings based on specific business needs. Zyla Labs’ API provides up-to-date tax rates, keeping businesses informed about changes in tax regulations. The API’s intuitive documentation and support make it user-friendly for developers. By utilizing this API, businesses can streamline their payment processes and focus on core operations.

How To Use The Taxes API?

1: Create an account on the Zyla API Hub.

2: Select the API you want to use, in this case, The Taxes API.

3: Choose one of the 5 available plans and make the payment.

4: Select the endpoint “TAX CALCULATOR” and complete the required data.

5: When you’re done, click the “test endpoint” button and in just a few seconds, you’ll get the taxes data!

In this video we will show you in detail how this API to calculate taxes works:

Currently, The Taxes API offers 5 plans, which you can pay monthly or annually. Each plan has prices indicated in USD. If you want to purchase a plan with infinite API calls or contact customer service, just send an email to [email protected]. This tool is definitely the best for Americans who want to calculate their taxes.

Read this post: How To Use The Color Generator API In 2024