Staying ahead of economic trends is critical in today’s fast-pace and data-driven world for making decisions in education and navigating a complicate corporate landscape. Fortunately, the proliferation of Application Programming Interfaces (APIs) has transformed access to economic indicators, putting a plethora of real-time data at our fingertips. The Monetary Inflation Index API, a portal to comprehensive and up-to-date information on monthly and annual inflation rates, is one of these useful resources. Researchers, entrepreneurs, investors. And politicians may unearth a treasure mine of information by using the capabilities of this API. Allowing them to make better-informed decisions, reduce risks, and capture opportunities.

What Do Economic Indicator APIs Do?

Economic indicator APIs. Such as the aforementioned Monetary Inflation Index API, is use for a variety of reasons linked to economic research, decision-making, and planning. Here are some examples of frequent applications using economic indicator APIs:

- Economic research and analysis: Economic indicator APIs enable researchers, economists, and analysts to have access to a wide range of economic data, such as inflation rates, GDP growth, unemployment rates, consumer spending, and more. These data points are critical for performing comprehensive economic research, and examining economic trends. And investigating the links between various economic factors.

- Financial and investment analysis: Economic indicator APIs are use by financial institutions, investment businesses, and individual investors to incorporate pertinent economic data into their financial models and investment plans. They may analyze general economic circumstances, discover investment possibilities. And manage risks more effectively by having access to indicators such as inflation rates, interest rates, currency rates. And stock market data.

- Economic indicators in policymaking and government decision-making APIs give governments, central banks, and policymakers with up-to-date economic data to help them make decisions. These variables aid in the formulation of monetary, fiscal, and regulatory policies. Inflation rates, for example, are critical in calculating suitable interest rates and ensuring price stability.

- Economic indicators are use by businesses across sectors to plan operations, estimate demand, modify pricing strategies, and allocate resources effectively. Businesses may obtain insights on issues like inflation rates, consumer spending, and GDP growth by using economic indicator APIs. Allowing them to make educated decisions regarding manufacturing, pricing, marketing, and expansion.

- Economic variables such as inflation rates and exchange rates have an influence on corporate profitability, costs, and supply chain dynamics. Economic indicator APIs are use by risk managers to monitor trends, detect possible hazards connected with economic volatility, and design risk mitigation methods. To manage inflation-related risks, businesses might. For example, utilize inflation data to analyze the impact on costs and modify pricing or apply hedging techniques.

- International comparisons and benchmarking: Economic indicator APIs provide cross-country comparisons. Allowing analysts to compare and measure economic performance and trends across nations. This makes it easier to analyze foreign markets, compare investments, and assess relative economic strengths and shortcomings.

Which API Have The Most Accurate Economic Indicators?

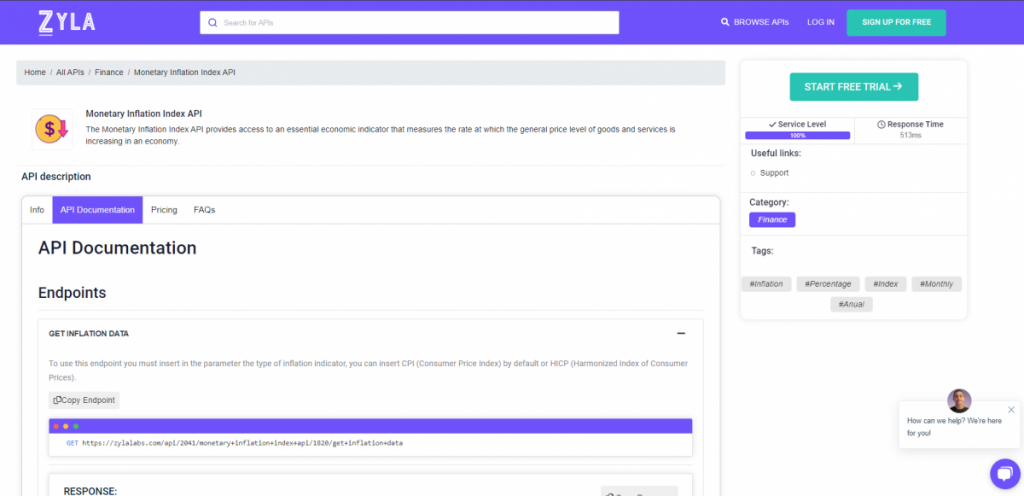

Following extensive testing, we can certainly claim that the Zylalabs API is the most user-friendly and produces the best results: Monetary Inflation Index API

Furthermore, the results are supplied in JSON format!

Entering CPI (Consumer Price Index) or HICP (Harmonized Index of Consumer Prices) into the “Get Inflation Data” endpoint. For example, results in the following:

[

{

"country": "Slovakia",

"type": "CPI",

"period": "march 2023",

"monthly_rate_pct": 1.161,

"yearly_rate_pct": 14.734

},

{

"country": "Slovenia",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": 1.505,

"yearly_rate_pct": 9.404

},

{

"country": "South Africa",

"type": "CPI",

"period": "march 2023",

"monthly_rate_pct": 1.017,

"yearly_rate_pct": 7.262

},

{

"country": "South Korea",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": 0.217,

"yearly_rate_pct": 3.697

},

{

"country": "Spain",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": 0.596,

"yearly_rate_pct": 4.096

},

{

"country": "Sweden",

"type": "CPI",

"period": "march 2023",

"monthly_rate_pct": 0.571,

"yearly_rate_pct": 10.639

},

{

"country": "Switzerland",

"type": "CPI",

"period": "april 2023",

"monthly_rate_pct": -0.003,

"yearly_rate_pct": 2.565

{

]Where Can I Find This Economic Indicator API?

- To get started, navigate to the Monetary Inflation Index API and click the “START FREE TRIAL” button.

- You will be able to use the API after joining Zyla API Hub!

- Utilize the API endpoint.

- Then, by pressing the “test endpoint” button, you may make an API request and see the results shown on the screen.

Related Post: Main Uses Of An API For Economic Indicators