Do you want to validate VAT numbers and get company data? You should use a VAT number validation API, and here we recommend one.

The VAT was established as a tax file number including all companies that perform business sales at the European level to differentiate between diverse scales of payment of this tax paid on the kind of national economies.

For example, several countries in the European Union have lowered taxes or eliminated the option to offset them immediately. Consequently, only companies who seek to do trade with other Public bodies may apply.

This identity was created with the introduction of the SEPA single payment network, which was initially implemented in Europe. As a result, companies now have to alter several rules governing the billing and recovery of work performed by other companies in the region. In actuality, one of these amendments mandates the collection of VAT from companies with intra-community activity.

The new strategy offers a tax benefit to both sides since the European Union considers it acceptable to not pay the tax at the moment of billing, given it is recorded through a reimbursement formula using models in the billed business.

Knowing which taxes each firm is subject to is a first-order problem since it implies the entire concept of tax collection in a country. Due to this, a lot of companies and governmental bodies try to figure out if the VAT statistics supplied by companies are true or whether they represent an effort to evade taxes.

Why Should Use VAT Validation?

A lot of circumstances can benefit from VAT number validity checks. One such circumstance is when you’re in a state office and have to verify a lot of VAT registrations from various businesses.

Sometimes people use VAT verification for the identification of firms upon enrollment on B2B e-commerce sites (e.g. web stores). Numerous line-of-business systems frequently utilize it to repeat VAT number validation data at different stages of the “customer lifecycle” (offer, purchase, invoicing, etc.). It is crucial to ensure the data are correct because of this.

Discover An API

However, it makes sense that you have numerous numbers to check rather than a small number of them, which suggests more labor requiring careful consideration and time commitment. As we’ve already stated, the goal of this is to enable you to get the technology necessary to expedite this task.

In this regard, APIs are special capabilities since they enable data to flow across various devices via their programming. This, for instance, enables the construction of several capabilities, one of which is the confirmation or demonstration of the falsity of a VAT number. Therefore, we advise using VAT number Validation API for your business. It provides you with data like country code, company name, company address, company city and company post code.

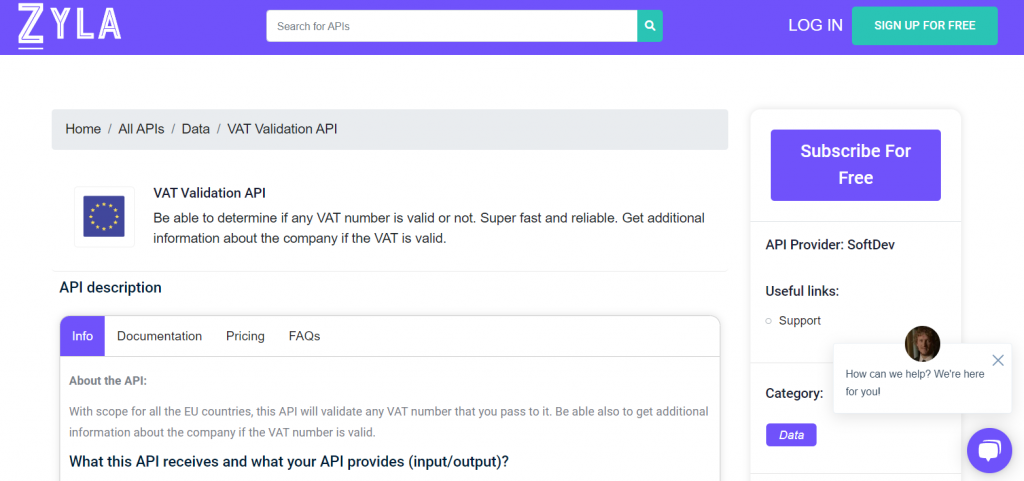

About the VAT Number Validation API

Among the most used APIs for verifying numbers in the European Union is the VAT number Validation API. You will be able to ensure a proper financial procedure in several firms with the help of this API. Data like the firm identifying information is reproduced. You can use it in a lot of scripting languages.