Do you want to validate BIN and ensure secure payments with a BIN checker? In this article, we’ll tell you how to do it!

To identify organizations that issue payment cards, the American National Standards Institute (ANSI) and the International Organization for Standardization (ISO) created the bank identification number. ANSI is a nonprofit organization (NPO) that develops business standards in the United States, whereas ISO is an international nongovernmental organization that develops standards for numerous industries.

Furthermore, using an Online Payment Security API is very easy and you can do it right from your computer or cell phone. You just need to enter the number of the card and you will immediately receive information about it. In this way, you will be able to know if it is valid or not, as well as if it belongs to a legitimate company.

We highly recommend using this type of tool in order to avoid frauds when buying products or services online. This is because it provides information about the validity of the card in addition to being able to detect if it has been blacklisted by any payment network for cases of fraud.

In addition, these tools are very user-friendly and can be used by both beginners and experienced people. To ensure secure payments on your e-commerce website, you should validate BINs using the correct API. If you don’t do this, you could end up accepting invalid cards which could result in financial loss for your business. This is as a result of their excellent usability and intuitiveness. We advise using this tool if you wish to start using one of these.

BIN IP Checker

This API has been created specifically for online business owners who want to carefully review credit/debit card transactions that occur on their websites. It paints a crystal-clear picture of just how risky the trades are. However, anyone is free to use this API on any platform in the manner of their choice and subject to their own set of limitations. How is this API utilized? The user will enter their credit/debit card’s BIN (Bank Identification Number) or IIN (Issuer Identification Number) in order to get as many details as they can. Additionally, if the request contains an IP address, it will return information about the IP address, compare the BIN information to the IP information, and determine the risk score for the transaction. Helping clients choose wisely is advantageous for online shops.

To use this BIN IP Checker API, you must first register. To start the free trial, click “START FREE TRIAL”. After that, you may begin running API queries. Select “test endpoint” to call the endpoint after providing the BIN number. The answer will include all pertinent data regarding that number. You can use it for development now that you know how to use it!

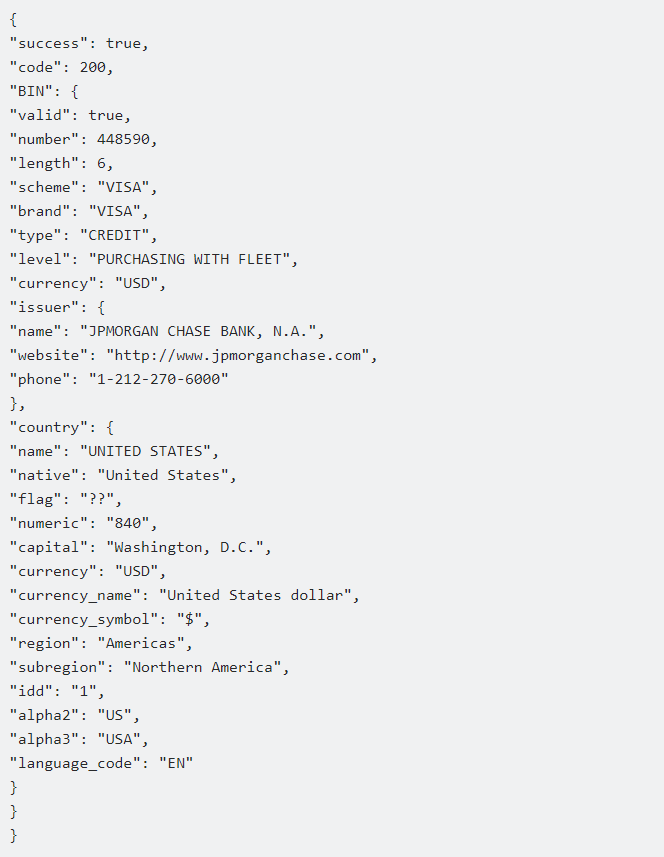

This endpoint will validate card BINs, which are the first six to eleven digits of each payment card, and it will provide a complete JSON answer. You can prevent fraudulent transactions from costing you money by using this API. Following your call, this API will respond with a response similar to the one seen here:

If the user provides only the BIN number, they will be given all of the BIN’s information. If the user sends both the BIN and the IP address of his client, the system will return the complete data of the BIN and the IP address together with a risk score.