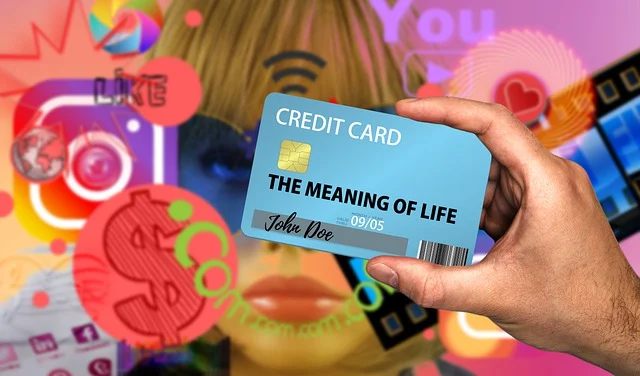

Business owners are aware of the risk that someone can hack into the system and steal information about your customers´ or your own card. In addition, if you do not protect card information, you could end up paying for something that you did not buy or use.

For the reputation of the business it´s crucial to keep all information safe, all private data protected, eliminating the danger of scam.

The PCI DSS contains 12 main requirements that cover a wide range of topics, including data protection, access control, vulnerability management, and security incident response. Each requirement has a specific set of requirements that must be met in order to achieve compliance. It´s necessary to count on an automated tool to read, cash and store data from credit cards to comply with the above listed requirements. Developers devise software to esa down the process and guarantee privacy, on the basis of Credit Card OCR API.

This API supports both domestic and international cards, so it’s perfect for anyone who wants to use it. It also allows you to check multiple cards at once, which can be useful when checking cards for a business or checking customer cards for your business.

A card validation API provides the following solutions: it assigns a unique ID to each person with access to sensitive data; protects sensitive data when it is stored on laptops or mobile devices; encrypts sensitive data when it is transmitted over open networks; regularly reviews policies and procedures to ensure compliance; maintains a documented information security program, and conducts annual self-assessments and external audits by a qualified third party,

With Card Validation Data API, you can quickly determine whether or not any of the cards in your database are valid. Additionally, you’ll receive more information about these cards, such as where they were issued and what their BIN number is. This API is perfect for those who want to verify if there are any invalid cards in their databases, and for preventing fraud in addition to seeing how well your system works with payment cards.

The first thing to do is to encrypt any sensitive data stored on your servers or transmitted over the Internet. The second step is to use strong authentication methods for employees who access sensitive data, such as two-factor authentication or multi-factor authentication. And the last step is to regularly audit your systems and processes to ensure that they remain secure.

The first step in staying up-to-date is knowing what standards are being introduced. To help you with that, we’ve put together a list of the most important cards: EMV is an abbreviation for Europay, MasterCard, and Visa. It refers to a set of standards for chip-based payment cards that are used in most of the world outside of the United States. In the US, these cards are commonly referred to as “chip-and-signature” or “chip-and-PIN” cards. The ones that follow are 3DS, AVS, CVV, TLS, SSL, AVAS, 3D Secure and Tokenization, all specific information to perform successfully with card payment.

An automated data capture API is ideal for those payment platforms that receive a credit card image, which businesses use to access the data and make your own validations, like authentication and credit card expiration date. The software has an edge on programmatic check-up of bank cards with efficiency and accuracy, protecting the card-holder´s private information; furthermore this tool is easy-to-use as it requires no expertise, and it´s functional which means that it can be integrated in any already existing system or website. It´s also affordable as it suits with its various plans any budgets.

In the endpoint “Get CC Details” the application needs only the input as a priority parameter, to ensure that images can be viewed properly. The speed in retrieving the result depends on the speed of the URL. The user can be certain that efficiency and privacy are guaranteed.

How To Get Started With Credit Card OCR API

If you count on a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

“ https://assets.materialup.com/uploads/103ef1d5-4d2e-4d0a-8c48-1aab4656ca35/preview.png” in the endpoint, the response will look like this:

{

"code": "200",

"data": {

"errorCode": 0,

"ocr": {

"cardNumber": "1234 5578 9012 3456",

"category": "",

"name": " UFN",

"validState": 0,

"validThru": "01/80"

},

"position": {

"bottom": 964,

"left": 165,

"right": 1432,

"top": 208

},

"score": 1

},

"message": "SUCCESS"

}