Would you like to create an app to help users understand the tax implications? Well, if that is your goal, then we have excellent news for you! There is an amazing Tax Calculator API that will help you achieve your goal. With this tool, calculating taxes is now much easier and simpler.

Understanding Tax Implications is essential to make informed financial decisions and complying with tax laws. Ignorance can lead to unexpected tax bills. Awareness helps optimize deductions and credits. It prevents tax-related errors and audits. Knowing the implications on investments maximizes after-tax returns. Understanding taxes is crucial for business owners to manage cash flow efficiently. It avoids penalties and legal issues. Awareness of tax consequences on inheritances helps with estate planning.

Proper knowledge assists in tax-efficient retirement planning. Comprehension of tax rules minimizes tax liability. It enables individuals to take advantage of tax-saving opportunities. Understanding tax implications fosters financial literacy and responsible citizenship. It empowers people to navigate complex tax systems confidently. Overall, being informed about tax implications ensures financial well-being and compliance with the law.

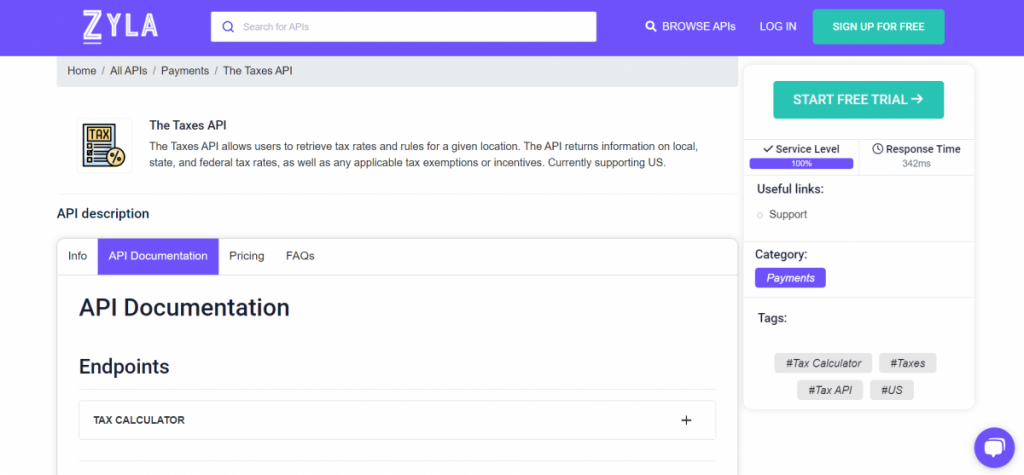

Not all users are informed about Understanding Tax Implications. For these reasons, many use apps to get help. If you are a developer looking to help users understand Tax Implications, then using a Tax Calculator API is a good idea. In this case, we recommend using The Taxes API available on the Zyla API Hub (API Marketplace). It’s the best Tax Calculator API!

Use The Taxes API To Help Users Understand Tax Implications

The Taxes API, offered by Zyla Labs, is a powerful tool that can greatly assist users in comprehending tax-related matters and making informed decisions. This tool is a part of Zyla Labs’ API Marketplace, specifically designed to provide users with a comprehensive solution for handling tax-related data. This API offers a wide range of functionalities, enabling users to calculate taxes, identify applicable deductions and credits, and stay up-to-date with the latest tax regulations.

One of the primary benefits of The Taxes API is its ability to simplify tax calculations for users. By integrating this tool into their applications or financial software, users can effortlessly calculate taxes for various scenarios, such as income tax, sales tax, or property tax. The API also offers real-time updates on tax regulations, helping users stay informed about changes that might impact their financial decisions. This ensures that users remain compliant with the latest tax laws, avoiding potential penalties and legal issues.

The Taxes API is not limited to individual users or businesses; it also caters to developers and fintech companies. By integrating this tool into their applications, developers can enhance their platforms’ capabilities and offer their users a more comprehensive financial experience. For these reasons, if you are a developer, you can integrate this tool into your website to help users understand Tax Implications.

Look at this video:

In conclusion, The Taxes API by Zyla Labs is a valuable resource for anyone seeking to navigate the complexities of tax implications. By leveraging this powerful tool, users can gain a clearer understanding of their tax responsibilities, optimize their financial decisions, and ultimately achieve greater financial well-being.

Read this post: Best Tax Calculation API For Investment Apps