Do you want to get all the information about credit cards with BIN numbers? You are in the perfect place! Keep reading!

The BIN is a unique code that identifies your financial institution. Each bank has its own BIN, which is assigned by the card scheme. The BIN is composed of four digits and is printed on the front of your plastic card. It can also appear on your monthly statement and at the bottom of the card.

So, we spent a significant amount of effort gathering BIN numbers from as many different sources as possible. This API includes filtering and refining the level of information as well as verifying its veracity. To present you with the most up-to-date information, we continually update our BIN database.

What Is The Purpose Of BIN Checker?

BIN Checker is mostly used in commercial enterprises to avoid fraud by adding an additional security layer to safeguard both customers and merchants. It is used by online stores to authenticate transactions against fraud and identity theft.

For example, if the location of your device where you perform the transaction does not match the country of issuance information returned from a BIN lookup, the transaction may be denied owing to fraud and more validation may be requested. Before trying further authorization, the online merchant’s system may quickly recognize the type of card and determine if they accept that card brand (Visa, Mastercard, etc.).

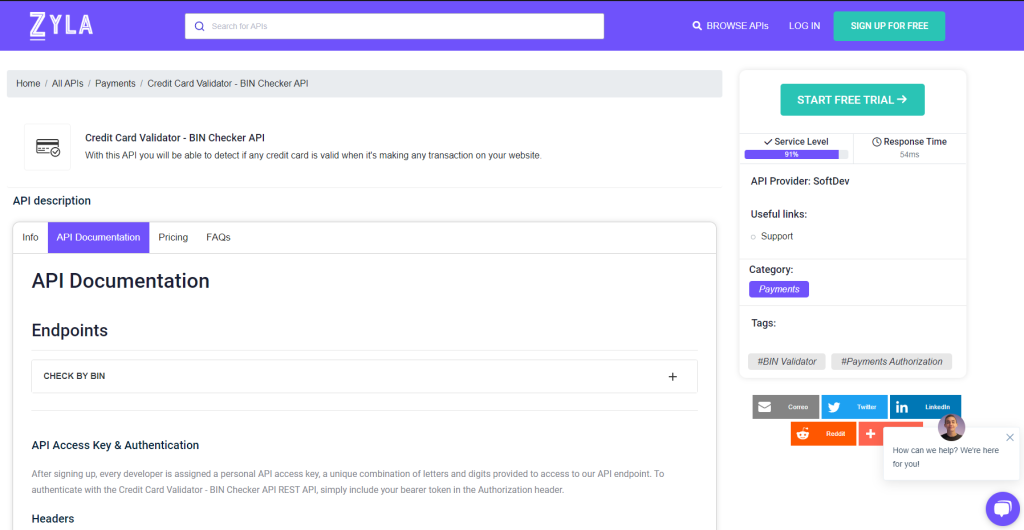

Use A Credit Card Validation API : Credit Card Validator – BIN Checker API

Credit Card Validator – BIN Checker API is designed to assist you in detecting fraudulent credit card transactions. Begin by using BIN numbers to verify, validate, and check all credit/debit card information.

By using the Credit Card Validator – BIN Checker API, developers can optimize their transaction approval rates by ensuring that the credit card information entered by the user is accurate and valid. This can help reduce the number of declined transactions, which can be frustrating for users and costly for businesses.

What does this API get and what does your API provide (input/output)?

To obtain the full details, the customer will transmit the credit/debit card (Bank Identification Number) or IIN (Issuer Identification Number).

What Are The Most Typical Applications For This API?

Credit Card Validator – BIN Checker API is suitable for people who want to include a payment gateway on their website. This API will aid in their efforts because it will detect if the card is invalid. This is also useful for identifying the issuing bank or business. So, depending on whether you have special deals with a particular bank, you will be able to authorize the transaction or not.

How Can You Obtain This Information?

1- Go to Credit Card Validator – BIN Checker API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- With your API key, you can already integrate the API in the language you need. In the mentioned URL, you can find a lot of Code Snippets, that can facilitate your integration.

Endpoint

- CHECK BY BIN

For instance, if you use the endpoint with the BIN number “448590,” the API will respond with the following:

{

"success": true,

"code": 200,

"BIN": {

"valid": true,

"number": 448590,

"length": 6,

"scheme": "VISA",

"brand": "VISA",

"type": "CREDIT",

"level": "PURCHASING WITH FLEET",

"currency": "USD",

"issuer": {

"name": "JPMORGAN CHASE BANK, N.A.",

"website": "http://www.jpmorganchase.com",

"phone": "1-212-270-6000"

},

"country": {

"country": "UNITED STATES",

"numeric": "840",

"capital": "Washington, D.C.",

"idd": "1",

"alpha2": "US",

"alpha3": "USA",

"language": "English",

"language_code": "EN",

"latitude": 34.05223,

"longitude": -118.24368

}

}

}The JSON-based Credit Card Validator – BIN Checker API is simple to integrate into your website or application. It also supports many languages, allowing you to easily convert the information into the language of your choice. You can also customize the appearance of your payment page to match the image of your business. Let us give it a try!