The widespread use of plastic money has replaced practically all the cash money payment system. Business owners need software to assist them.

A payment gateway is a software service that enables merchants to accept payments online from their customers. It processes payments, verifies them, transfers funds, and provides transaction reports.

Payment gateways are often used with online stores and e-commerce platforms but can also be used with other types of businesses. Users need automated technology that can pave the way of processing payment fast, efficiently and accurately. They request from developers to devise tools for this purpose, and they base their developments on the best application available on the market: Credit Card OCR API.

Credit card scanning APIs are frequently used to automate processes, which is particularly beneficial if you run a business with a lot of transactions. This is because you won’t have to spend time manually inputting data into your system each time a transaction occurs; instead, you can use an API to automatically process payments and receive information about transactions. Additionally, credit card validation APIs can be used to create new features or improve existing ones in your business’s software. This can help improve customer experience by making it easier for customers to pay for goods and services, as well as make it simpler for your staff to manage transactions.

Likewise, this technology guarantees the security of the customers´ data, which a stern feature as there´s always the risk of phishing and scamming. In addition, this API supports multiple platforms, so if you want to start accepting payments from your website or from an e-commerce platform, you can do it easily without having to worry about compatibility issues.

The customer’s bank will then contact the issuing bank to verify that the transaction is valid and that the cardholder has enough available funds in their account. This process is known as “authorization” and can take a few seconds or up to a few days depending on the circumstances. This API allows to process payments quickly and easily, without having to fill out any forms or wait for approval from the bank. It also supports many different programming languages, so it’s easy to integrate into any existing systems.

This means that you can start accepting payments immediately after signing up for an account with this API.

APIs are used by software developers to create applications or websites that interact with other applications or websites. In addition, APIs are used to exchange data between software components or applications. APIs are used in many different ways. They can also be used to integrate features into existing applications or websites, and they can be used by developers to create new applications or websites.

What Are The Benefits Of Integrating A Payment Gateway Into Your Business?

Integrating a payment gateway into your business can help accept payments more easily and efficiently. With a payment gateway, you can accept payments online, over the phone, or in person. In addition, this API is very user-friendly and easy to integrate into your website or app. It also offers a variety of features that make it easy to use and customize. And best of all: it’s very reliable and secure. This means that you can rest assured that your transactions will be processed quickly and accurately.

There are many benefits to integrating a payment gateway into your business, including:

– It’s easy to set up and use.

– It’s secure, so your customers’ information is protected.

– It helps you track your sales and profits.

– It helps you manage your cash flow.

– It makes it easier for customers to pay you.

– It helps your business grow by allowing you to accept payments from customers around the world.

Choosing the right payment gateway for your business is critical if you want to be successful. If you choose the wrong payment gateway, it could cost you money or even damage your reputation. Here are some points to consider when choosing a payment gateway: the number of transactions the payment gateway can handle, if it can’t handle the volume of transactions that you need, then it’s not going to be useful to you; if the payment gateway is secure, if it isn’t secure enough, then it could put your customers at risk and damage your reputation. Finally, consider how easy it´s to use; if it isn’t easy enough then it will cost you more time and money in the long run.

To Start Using Credit Card OCR API

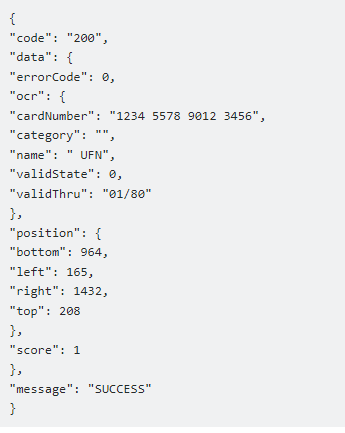

If you already have a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is : https://assets.materialup.com/uploads/103ef1d5-4d2e-4d0a-8c48-1aab4656ca35/preview.png in the endpoint, the response will look like this: