Do you want to obtain the current price of Iridium? Then, you need to use an API. Here, we recommend the best one!

In the production of deep-water pipelines, automotive catalysts, and aviation engines, companies needs iridium. This is because of its exceptional resistance to corrosion and high temperatures. In addition to timepieces and compasses, its application has expanded to include spark plugs, medical, and technological equipment.

Iridium was first found in 1803 amid the insoluble impurities of natural platinum. It is one of the most uncommon elements on Earth, with just three tons of it extracted and used each year. It is sold in modest numbers but is frequently essential in specialized goods like the temperature-resistant crucibles needed to cultivate synthetic crystals. Moreover, people use it in electrical and telecommunications systems.

Iridium Manufacturing

However, it is both rare and resistant. As a result, its price is increasing quickly. On some occasions, it has increases of over 100%. Iridium costs over $4,900 per ounce, which is more than three times the cost of gold. Analysts in the field predict that it will keep expanding.

Due to production interruptions in 2020, this rising tendency has intensified. also as a result of the rise in demand for metal, particularly for use in electronic displays. Investors anticipate that it will be utilized to manufacture hydrogen instead of fossil fuels, an element that is becoming more and more sought-after as a clean energy source.

In addition to other platinum-group metals like rhodium and palladium, the price of iridium has increased, reaching all-time highs as a result of supply shortages. Given that between 80% and 85% of the world’s iridium is produced in South Africa, this information is extremely pertinent.

Companies produce 250,000 ounces annually, as opposed to about 10 million ounces for palladium and 8 million ounces of platinum. Due to the market’s tiny size, any manufacturing disruption might significantly affect the product’s pricing. Few people participate in the purchasing and selling of metal, which is due to its size. Large industrial clients make up the majority of the market.

Use An API To Get The Current Price Of Iridium

If you want to invest in the iridium market, because you are at the forefront of technology, or as a financial asset, you need to be able to keep an eye on market dynamics. This is because many factors affect the price of precious metals: from economic to geopolitical. These situations generate different variations in prices, so you should follow up to know when to invest.

However, it may take you a long time to search for the price every day, perform an analysis of its fluctuation, verify that it is the actual price in all the markets of the world and more. Here we want to help you with an API that is all in one.

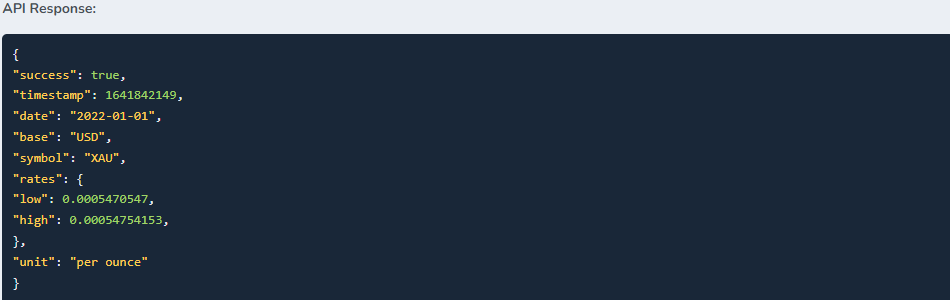

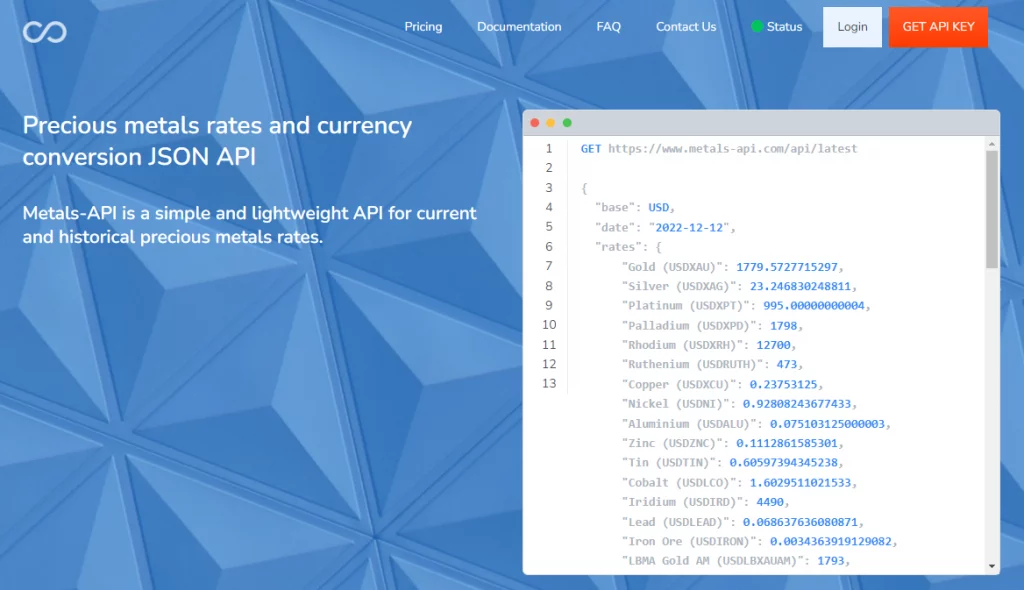

With Metals-API you will be able to see the price at the moment, evaluate historical prices and fluctuation data, and with data provided by financial authorities such as the World Bank and LBMA. A type of response would be like this:

About Metals-API

Metals-API is the best if you are an investor or want to advise investors from all over the world. You can incorporate any type of data contained in the API in the programming language you like.

It has vast documentation with data on different metals, in different currencies, and at different times, that you can include on your site. In this way, you can juxtapose different information so that clients can have a market analysis at hand. Thus, you will build trust with your customers, and they will come to you for giving complete and legitimate information.