This post will show you how to utilize an API to get platinum prices from the world’s largest and most significant exchange marketplaces, in this example, Nasdaq.

The global platinum market was severely oversupplied in 2021. Palladium prices have surged as a result of the Ukraine crisis, driving manufacturers to transfer to lower-cost platinum, weighing on growth. Russia produces over a quarter of the world’s palladium and one-tenth of the world’s platinum.

Substantial platinum imports into China were absorbed in 2021, with investors taking advantage of cheap prices. The platinum supply is predicted to drop by 1% in 2022 as a backlog of semi-processed metal in South Africa depletes.

Finally, whether you wish to work in the platinum industry or your firm needs platinum to run, you must be informed of current prices. There are, however, other online funding accessible. This is important to remember since comprehending the factors that define these metal rates needs data from reliable sources. Keep an eye on the Nasdaq values.

About Nasdaq

The Nasdaq is the world’s second-largest stock and securities exchange, trailing only the New York Stock Exchange (NYSE). All of its transactions are conducted electronically through dealers rather than in-person amongst traders. In general, Nasdaq attracts more high-tech and high-growth companies than other exchanges.

The Nasdaq, unlike several other exchanges, does not have a physical trading floor. All of its equities are exchanged electronically via an automated computer network. The Nasdaq draws some of the world’s largest blue-chip corporations. Apple, Amazon, Microsoft, Meta (previously Facebook), Gilead Sciences, Starbucks, Tesla, and Intel are among the major equities traded on the Nasdaq. Because it attracts high-growth firms, its equities are more volatile than those on other exchanges.

You’ll have to use the correct tools to collect data. For this purpose, we strongly recommend using an API that provides current platinum prices as well as historical rates based on Nasdaq data. Choose one with fluctuation data so you can take into account all of the variables when determining whether to invest.

What Is An API?

An API is a mechanism that allows various devices or applications to communicate with one another. You’ll need to check up and rely on technology for help. While a few sites may be useful, bear in mind that they are not all accessible or give the same content.

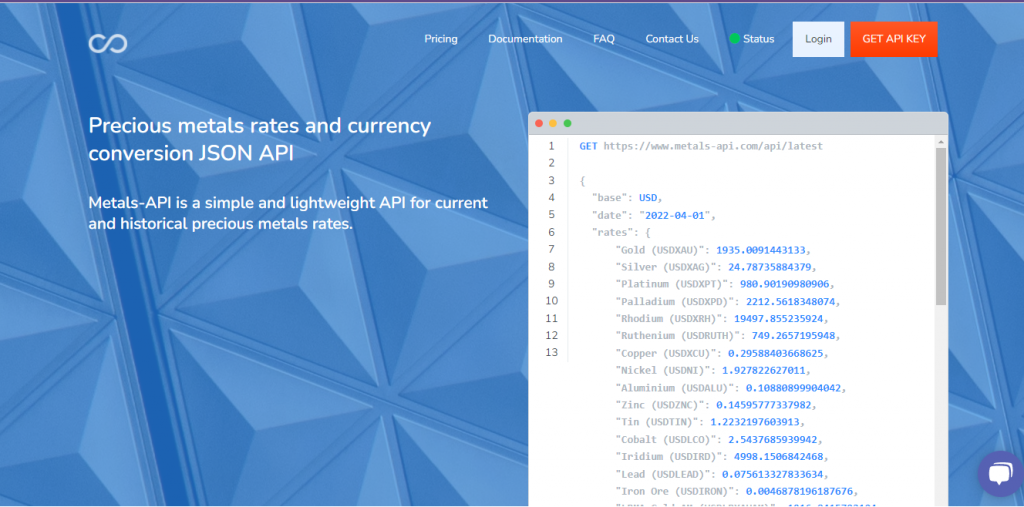

Finding an API is easy, but finding one that offers platinum prices in Nasdaq values is more difficult. Metals-API, one of the biggest and most popular precious metals stocks, produced the data. You may also use the API to integrate it into your website or app, and the plugins on the page can show you current and historical pricing.

Follow these steps to obtain it:

- To obtain an API key, visit www.metals-api.com and fill out the form.

- Look up the symbols you’ll be utilizing in a dictionary, such as money and platinum.

- Before concluding the API call, use these indications to add metal and currency to the list.

- Finally, press the “execute” button.

Why Metals-API?

It is an API that analyzes metal prices (including silver) every 60 seconds with an accuracy of two decimal points. The Metals-API receives currency rate data from over 15 trustworthy sources every minute. Moreover, its technology instantly converts precious metal values into 170 different currencies all around the world (you could see the prices in your local currency). However, because numerous currencies are becoming more popular, Metals-API also accepts digital currencies.