In this post, we will provide an API for obtaining metals futures prices for 2022 to determine the ideal time to invest.

In 2021, the metals complicated had a rough year. The prices of the four major precious metals declined this year. As the desire for capital safe havens has dropped and the US Federal Reserve has become more aggressive, gold has plummeted.

Various supply chain constraints ranging from severe semiconductor manufacturing shortages to transportation capacity bottlenecks influence metal prices. Should we expect prices to rise in 2022 following a tough year in 2021? The basic answer is “probably not.”

What Is The Actual Situation Of Metals?

In the 4th quarter of 2021, gold attempted to recuperate some of the ground it lost earlier in the year, as rising concerns about the impact of a new omicron version of the coronavirus on the global economy bolstered safe-haven demand. Seasonal high retail sales in important regional marketplaces boosted the investment.

As a result, gold rose 4.4 percent over time, reaching $1,820 per ounce in 2021. Despite a strong fourth-quarter performance, gold-finished 2021 was in the red, dropping 6.3 percentage points.

With expectations of an inflationary peak in the following months, gold faces a difficult economic system in the short to mid-term. Over the next tightening cycle, with annual prices decreasing to $1,775 per ounce in 2022 gold can remain on a downward trend.

Silver, like gold, concluded the fourth quarter of 2021 in the black, but with a considerably better quarterly performance, increasing in value by 7.2 percent vs 4.4 percent for gold. Silver’s underperformance relative to gold was mostly due to its strong industrial core. (Silver is legally categorized as an industrial metal rather than a precious metal since pure industrial demand accounted for more than 60% of physical consumption.)

Several factors impeded last year’s much-anticipated rebound in global industrial production, and hence industrial demand for silver. It suggests that supply recovery exceeded demand recovery, resulting in increased metal availability.

Furthermore, heightened uncertainty about the quality of the post-pandemic economic recovery will constrain the rise of industrial demand. This, along with a considerable increase in metal supply, will lead to a more balanced silver market in 2022.

It is a very active market. If you want to invest in any of these companies, you must understand metal pricing. Not only are current prices shown, but so are historical values, allowing you to keep track of the variables influencing the value of your preferred metal. To do this, you must use an API.

What Exactly Is An API?

An API is a technique that lets one device in one location send information to another or more devices in another location. You may view videos and share them with your community. You can include the API answer in the design of a website or app.

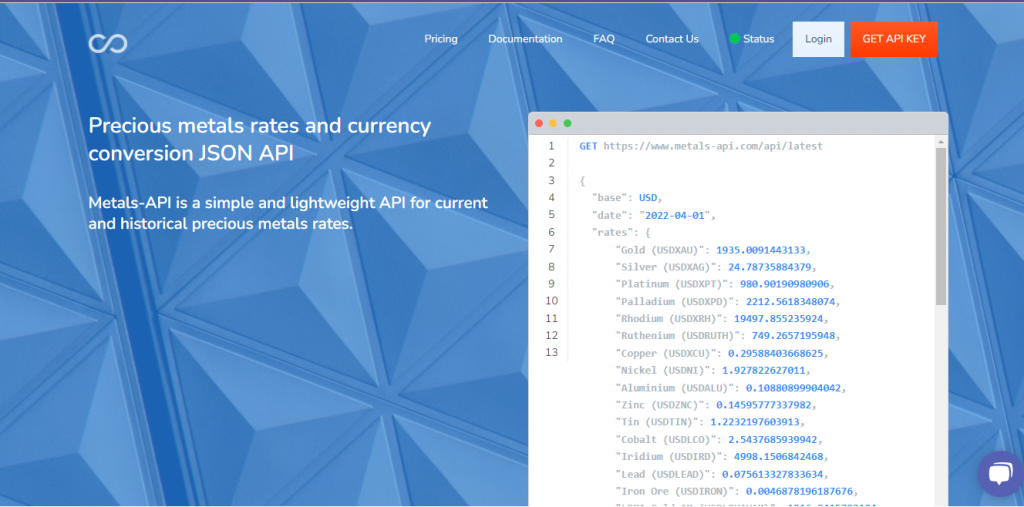

Metals trading is only viable if you have exposure to up-to-date data. As a consequence, to choose the optimal moment to invest, they must stay up to date on its price and market activities. To obtain this information, we propose using the Metals-API service.

Why Metals-API?

Metals-API is the finest API on the market (Application Programming Interface). This is because it can provide metal rates fast, safely, and conveniently. Many precious and non-precious metals, including lithium, gold, platinum, palladium, copper, and silver, are utilized in its system. All of this with up-to-date data and updates in less than a minute! That is, you will be able to determine the best moment to purchase this metal based on its features. This type of knowledge might save you loads of effort.