Are you looking for a way to know LME Lead spot rates? Then use an API!

But first, let’s discuss lead and its significance. This is a soft metal with a low melting point that is easy to produce and does not corrode easily, making it extremely useful. It’s also plentiful and simple to extract. Nonetheless, while lead, like many other metals, is dense, ductile, and malleable, it has several non-metallic qualities.

In 2019, China accounted for 46.7 percent of global lead mining output, while the United States accounted for 6%. That year, global lead output was expected to surpass 4.5 million metric tons. Australia was a large producer as well, accounting for 9.6 percent of global lead output.

It’s mainly used for:

- Paints and pipes as a corrosion-resistant metal.

- Vehicle batteries, and is an important component in lead-acid batteries.

- Soldering of electrical equipment components.

The LME, on the other hand, offers cash trading since it offers contracts with daily expiry dates of up to three months from the deal date, weekly contracts of up to six months, and monthly contracts of up to 123 months. It offers hedging, worldwide reference pricing, and the option of physical delivery to settle contracts.

Pricing for such metals may be tough to come by. It is, nevertheless, not impossible. We strongly urge you to use an API for this. This enables you to obtain data from several sources, including the London Metal Market (LME). It is used on many websites for a number of reasons, and it may be beneficial in any case. In this situation, a few mouse clicks might lead to LME Lead rates in seconds.

How To Obtain An API

You must first find software that supports it before you can use one. There are a plethora of them available on the internet, and each one may supply you with different facts. This is why, in order to avoid wasting your time, you need to be cautious in your choices.

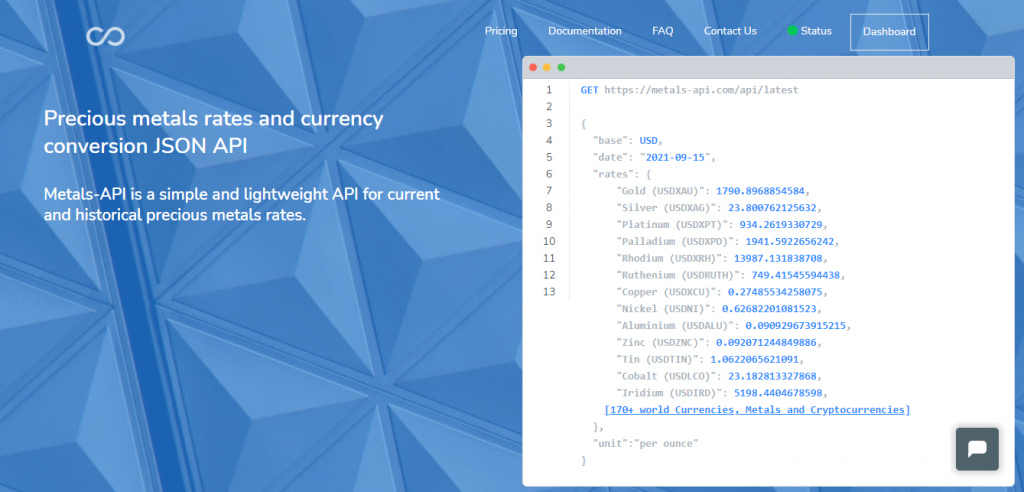

For acquiring these prices, Metals-API, one of the most popular and comprehensive APIs for precious metals pricing, is recommended. This allows you to monitor real-time metal prices and quotations from across the world, as well as follow precious metal spot prices and metal charts via interactive features.

To take use of it, you must perform the following:

- You may generate your own API key at www.metals-API.com.

- Look for the chosen metal (LME-LEAD) and the desired currency.

- Use these symbols to add metal and money to the list before ending the API call. You may also specify the programming language and the pricing range.

- Finally, you press the “run” button and you’re finished! The API will appear on your screen.

The end product will look like this:

{

"success": true,

"timestamp": 1519296206,

"base": "LEAD",

"date": "2018-09-10",

"rates": {

"AUD": 1.566015,

"CAD": 1.560132,

"CHF": 1.154727,

"CNY": 7.827874,

"GBP": 0.882047,

"JPY": 132.360679,

"USD": 1.23396,

[...]

}

}

How Precise Is This?

It is 100 percent accurate and dependable. Every minute, Metals-API gets data from roughly 15 credible data sources. Among them are banks and financial data suppliers. As a consequence, you’ll get extremely accurate pricing. Metals-API works with precious metals including gold, silver, aluminum, platinum, and palladium to determine their market worth. Data from the website may be used in spreadsheets, other websites, and mobile apps, among other places.