In the fast-paced world of digital transformation, where technical advances are propelling companies to unprecedented levels of efficiency, APIs have emerged as unsung heroes, enabling seamless integration and functioning across platforms. This blog delves into a special form of type of API that has recently gained popularity – VAT Validator APIs. We will look at the issues it solves, the answers it provides, and how it can greatly improve operating efficiency. So, whether you’re an inquisitive developer or a consumer looking for answers, let’s dive into the world of VAT validator APIs.

The Difficulty: Navigating The EU Tax Landscape

Consider the following scenario: A worldwide e-commerce company that serves clients from all over the world must compute and confirm Value Added Tax (VAT) for each transaction. With the intricacy of EU tax legislation, manually verifying precise VAT computations can rapidly become a maze. Every blunder might lead to regulatory difficulties, financial penalties, and a poor customer experience. This is when the VAT Validator API comes into play.

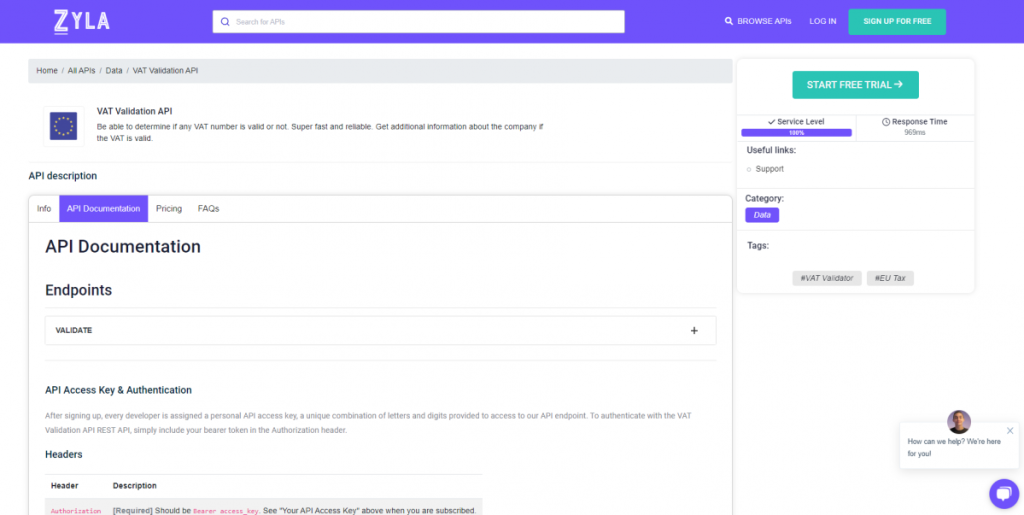

The Solution: The VAT Validator API Has Been Launched At Zyla API Hub

The VAT Validator API, offered at Zyla API Hub, is a game changer. This API, designed to simplify VAT validation for enterprises operating in the European Union, provides a simple solution to a complex problem. Now, let’s take a closer look at the features and advantages that make this API such a valuable tool for organizations.

VAT Number Validation Made Simple

By automating the validation against official EU databases, the VAT Validator API streamlines the process of validating VAT numbers. Businesses may confirm the authenticity of their clients’ VAT numbers in real-time by connecting to these repositories in a safe and easy manner.

Improved Compliance

Compliance is non-negotiable in the complex world of EU tax legislation. By cross-referencing VAT numbers with the most recent official data, the VAT Validator API assists businesses in conforming to these rules. This equates to lower compliance risks and a stronger corporate reputation.

Effortless Integration

Integration issues frequently dissuade firms from using new solutions. The VAT Validator API, on the other hand, allows for a simple connection whether you’re working with an e-commerce platform, a financial management system, or CRM software. This implies you may reap its benefits without changing your current practices.

Precision In Real Time

Manual VAT validation is both time-consuming and error-prone. The VAT Validator API delivers correct findings in real-time, eliminating the delays associated with human verification. This results in more efficient transactions and happier consumers.

In this part, we’ll provide an example to demonstrate how it works. The “VALIDATE” API endpoint will be utilized. To gain access to VAT-related information, enter the VAT number and the country code. That easy! Here’s how it works:

{

"valid": true,

"vatNumber": "288305674",

"countryCode": "GB",

"companyName": "WEIO LTD",

"companyAddress": "142 CROMWELL ROAD",

"companyCity": "LONDON",

"companyPostCode": "SW7 4EF",

"serviceStatus": true

}Using The VAT Validator API For The First Time

Follow these steps to begin your road toward efficiency:

- Sign up here: Create a Zyla API Hub account.

- To use the API, follow these steps: Access the VAT Validator API after you’ve registered.

- Obtain the API Key: Create your own API key for authentication.

- Ease integration: Use the documentation given to effortlessly integrate the API into your systems.

- Begin Validation: Begin checking VAT numbers in real-time to improve your operations.

Related Post: Next-Level Precision: Elevate With A VAT Number Validation API