The requirement for accuracy has never been more crucial in the fast-changing context of digital transformation, where data flows constantly between organizations and customers. Every conversation and transaction is dependent on the accuracy of the information shared. This is where sophisticated APIs come in, with solutions that improve data correctness, dependability, and overall user experience. This article delves into the world of VAT Number Validation APIs, examining their importance, advantages, and the revolutionary influence they may have on EU tax compliance.

The Obstacle: Navigating The Difficulties Of VAT Number Verification

Consider the following scenario: a company in one EU member state does business with a partner in another EU member state. Cross-border transactions are subject to Value Added Tax (VAT) under European Union legislation. However, in order for a firm to apply the right VAT treatment, the VAT identification number (VATIN) of the counterparty must be precisely verified. Financial inconsistencies, regulatory concerns, and strained company relationships can all result from a single-digit miscalculation in this identification.

Herein lies the difficulty: manually checking VAT numbers is time-consuming and prone to human mistakes. The variety of VAT forms used by EU member states adds another degree of complication. Developers and organizations demand a dependable, effective solution that can automate VAT number validation while guaranteeing regulatory compliance.

The Solution: The VAT Validation API Is Now Available At The Zyla API Hub

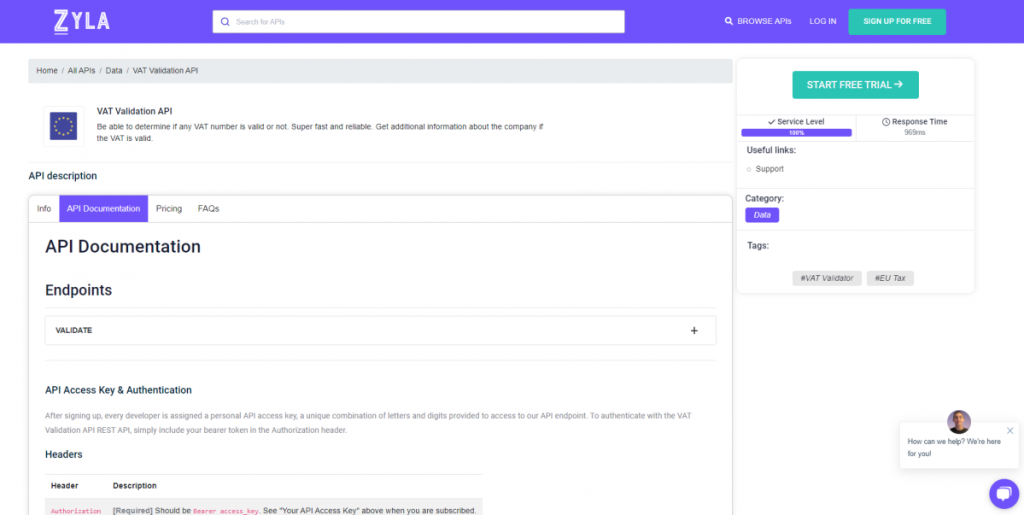

In this environment, the VAT Validation API stands out as a beacon of precision. This API is hosted at Zyla API Hub, a trusted platform for cutting-edge solutions, and was specifically created to solve the intricacies of EU tax legislation. Developers may easily implement VAT number validation features into their programs, websites, or systems using the power of this API.

Unlocking Potential: VAT Validation API Features And Benefits

Let’s take a closer look at some of the wonderful features and benefits that the VAT Validation API offers:

- Automated Validation: Say goodbye to human mistakes. The API automates the VAT number verification procedure, considerably lowering the chance of human error.

- Real-Time Results: When it comes to commercial transactions, time is important. The API returns validation findings in real-time, ensuring that choices are made quickly and precisely.

- EU-Compliant: The API makes it easier to navigate the complex web of EU tax legislation. It checks VAT numbers in accordance with EU requirements, hence improving compliance.

- Easy Integration: The API integrates seamlessly with your existing systems. Its user-friendly design and extensive documentation make implementation simple and straightforward.

- Cross-Border Confidence: Businesses may participate in cross-border transactions with confidence knowing that their tax treatment is correct thanks to precise VAT validation.

In this part, we’ll provide an example to demonstrate how it works. The “VALIDATE” API endpoint will be utilized. To gain access to VAT-related information, enter the VAT number and the country code. That easy! Here’s how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}Your Quick Guide To Using The VAT Validation API

Now that you’re ready to unleash the power of the VAT Validation API, here’s a quick start guide to get you started:

- Step 1: Register: Begin by requesting an API key from Zyla API Hub. This key will allow you to use the VAT Validation API.

- Step 2: Implementation: To effortlessly integrate the VAT Validation API into your selected platform or application, refer to the API documentation.

- Step 3: Implementation: After integrating the API, begin providing VAT numbers for validation and receiving real-time results.

- Step 4: Transformation: Watch as accuracy becomes the foundation of your relationships and transactions.

Finally, the VAT Validation API is a game changer in the world of EU tax compliance. Its comprehensive features and seamless integration capabilities make it an absolute must-have for organizations and developers that place a premium on precision and efficiency. You may accelerate your initiatives into a domain of precision by employing this API, paving the road for development and confidence in every connection.

Visit Zyla API Hub now to see how the VAT Validation API can boost accuracy and propel your company to new heights in the digital era.

Related Post: VAT Number Validation Now Simplified With An API