Are you looking for a good API to safeguard your business with advanced online payment security? We have a recommendation for you!

Today, it is common knowledge that the Internet is not a safe place. In addition to the obvious dangers of cybercrime and hacking, there are also many other online threats that we may not be aware of. Each time we make an online purchase, we take a risk. This is because the information we provide to make an online purchase is transmitted through a network that is not secure. Therefore, if we want to protect our personal information and safeguard our business, we must use an API that can help us.

A BIN Database Lookup API is an application programming interface that allows developers to integrate payment security features into their applications, websites, or services. There are also APIs that allow developers to access data about specific payment methods. This way they can know more about how secure these methods are and how they can be improved.

An anti-fraud solution is necessary for any company that handles sensitive data or transactions. A capable anti-fraud system can help you identify your system’s faults and take corrective action in addition to aiding you in identifying and preventing fraud.

An anti-fraud system typically uses an API to retrieve information about well-known criminals and scam attempts. You can then use this information to identify and thwart fraud attempts on your website or app. An API can also be used by an anti-fraud system to alert the provider of any suspicious activity so that it can be investigated further.

BIN IP Checker

Webmasters that want to carefully investigate credit/debit card transactions that occur on their websites can use this API, which was created with their needs in mind. It is an obvious example of how risky the transactions are.

This API is particularly made for online store owners who wish to thoroughly examine the credit/debit card transactions made through their websites. It provides a clear picture of how unsafe the transactions are. However, anyone can use this API on any platform as they see fit and within their own set of restrictions.

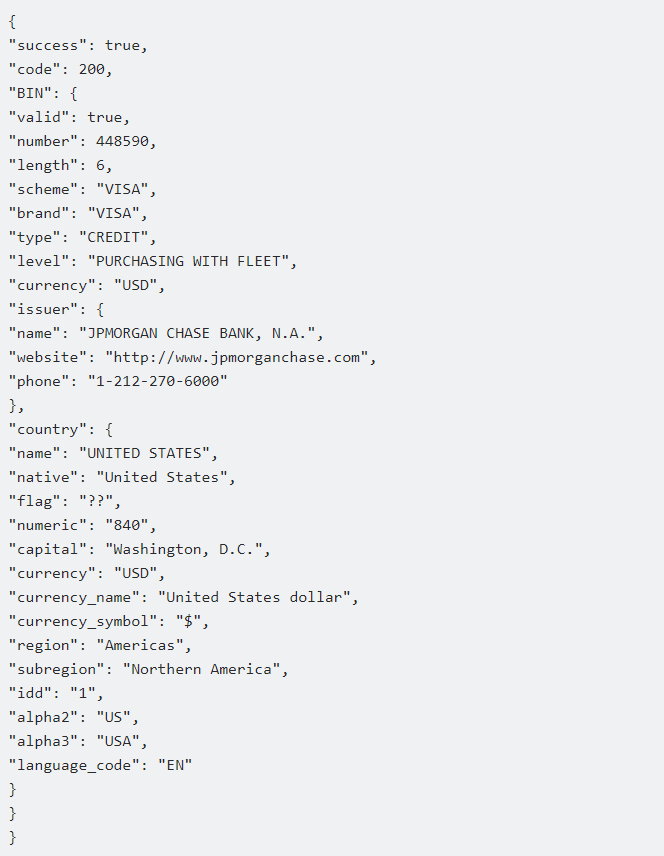

The BIN of the credit card and the user’s IP address who made the request will both be verified by this API. It will assess whether the nation of the IP address and the card’s BIN match by comparing the BIN and IP information. This is a fantastic approach to thwart fraudulent transactions at the source. The following is an example of the type of response you will get from this API:

If your business conducts a lot of transactions, you are aware of how challenging it is to prevent fraud. However, you will be able to swiftly and simply identify any fraudulent activity in your system with the aid of this API.

The Fraud Detection API analyzes a variety of data points, including IP addresses, geolocation information, user behavior, and more, using advanced algorithms. Additionally, a risk score that can be used to detect whether a transaction is fraudulent is calculated using these data points.