In today’s hyper-connected digital landscape, the specter of business fraud looms larger than ever before. As organizations migrate towards online platforms, they inadvertently expose themselves to a myriad of fraudulent activities. From identity theft to credit card fraud, cunning cybercriminals exploit vulnerabilities, leaving businesses vulnerable to substantial financial losses and damaged reputations.

However, by entering a BIN Checker API, a sentinel in the battle against fraudulent activities. This advanced type of tool operates as a gatekeeper, meticulously scrutinizing the Bank Identification Number (BIN) of each transaction. Its intricate algorithms cross-reference BIN data with comprehensive databases, instantly highlighting discrepancies or irregularities. By deciphering the hidden patterns of legitimate transactions and fraudulent attempts, a BIN Checker API empowers businesses to halt suspicious activities in their tracks. A BIN Checker API serves as a vigilant guardian, fortifying the ramparts of businesses’ online domains. Its intricate analysis and swift responses ensure that businesses can operate with confidence, protected from the rising tide of modern-day fraud.

The Power of a BIN Checker API in Fraud Prevention

In the complex realm of modern commerce, where transactions happen at the speed of thought, the battle between legitimate business and fraudulent activity rages on. This is where a BIN Checker API emerges as a stalwart defender, its presence often unsung but invaluable.

Imagine a digital bouncer meticulously inspecting each guest at a grand gala. Similarly, a BIN Checker API meticulously inspects the Bank Identification Number (BIN) of a transaction, sifting through a vast repository of data to unveil insights. Like a digital Sherlock Holmes, it uncovers hidden connections, revealing if a transaction is genuine or a masked charade.

With its lightning-fast algorithms, the type of API becomes an indispensable sentinel, analyzing patterns and anomalies in real time. It empowers businesses to make swift, informed decisions, safeguarding their interests and customer trust. This unassuming guardian exemplifies the synergy of technology and vigilance, ensuring that the digital landscape remains secure and resilient against the ever-evolving landscape of fraud. However, if you want to start to work with the best tool in the market, you should pick Credit Card Validator – BIN Checker API.

Proactive Fraud Detection: Stay Ahead of the Game With Credit Card Validator – BIN Checker API

In the ever-shifting landscape of digital transactions, waiting for fraud to rear its head is a perilous game. Enter the Credit Card Validator – BIN Checker API, your proactive shield against the lurking shadows of fraudulent activities.

Gone are the days of reactive damage control. With the Credit Card Validator – BIN Checker API, businesses gain a potent ally that spots potential threats even before they manifest. It’s like having a sentinel equipped with a sixth sense for deception, tirelessly analyzing Bank Identification Numbers (BINs) to uncover telltale signs of malfeasance.

This API doesn’t just stop at pointing out red flags; it deciphers intricate patterns in transactions, sounding the alarm at the slightest irregularity. It’s a digital fortune teller that predicts the tricks up fraudsters’ sleeves. By staying one step ahead, businesses can safeguard their operations, reputation, and customer trust. In the high-stakes arena of fraud prevention, the Credit Card Validator – BIN Checker API isn’t just a tool; it’s a strategic advantage that ensures you’re always in control.

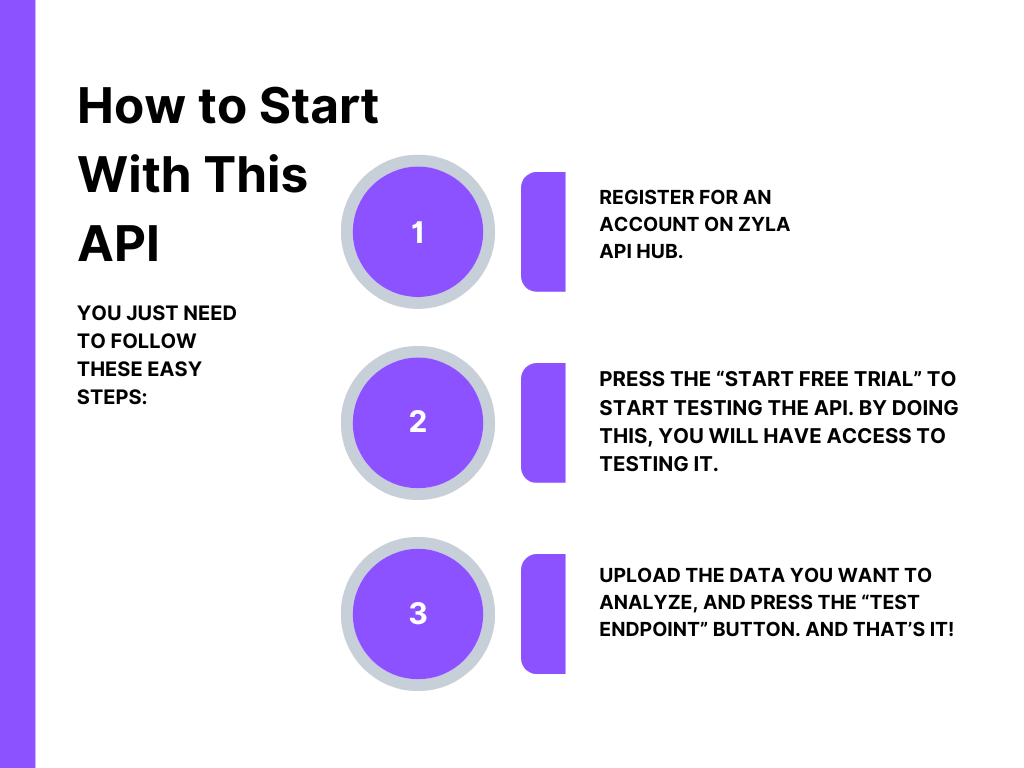

See The Following Steps To Start To Use This API

The country code, IP city, card type, and even category are displayed in the response after inputting the card’s BIN, which is 448590, in the test endpoint:

Don’t let your business become a statistic in the grand narrative of fraud. The Credit Card Validator – BIN Checker API isn’t just a solution; it’s your shield against evolving threats. Embrace it as the cornerstone of your fraud prevention strategy and stride confidently into the future, where security meets innovation.