Do you regularly deal with metals prices? Learn how to use an API to get real-time data by reading this article.

The spot price of a commodity or security is the current market price at which it can be bought or sold. It reflects the current supply and demand for the commodity or security and is influenced by a variety of factors, including economic conditions, political events, and market trends. The spot price is also known as the “cash price” or “spot rate,” and it is typically quoted in real-time on financial markets. It is different from the futures price, which is the price at which a commodity or security can be bought or sold at a specified date in the future.

Spot prices are used in a variety of contexts, including in the commodities markets (e.g., for oil, gold, or wheat), the foreign exchange market (for currencies), and the stock market (for shares of individual companies). In general, the spot price is the most current and relevant price for a particular commodity or security, and it can fluctuate significantly over time as market conditions change.

Iron is a metal that is abundant in the Earth’s crust and is an essential component of many minerals. Iron is a strong, hard, and durable metal that is used in the construction of buildings, bridges, and other structures, as well as in the manufacture of a wide range of products, including vehicles, appliances, and tools. Iron is not considered to be a precious metal, as it is relatively abundant and not as rare as gold, silver, and other precious metals. However, it is an important industrial metal that is widely used in a variety of applications and has a significant impact on the global economy.

The price of iron varies based on a number of factors, including global demand, supply, and economic conditions. The price of iron ore, which is the raw material used to produce pig iron, has fluctuated significantly in recent years. In general, the price of iron tends to be influenced by global economic conditions, as well as political and other factors that can affect the supply and demand for metal. This is why lots of businesses rely on a Metals API to get real-time information.

What Is A Metals API And Why You Could Profit From It?

An API, or application programming interface, is a set of rules and protocols that allows different software systems to communicate and exchange information. These guidelines enable different software applications to share data and functionality with each other. For instance, a financial software application might use an API to retrieve real-time stock market data and display it within the program. APIs are an integral part of many online activities and are used to facilitate communication and data exchange between different systems.

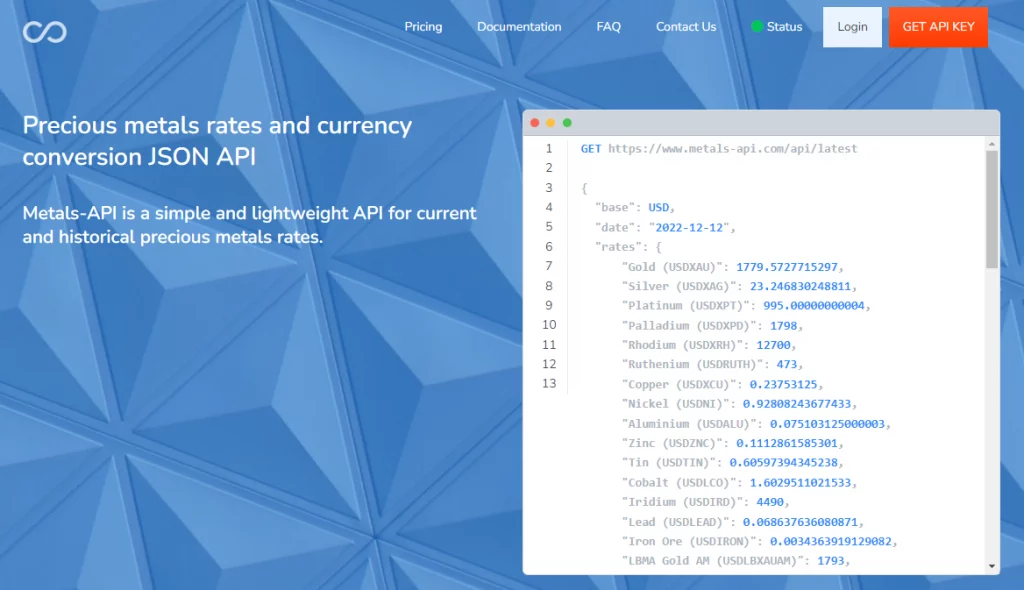

Today it is quite common for businesses that are affected by the price of these metals to incorporate access to real-time information into their platforms with the help of APIs. By obtaining this data, they can elaborate more complex information. Some APIs even provide the possibility of viewing this information through graphs, as is the case with MetalsAPI, a tool that we recommend you get to know.

More About MetalsAPI

MetalsAPI is an API intended to assist in precious metals trading. MetalsAPI provides you with the most comprehensive and up-to-date information available to support your precious metals trading strategy. It provides information about the market and its individual parts, giving you access to a wealth of data that would otherwise be unavailable. It offers a robust set of APIs for accessing real-time spot prices, prices recorded over time, and historical market data for major precious metals, including gold and silver.

If you are a trader, work in the industry, or are simply interested in precious metals, you may find this API useful. It contains several data sources that can be useful for your business. It is built with computer languages and uses a RESTful interface. With the MetalsAPI you can create your own data service or use it as a reference point for more complex business applications to reduce costs and generate revenue.