You may be searching for an API with aluminum prices. It’s necessary to acquire it from a reliable source. Here, we suggest using an API with data from Shanghai Futures Exchange.

The top ten aluminum-producing nations on the planet are China, Russia, and India, with China, Russia, and India leading the way. Aluminum output is increasing in the worldwide market, indicating high demand from related industries like automobiles, electrical applications, construction, and consumer goods.

Commercial opportunities in the world’s leading aluminum-producing economies are projected to grow rapidly as long as the demand for aluminum in a variety of industries stays high. Like other metals and commodities, the situation in Ukraine may have an impact on the price.

Having all this in mind, if you own a firm that works with aluminum, you should be updated about the prices and the factors that affect it. Over time, you can watch the fluctuation of it and analyze the best moment to invest. To collect the most reliable data, you should watch Shanghai Futures Exchange information.

What Is Shanghai Futures Exchange?

The Shanghai Futures Exchange (SHFE) is China’s main manufacturing speculative trading venue. It was established in 1999 as a consequence of the merging and restructuring of the founding financial markets, Shanghai Metals, Construction Materials, Cereals and Oils, Petroleum, Chemicals, nickel, Coal, and Agricultural Materials.

Shanghai Futures Exchange (“SHFE”) operates under the unified control of the China Securities Regulatory Commission (“CSRC”) and arranges futures trading permitted by the CSRC in line with the values of transparency, objectivity, honesty, and sincerity. The SHFE currently offers 20 futures contracts and 6 commodity options, including futures on copper, aluminum, zinc, lead, nickel, tin, gold, silver, steel rebar, steel wire rod, hot-rolled coil, fuel oil, crude oil, bitumen, natural rubber, wood pulp, TSR 20, stainless steel, LSFO, and bonded copper, as well as copper option, natural rubber option, gold option, aluminum option, zinc option, and crude oil option.

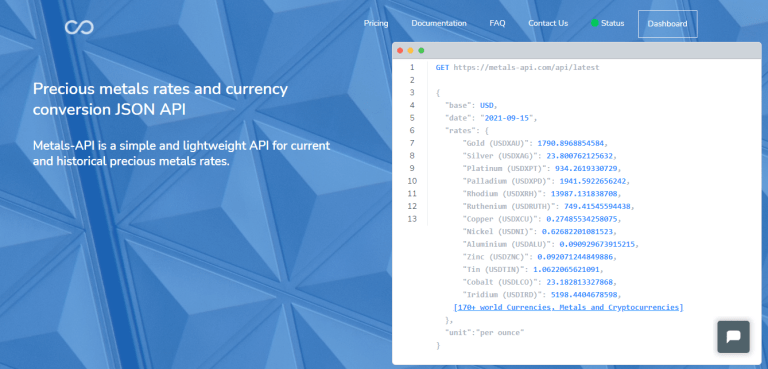

It is important to utilize an API to access data from this source. It is a device platform that enables two or more devices to exchange data. There are several of them on the internet, but not all of them are open, provide the same material, or operate in the same manner. We propose Metals-API as the finest instrument for investing in aluminum.

To retrieve the data, proceed as follows:

- Access www.metals-api.com to obtain your unique API key.

- In the glossary, look up the symbols you’ll be employing. You may use aluminum if you choose (ALU). It’s from SHFE.

- Before initiating the API call, use these indications to add metal and currency to the list.

- To finish, press the “run” button.

About Metals-API

Metals-API uses bank data to determine current and historical precious metals prices. The Metals-API can provide real-time precious metals data with a frequency of up to 60 seconds. It collects information from the most trustworthy sources. It gathers data from the most reliable sources. You can have access to Shanghai Futures Exchange pricing such as COMEX/NYMEX rates.

Among the features include the ability to trade precious metals, convert specific currencies, and display Time-Series data, volatility statistics, and the day’s lowest and highest values. The API provides accurate precious metal currency exchange information in over 170 currencies throughout the globe, including other major digital currencies.