Businesses have extraordinary possibilities and difficulties in the ever-changing context of digital transformation. As operations grow more computerized and global, maintaining tax compliance has emerged as a vital part of corporate operations. The significance of VAT (Value Added Tax) certification cannot be emphasized in this situation. It is not only about regulatory compliance; it is also about sustaining smooth operations and increasing consumer trust. Here is when VAT Validator APIs come into play.

The Difficulty: Navigating The Complicated VAT Landscape

Consider the following scenario: an e-commerce company established in the European Union (EU) wishes to expand its reach across borders. As it crosses borders, it enters a maze of differing VAT requirements enforced by various EU member states. The difficulty is identifying the right VAT rates and adhering to the applicable requirements. Miscalculations or inaccuracies can result in financial fines, operational interruptions, and reputational damage.

The VAT Validator API Is The Solution

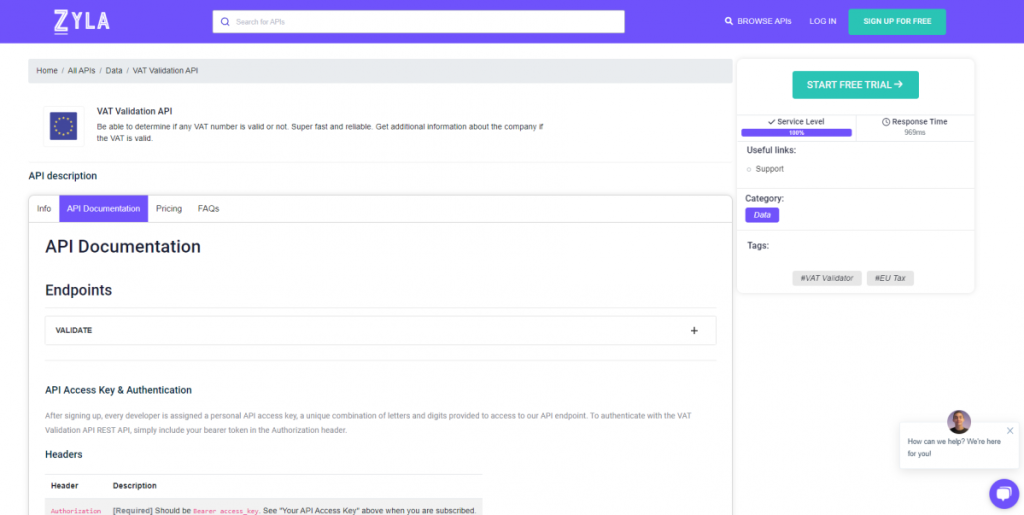

Businesses may use VAT Validator APIs to address this complex issue. Among the noteworthy companies in this industry, Zyla API Hub’s VAT Validation API stands out as a formidable solution. This API is intended to simplify the process of verifying VAT numbers, ensuring businesses apply the correct tax rates and comply with the EU’s complicated VAT legislation.

Zyla API Hub: The Doorway To Better VAT Validation

The Zyla API Hub, which acts as a complete platform presenting the VAT Validation API, is at the heart of the solution. This hub serves as a conduit between companies and a streamlined VAT validation procedure. It provides a user-friendly interface that developers can simply incorporate into their systems, allowing them to leverage the VAT Validation API’s features.

Features And Advantages: Boosting Your Business

Zyla API Hub’s VAT Validation API has a number of capabilities that can be extremely beneficial to organizations operating in the EU or dealing with EU transactions. Developers may quickly include the API in their applications thanks to its user-friendly documentation and implementation guidelines. Here are several significant advantages:

- Accurate VAT Validation: The API uses complex algorithms to validate VAT values accurately, lowering the chance of mistakes and assuring regulatory compliance.

- Real-time Validation: Businesses may examine VAT numbers in real-time, allowing for rapid choices during client interactions.

- Seamless Integration: With thorough documentation and support, integrating the API into existing systems is a breeze.

- Multi-Country Support: The API supports a wide range of EU member states, allowing businesses to conduct cross-border transactions.

- Cost and time efficiency: By automating the VAT validation process, organizations may save time and money while reducing the likelihood of costly errors.

In this part, we’ll provide an example to demonstrate how it works. The “VALIDATE” API endpoint will be utilized. To access VAT-related information, enter the VAT number and the country code. That easy! Here’s how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}Getting Started: Your Path To Improved VAT Compliance

It’s easier than you think to get started with the VAT Validation API. Take the following steps:

- Register here: Begin by signing up for an account on the Zyla API Hub. This step grants you access to the VAT Validation API and its resources.

- Documentation for the API: Explore the whole API documentation for Zyla API Hub. Discover endpoints, parameters, and integration rules.

- Create a one-of-a-kind API key that will function as your authentication credential while performing API calls.

- Integration: To connect the API to your systems, follow the integration suggestions. To guarantee a smooth integration process, use example code snippets and tutorials.

- Test and Deploy: To ensure seamless functionality, conduct rigorous testing before deploying in a production environment.

Related Post: The Power Of VAT Validator APIs: Data Accuracy Redefined