Do you want to automate your workflow? Then you should try this top VAT validation API!

You have probably heard the word API more than once if you work in the computer or programming industry. The word API, which stands for Application Programming Interfaces in English, is a formal designation that describes how one software module interacts with another.

Simply said, APIs are a collection of protocols, functions, and instructions that allow programmers to build customized operating system programs. Because APIs enable program developers to no longer be compelled to build code from scratch, they are of utmost importance when it comes to streamlining their job.

An API gives the computer access to specified functions for interacting with the operating system and other programs. A further noteworthy quality of an API is that it solely serves as an interface for software. This allows diverse apps to connect without the user having to become involved, which is unquestionably very helpful.

Unquestionably, having access to APIs contributes to more flexibility in all aspects of information and service delivery. An application layer that may be used to deliver information to new audiences can be built using an API.

The capacity to personalize services and content allows both businesses and individual users to build on-demand user experiences. This is made possible by the customization choices provided by APIs.

How An API Can Help You Automate Your Workflow?

Thanks to the protocols, features, and commands of the APIs, agencies may alter processes to boost efficiency, making IT experts responsible for handling the task. Since the API will do it for you and with a much smaller margin of error than the human eye, it might be helpful to validate each number in the case of VAT numbers rather than having to check each one individually.

Thanks to the APIs, the created material is automatically published and made available through a wide range of channels, making the distribution process more effective. Additionally, because of the APIs, the material may be easily and swiftly incorporated from any website, ensuring fluidity in the information processing process.

Why VAT Validation

Every firm that registers for VAT is granted a VAT number, which serves as a special identifying number. A VAT number, which is used for taxes, is only given to businesses that have registered for VAT.

As a result, a VAT number is also commonly referred to as a VRN, or VAT registration number. In this way, even if some organizations actively try to cheat taxes, many businesses pass their figures off as having typos.

Because of this, it’s crucial to provide a proper fiscal system in which all applicable taxes are paid. It is crucial to make use of tools like the VAT Validation API to validate these statistics with more fluidity.

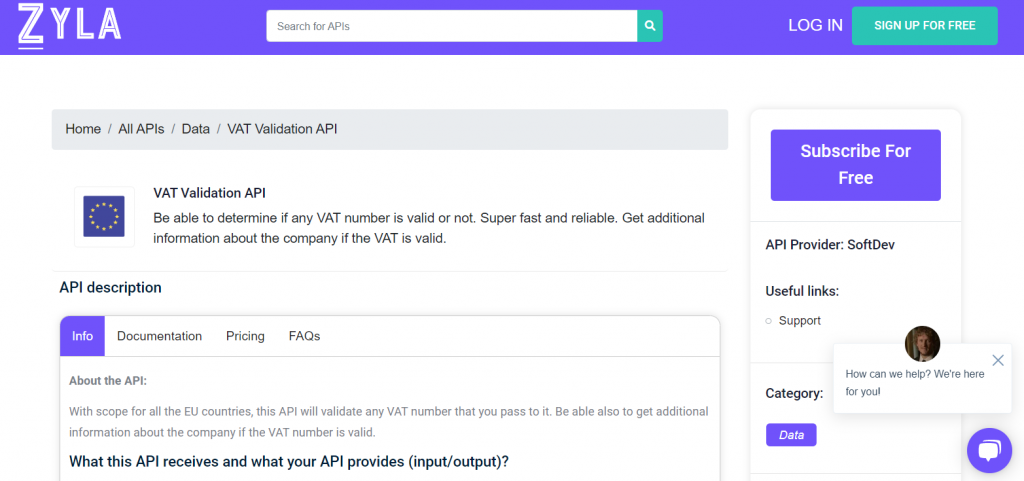

About the VAT Validation API

Due to its compatibility with a variety of computer languages, VAT Validation API is among the most beneficial you can discover online. Additionally, it returns various data so that you may verify that a corporation is paying its taxes on time.