In the fast-paced realm of financial data services, Xignite has long been a stalwart, providing essential data that fuels decision-making processes across industries. However, the landscape is evolving, and the demand for alternatives in the financial sector is gaining momentum. So, let’s talk about Xignite alternatives!

Understanding the Need for Xignite alternatives:

As businesses navigate the intricate web of financial data, limitations of platforms like Xignite become apparent. Data latency issues and cost considerations emerge as key pain points, prompting a critical evaluation of available alternatives. Beyond these challenges, the recognition of the importance of diverse data sources in financial decision-making becomes paramount.

Real-time Data Accuracy

Ensuring accurate and timely data is the lifeblood of financial operations. A detailed comparison of real-time data accuracy among alternatives becomes imperative. The reliability of financial data is not merely a checkbox; it is a foundational element for businesses striving to stay ahead in a dynamic market.

While Xignite may offer robust services, the financial savvy are compelled to dig deeper. Analyzing pricing models of both Xignite and its alternatives unveils the economic viability of each. The quest is not just for an alternative but for a solution that is cost-effective without compromising quality, a balance that defines financial prudence.

In the ever-evolving landscape of financial data services, the quest for the right provider is unending. This exploration of Xignite and its alternatives serves as a guide for businesses navigating this intricate terrain. As we conclude, it’s crucial to summarize the key points discussed in this blog post. The call to action is clear – businesses are encouraged to explore and evaluate Xignite alternatives, emphasizing the critical importance of selecting a data provider that aligns precisely with their specific needs and goals.

Metals API

The original version of Metals-API was an Open-Source, lightweight, and straightforward API that gave the historical and current values of the precious metals that banks owned. For a maximum of sixty seconds, the API offers precise real-time data on precious metals to two decimal places. Obtaining time-series and fluctuation data, converting single currencies, calculating the day’s lowest and maximum price, and offering precious metal exchange rates are a few of the features.

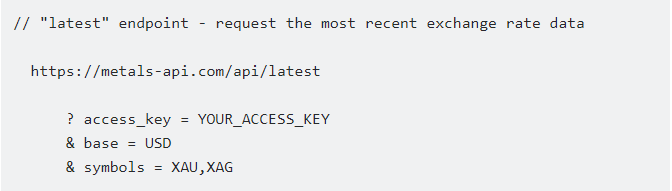

All five of the primary API Endpoints, which you can use to get various types of data, originate from the Base URL. Just send your distinct access key to one of the endpoints as a query argument:

You will receive periodic and recurring invoices in advance, based on the kind of Subscription plan you select when buying the Subscription (daily, weekly, monthly, or annually). At the conclusion of each period, Your Subscription will automatically renew under the same terms unless you or the firm opt to terminate it.

The Metals-API is extremely responsive, offering guaranteed availability, scalable quantities, and millisecond response rates. Thousands of developers, SMBs, and large corporations utilize it daily. Because it has over six years of expertise and dependable data sources, this API is the greatest resource for metals rates. Their support staff is always dependable and available to you when you need them!