The landscape of automotive insurance is undergoing a profound transformation fueled by data-driven insights. In this era of innovation, automotive insurance companies are harnessing the power of technology to refine risk assessment, streamline claims processing, and offer personalized premiums. At the heart of this evolution lies a pivotal tool: the Vehicle Data APIs. A Vehicle Data API serves as the bridge that connects insurers to a wealth of accurate and comprehensive vehicle data, revolutionizing the way insurance companies operate and serve their customers.

Key Factors When Choosing a Vehicle Data API for Insurance Companies

Selecting the right Vehicle Data API is a critical decision that shapes the effectiveness of data utilization within automotive insurance companies. Several key considerations should guide this selection process, ensuring that the chosen API seamlessly aligns with the unique needs of insurance operations.

Data Accuracy and Precision

The foundation of effective insurance operations lies in the precision and accuracy of data. An exemplary Vehicle Data API should provide a comprehensive array of vehicle information, ranging from specifications to historical data. This ensures that insurers have access to reliable insights that facilitate informed risk assessment and decision-making.

Integration Flexibility and Speed

Efficient integration is paramount for insurance companies aiming to maximize the benefits of vehicle data. The chosen Vehicle Data API should offer a seamless integration process, allowing insurers to swiftly incorporate data-driven capabilities into their operations. This agility enhances the company’s ability to respond to evolving market dynamics and customer needs.

Cost-Effectiveness and Scalability

Balancing cost and value is crucial for insurance companies. A superior Vehicle Data API offers pricing models that accommodate budget constraints while delivering robust data coverage. Scalability ensures that the API can seamlessly grow with the company’s expanding data requirements and operational scope.

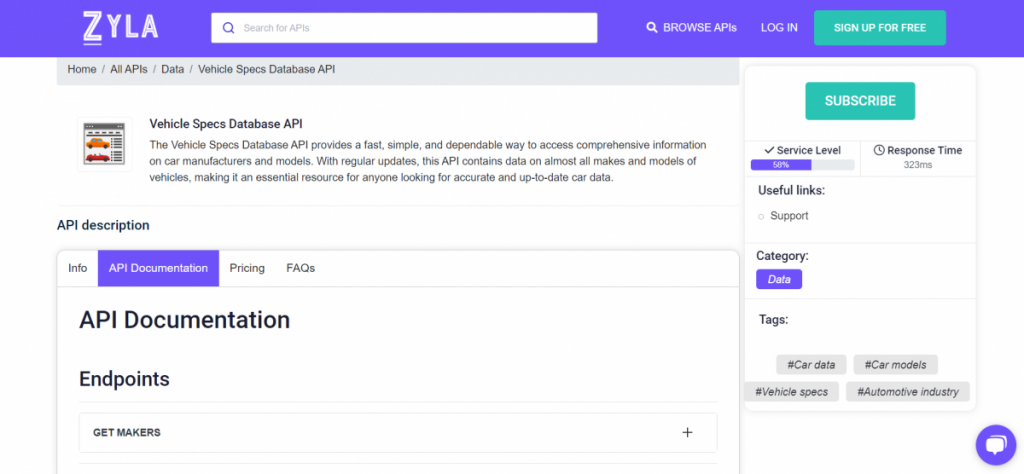

In the realm of Vehicle Data APIs tailored for automotive insurance companies, Vehicle Specs Database API stands out as a beacon of excellence.

Vehicle Specs Database API: A good tool For Automotive Insurance Companies

The Vehicle Specs Database API from Zyla Labs is a fast, simple, and dependable way to access comprehensive information on car manufacturers and models. With regular updates, this API contains data on almost all makes and models of vehicles, including their specifications, fuel economy, safety ratings, and insurance costs.

This API is an excellent tool for automotive insurance companies. Insurance companies can use Vehicle Specs Database API to get accurate and up-to-date information on vehicles. And then, they can then use to price their policies more accurately. Also, the API can create custom reports on vehicle safety, fuel efficiency, and insurance costs.

For example: To price policies more accurately. Insurance companies can use the API to get the make, model, year, and mileage of a vehicle. They can then use this information to look up the vehicle’s specifications, fuel economy, and safety ratings. Then, you can calculate the risk of insuring the vehicle and set a fair price for the policy.

Watch this video:

In the dynamic landscape of automotive insurance, Vehicle Specs Database stands as the catalyst for transformation. Their integration empowers insurance companies to harness the power of data, refine their operations, and deliver enhanced value to policyholders.

Read this post: Use This Vehicle Database API For Automotive Research And Analysis