Did you know that there is an incredible API to calculate taxes in a simple and easy way? Thanks to an amazing Taxes API, you will be able to! In fact, thanks to this digital tool, Worldwide Companies can calculate their taxes more easily. If you are interested in knowing more, read this post.

Calculating taxes accurately is essential for Worldwide Companies for legal compliance and financial transparency. Accurate taxation ensures fair contributions and avoids penalties. It builds trust with stakeholders and enhances the company’s reputation. Correct tax calculations lead to better financial planning and resource allocation. Ethical tax practices create a level playing field and foster healthy competition. Transparent tax reporting builds investor confidence and attracts potential partners.

It ensures adherence to local tax laws and international regulations. Incorrect tax calculations can lead to reputational damage and legal consequences. Proper tax management supports sustainable growth and corporate social responsibility initiatives. Accurate tax filings prevent potential audits and save resources in the long run. Overall, accurate tax calculations are crucial for a company’s success, sustainability, and positive impact on society.

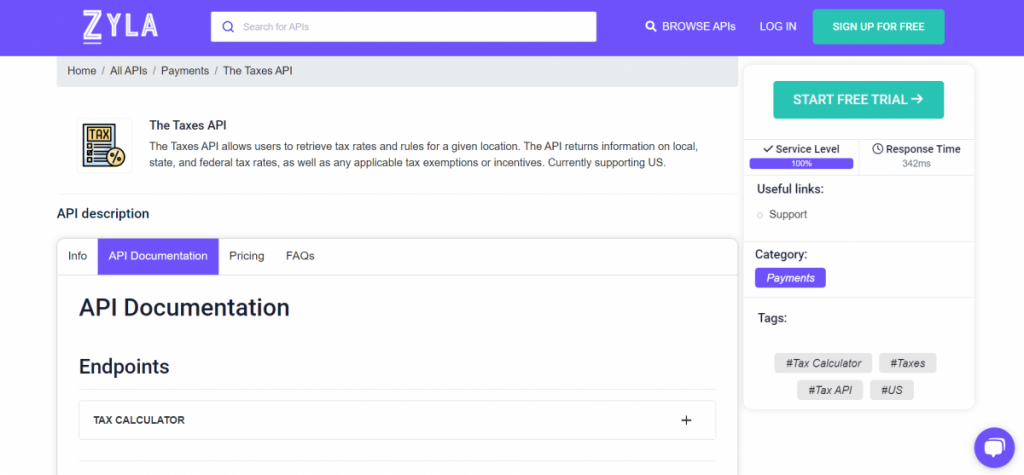

However, sometimes large companies have problems calculating their taxes correctly. For these reasons, The Taxes API from Zyla Labs exists. It is a tool that returns information on local, state, and federal tax rates, as well as any applicable tax exemptions or incentives.

The Taxes API Is The Best Tool For Worldwide Companies!

The Taxes API from Zyla Labs is a powerful tool that allows businesses to calculate taxes accurately and efficiently. The API provides real-time tax rates for all 50 states and the District of Columbia, as well as for many cities and counties. It also includes information on tax exemptions and deductions. This tool is easy to use. Developers can simply make a request to the API, specifying the location of the sale and the type of goods or services being sold. The API will then return the applicable tax rates.

Here are some of the reasons why The Taxes API from Zyla Labs is the best tool for worldwide companies to calculate taxes:

-Accuracy: The Taxes API provides real-time tax rates, so businesses can be sure that they are calculating taxes accurately.

-Efficiency: This tool is easy to use and integrates seamlessly with other applications. This can save businesses time and money.

-Compliance: It includes information on tax exemptions and deductions, so businesses can ensure that they are compliant with all tax laws.

-Global coverage: It covers all 50 states and the District of Columbia, as well as many cities and counties. This makes it a valuable tool for businesses that sell goods or services across multiple jurisdictions.

Watch this video and discover how to calculate taxes with this API:

If you are looking for a powerful and reliable tool to help you calculate taxes, The Taxes API from Zyla Labs is the best choice. With its accuracy, efficiency, compliance, global coverage, scalability, security, and support, this tool is the perfect solution for businesses of all sizes.

Read this post: Try Out The Best Tax Calculator API For Free In 2024