Credit Card OCR API can be used for marketing purposes in several ways to enhance user experiences, gather data insights, and optimize marketing campaigns. Herein you`ll find some ways a credit card recognition API can be beneficial for marketing.

When using a credit card recognition API for marketing purposes, it’s crucial to prioritize user privacy and data security. Likewise, you must ensure that you are compliant with relevant data protection regulations (e.g., GDPR, CCPA) and have robust security measures in place to protect customer payment data. Keep on reading to find out more details.

Developers customize software to satisfy their clients in the field of marketing, so as to meet their needs. They base their developments on the most robust application on the market: Credit Card OCR API, and its suite of automated tools, which guarantee efficiency, accuracy, functionality and versatility.

Additionally to the priorities above stated, developers and marketers must communicate clearly to users how their data will be used and obtain their consent where necessary.

Most Common Use Cases Of Credit Card OCR API

The software allows simplified user registration. It makes the user registration process smoother by allowing users to scan their credit cards instead of manually entering information. This can encourage more sign-ups and conversions for your marketing campaigns.

Likewise, in e-commerce or mobile apps, implementing credit card recognition can speed up the checkout process. Users are more likely to complete a purchase if they can quickly and easily input their payment information, leading to increased sales.

In addition, the API allows to simplify the subscription sign-up process by recognizing and validating credit card details. This can be especially useful for marketing subscription-based services or products.

It`s advisable to use credit card recognition to capture contact and payment information during lead generation campaigns. This data can be used for follow-up marketing efforts and lead nurturing. Additionally, the marketer can collect data on customer purchase behaviors and preferences through credit card recognition. This information can be used to tailor marketing campaigns and promotions to individual customers.

Furthermore, you should implement credit card recognition as part of a loyalty program, where customers can easily earn rewards or discounts for using their recognized credit cards for purchases. For this purpose, it´s crucial to analyze payment data to gain insights into customer spending habits, purchase frequency, and average transaction amounts. This information can inform marketing strategies and product offerings.

Benefits of Credit Card Scanning API

Firstly, marketers should use credit card recognition to detect and prevent fraudulent transactions, which can protect your customers and your brand reputation. Also, to communicate your commitment to security in your marketing messages.

Secondly, they use the software to identify opportunities for cross-selling or upselling based on customer purchase history. Moreover for craft targeted marketing campaigns to promote complementary products or services.

Third, it´s advisable to segment your email marketing lists based on payment data, allowing you to send relevant offers and promotions to specific customer segments. This can improve email open and conversion rates. For mobile apps, implementing credit card recognition can enhance in-app purchases and mobile marketing campaigns. Users are more likely to engage with mobile offers if they can easily make payments.

Furthermore, the user must conduct A/B tests with different marketing messages and offers, and measure the impact on credit card usage and conversion rates. Optimize your marketing campaigns based on data-driven insights.

Last not least, it´s essential to leverage the convenience of credit card recognition to boost user engagement in loyalty apps, mobile wallets, or membership programs. You must encourage users to make repeat purchases and interact with your brand more frequently. Additionally, you must communicate clearly to users how their data will be used and obtain their consent where necessary.

To Get Started With The Tool

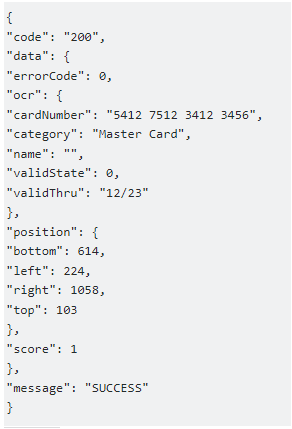

Once you get a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

“https://www.mastercard.co.nz/content/dam/public/mastercardcom/nz/en/consumers/find-a-card/images/world-mastercard-card_1280x720.jpg” in the endpoint, the response will look like this: