In the intricate world of investments, Exchange-Traded Funds (ETFs) have emerged as versatile instruments that offer exposure to a variety of asset classes. Among these, Physical Gold Shares ETFs have gained prominence as an avenue for investors to access the potential benefits of gold without the complexities of physical ownership. This article explores the significance of Physical Gold Shares ETFs, delves into the advantages of using a top-rated API for accessing investment data, and provides a comprehensive guide on effectively obtaining Physical Gold Shares ETF rates through the use of an Application Programming Interface (API).

Understanding Physical Gold Shares ETFs

Physical Gold Shares ETFs represent a category of ETFs that aim to track the performance of gold by holding physical gold in custody. These ETFs offer investors a convenient and efficient way to gain exposure to the precious metal, allowing them to benefit from potential price appreciation and the stability that gold historically provides.

Benefits of Utilizing a Top-Rated API for Accessing Physical Gold Shares ETF Rates

Real-Time Accessibility of ETF Rates

Utilizing a top-rated API ensures that investors have real-time access to Physical Gold Shares ETF rates. This immediate data accessibility empowers investors to make timely decisions based on the latest market information, enabling them to capture opportunities and manage risks effectively.

Accuracy and Reliability of Data

The accuracy of investment data is paramount to making informed decisions. A top-rated API provides access to accurate and reliable Physical Gold Shares ETF rates, giving investors confidence in the data they are using to drive their investment strategies.

Enhancing Investment Analysis through API Integration

APIs serve as bridges between data sources and investors, facilitating the integration of investment data into analytical tools and platforms. By incorporating API data, investors can enhance their investment analysis, track historical performance, and gain insights that inform their strategies.

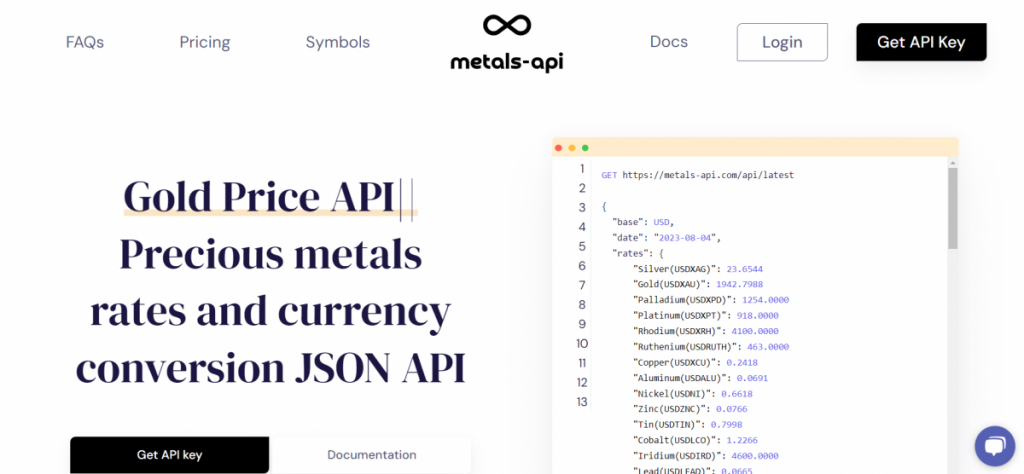

Use Metals-API!

Metals-API is a RESTful API that provides real-time and historical precious metals data. It is powered by 10+ exchange rate data sources. Also, it can deliver data at an accuracy of 2 decimal points. The frequency as high as every 60 seconds.

Metals-API offers a variety of endpoints to help investors obtain Physical Gold Shares ETF Rates. For example, the “latest rates endpoint” returns the latest price for any precious metal in any currency. The “historical rates endpoint” returns historical prices for any precious metal in any currency. The “Fluctuation data endpoint” returns fluctuation data between two specified dates for all available or a specific set of currencies. An investor could use the symbol “SGOL” to obtain Physical Gold Shares ETF.

Currently, Metals-API offers 8 plans, which you can pay monthly or annually. Each plan has prices indicated in USD. If you want to purchase a plan with infinite API calls or contact customer service, just send an email to [email protected]. Also, you could save 2 months with annual billing.

Watch this video:

In conclusion, Physical Gold Shares ETFs offer investors an accessible and efficient way to tap into the potential benefits of gold investment. By leveraging Metals-API, investors can access real-time and historical ETF rates, enhancing their investment analysis and decision-making process.

Read this post: Best API To Obtain iShares Gold Trust Micro Prices