Investing in gold has always been a staple strategy for those seeking to diversify their portfolios and mitigate risks. To cater to the evolving needs of investors, the financial market has introduced innovative vehicles, such as Exchange-Traded Funds (ETFs), that offer exposure to gold through strategic approaches. The FT Cboe Vest Gold Strategy Quarterly Buffer ETF stands out as an exemplar of this innovation, providing investors with not only the potential for gold investment but also a buffer against market fluctuations. In this article, we delve into the significance of this ETF and how utilizing a top-rated API can empower investors with accurate and timely FT Cboe Vest Gold Strategy Quarterly Buffer ETF rates.

Introduction to FT Cboe Vest Gold Strategy Quarterly Buffer ETF

A. Exploring Gold Strategy ETFs

Gold Strategy ETFs, including the FT Cboe Vest Gold Strategy Quarterly Buffer ETF, are designed to optimize the benefits of gold investment while mitigating potential downsides. Unlike traditional ETFs that merely track the price of gold, these specialized ETFs incorporate strategies to provide a level of protection against market volatility. The FT Cboe Vest Gold Strategy Quarterly Buffer ETF employs a buffer mechanism, ensuring that investors are shielded from a certain percentage of losses within a defined period.

B. The Significance of Buffer ETFs

Buffer ETFs like the FT Cboe Vest Gold Strategy Quarterly Buffer ETF bridge the gap between passive gold investment and actively managed funds. By offering a degree of downside protection, these ETFs appeal to risk-conscious investors who wish to participate in the potential upside of gold markets without exposing themselves to the full extent of market downturns. This innovative approach aligns with modern investors’ demand for smarter and more controlled investment options.

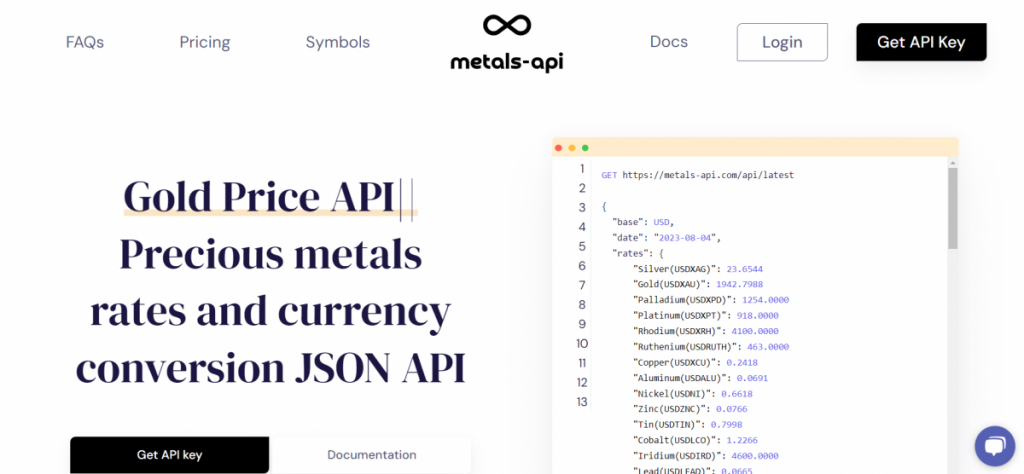

Top Rated API Is Metals-API

Metals-API is a cloud-based API that provides real-time and historical data on precious metals. It’s a powerful tool for investors, traders, and analysts who need access to up-to-date precious metals data. It is easy to use and can be integrated with a variety of trading platforms and software applications. It offers a wide range of features, including:

-Real-time prices for gold, silver, platinum, and palladium.

-Historical prices for any date range

-Currency conversion

-Time-series data

-Support for multiple symbols

To get FT Cboe Vest Gold Strategy Quarterly Buffer ETF (BGLD) rates with Metals-API, you could use one of the multiple endpoints.

The endpoint will return a JSON object with the following data:

-Symbol: The symbol for the ETF.

-Price: The current price of the ETF

-Change: The change in price since the previous day

-Volume: The number of shares traded in the last 24 hours

-High: The highest price of the ETF in the last 24 hours

-Low: The lowest price of the ETF in the last 24 hours

Watch this YouTube Video:

In conclusion, the FT Cboe Vest Gold Strategy Quarterly Buffer ETF represents a forward-thinking approach to gold investment, offering a balance between potential returns and downside protection. By harnessing the capabilities of Metals-API, investors can access accurate and timely ETF rates, analyze historical performance, and make informed decisions that align with their investment objectives.

Read this post: How To Obtain Franklin Responsibly Sourced Gold ETF Prices With An API