If you need nickel rates you must use an API. Here, we make a recommendation with data from Shanghai Futures Exchange.

The value of nickel has risen dramatically in recent weeks since the United States announced that it will no longer import nickel from Russia. The report warns that the United States’ reliance on foreign supplies of battery metals like nickel might harm national security. The exclusion of battery metals from energy limits may emphasize the risk of relying on other countries for them as the United States converts to cleaner forms of energy, such as electric cars.

Finally, you must remain up to date on industry developments so that you don’t lose out on possibilities to benefit from picking the finest solution for you. If you’re considering investing in nickel or if the nickel price affects your business, the simplest method to determine is to examine pricing data over time and see how it’s evolved. You must get data from the most trustworthy sources, in this instance, the Shanghai Futures Exchanges.

What Are Shanghai Futures Exchanges?

The Shanghai Futures Exchange (SHFE) is China’s primary trading venue for industrial derivatives. It was founded in 1999 as a result of the merger and reorganization of the founding financial markets, which were Shanghai Metals, Construction Materials, Cereals and Oils, Petroleum, Chemicals, nickel, Coal, and Agricultural Materials.

SHFE created its trading activity and market management rules and regulations in line with The Interim Provisions of the State Council Concerning the Administration of Futures Trading and The Measures of the CSRC and the Administration of Futures Exchanges. SHFE presently has over 200 members, with futures brokerage firms accounting for more than 80% of them. It also has over 250 remote processing terminals spread around the country. To collect data from this trade market, you need to use an API.

About APIs

API stands for Application Programming Interface. What does it imply? It is a piece of software that interacts and transfers data across two or more devices. It’s common in online banking and social networking services.

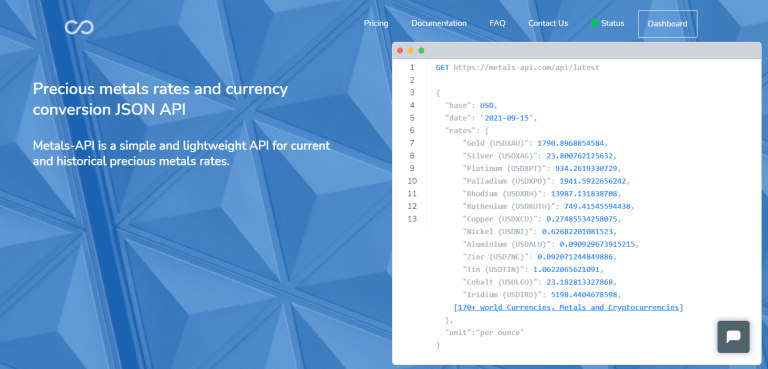

There are several APIs available on the internet that give metal data; however, collecting excellent rate data may be difficult. Regrettably, not all of them send rates from the Shanghai market. Metals-API is a good source for nickel rates.

Why Metals-API?

Metals-API provides data on a variety of metals, including nickel, gold, palladium, and HRC steel. Moreover, you can monitor the prices of these metals in over 170 other currencies, including USD, EUR, and BTC. It collects data from well-known financial firms. Rates for COMEX/NYMEX are also accessible. Furthermore, it is utilized by companies of all sizes, such as the worldwide mining company Barrick Gold.

This API delivers real-time precious metals data with an accuracy of 2 decimal points and a frequency of up to 1 min. You can analyze indications and determine the best moment to invest by using current and historical pricing. For this aim, Metals-API may also be used to detect fluctuation data.