Do you want to get a metal future index? In this article, we recommend a top API to get this.

Investing in precious metal prices can seem difficult. Some of these values can be very fluctuating and dynamic as many economic and geopolitical factors influence them. However, there are many ways to invest to make a profit in this business. You will always win if you can anticipate. This is why metal futures indices are so important.

They are normally settled monthly in March, June, September, and December. Several yearly contracts are also common. You should also keep in mind that stock index futures paying is in cash. If the indices value at the expiration date is greater than the agreed price the purchaser profits while the vendor (called the prospective writer) loses. On the contrary case, the customer loses money while the seller profits.

Why Consider Index Futures?

Index futures are agreements to purchase or sell a monetary index at a preset current price for a future point. Index futures, which were originally meant for investment firms, are now available to retail investors as well.

What is the advantage of this? These contracts are highly effective for anticipating price rises by establishing a set rate. Index futures are used by asset managers to protect their equity investments versus stock losses. Index futures, on the other hand, can be used by traders to wager on the industry’s trajectory.

This type of contract, on the other hand, measures the value of a certain item or collection of resources, such as markets, metals, and exchange rates. A contract is a sort of derivative that obligates buyers to purchase the fundamental asset at a fixed price on a specific day.

The operator is liable to provide the financial value at expiry unless the agreement is resolved earlier expiring through an offsetting operation. Index futures are used by traders to hedge or speculate on future price fluctuations in the fundamental stock index.

Why Use An API?

An API is a technology that allows you to anticipate the precious metal market. It’s software that programmers incorporate into the architecture of websites or applications. In this case, you must acquire one that provides data such as current prices, historical prices, and fluctuation data.

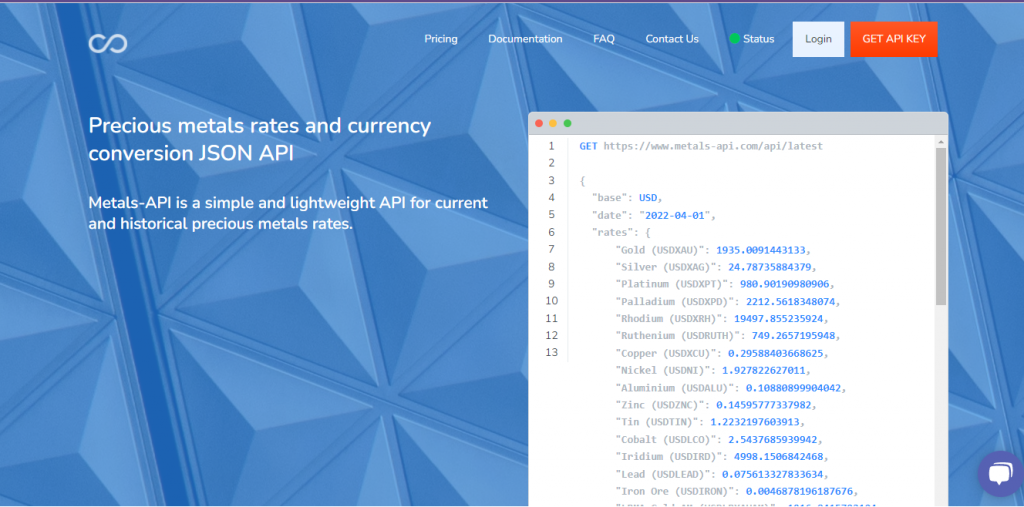

For this purpose, Metals-API contains all of these data. Moreover, you can access the metal future index. If you get this information you will be a very professional investor in this difficult business. Because with this tool, it won’t seem so difficult anymore.

About Metals-API

An API like Metals-API will allow you to become a great precious metals investment professional. Provides information on many metals such as gold, silver, palladium, and copper. You can also find it in your currency and foreign currencies since it works with currencies from around the world such as dollars, euros, pesos, and yen.

It is very easy to use on your page because it works in various programming languages. By incorporating this API into your page you will be able to advise your clients with the most reliable information in the world. This is because it obtains information from the most relevant financial authorities in the world.