You need to read this article if you are looking for an API for metal information from the Pakistan Mercantile Exchange.

Working with metals may be a difficult journey. It is a competitive industry impacted by a multitude of variables. One of them is the conflict in Western Europe. These occurrences have caused the price of numerous metals to rise or fall in recent years and months. Moreover, changes in important sections of the global economy, such as power or varied businesses that use metals, might destabilize the metals’ value. As a consequence, you must stay up to date on the rates provided by a reliable source.

Since a sizable majority of metal traders are based in Pakistan, these metal markets are the most reliable. It is critical to stay up to date with Pakistan Mercantile Exchange pricing to achieve this goal. Keeping this in mind, if you’re considering trading in metals, you’ll want to keep up with metals prices. It is necessary to stay current on the most important retail prices around the planet.

What Exactly Is the Pakistan Mercantile Exchange?

PMEX was created in 2002 and commenced operations in May 2007, delivering a diverse selection of domestic and global commodities across many asset classes. PMEX is a demutualized exchange with institutional ownership.

Pakistan Mercantile Market Limited (PMEX), the nation’s first and only demutualized commodity derivatives exchange, is licensed and regulated by the Securities and Market Commission of Pakistan (SECP). PMEX offers a full array of services under one roof, covering trading, clearing and settlement, custody, and back-office, all based on an advanced multi-dimensional network and cutting-edge technology. It is capable of working with commodities and also metals so important in the global market such as gold, silver, platinum, copper, and palladium.

To get this data, you’ll need the necessary tools. For this reason, we strongly recommend using an API that provides current metal prices as well as historical rates based on Pakistan Mercantile Exchange data. You must also choose one that provides fluctuation statistics so that you can take into account all of the factors when determining the best time to buy.

About APIs

An application programming interface (API) is a service that connects two devices or applications (API). You’ll need to utilize the tools listed to assist you. While several services may be useful, keep in mind that they are not all functioning or give the same content.

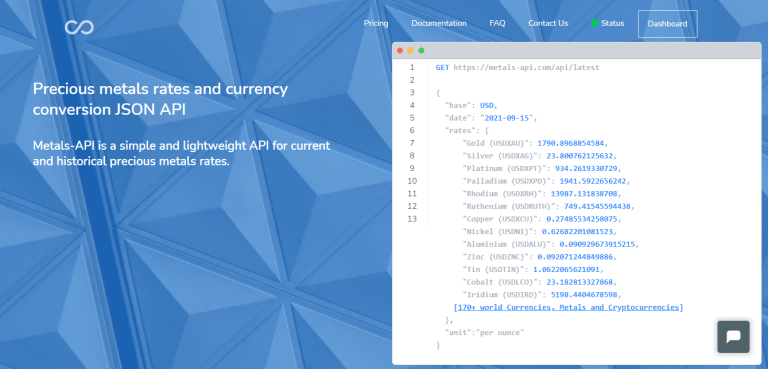

Finding an API is straightforward, but finding one that provides copper prices in Bombay Stock Exchange values is more challenging. Metals-API, one of the world’s top precious metals inventories, compiles this information. You may use the API to combine it into your application or website, as well as the extensions on this site, to obtain current and historical values.

To obtain it, perform these steps:

- Go to www.metals-api.com to obtain an API key.

- Begin by searching the dictionary for the symbols you’ll be utilizing.

- When you finish the API request, use these indicators to add metal and currency to the list.

- Press the “run” button.

Why Metals-API?

Metals-API is a technology that gives real-time metals pricing information. Over 170 currencies, including the US dollar, euro, and digital currencies, are accessible at these exchange rates. This data is acceptable whether it is presented in the form of real numbers or historical rates.

Price fluctuation may be used to determine the key reasons for movement and the optimum time to purchase. It contains COMEX/Nymex rates as well as information from another commercial body. To integrate the data into your website or app, you may utilize a variety of computer technologies, including PHP, JSON, and Python.