To receive gold prices from Nasdaq, one of the most reliable sources, we propose utilizing a free top API.

Gold is one of the world’s most powerful metals. In 2020, global gold mine production was 3,478.1 tonnes (122.7 million ounces), a modest decrease for the second year in a row after steadily growing in previous years. Covid-19 may have played a role in the postponement, but we may also be witnessing the effects of reduced experimental funding.

This makes us question if the price of gold has risen. Consider the scenario in South Africa. With over 1,000 tonnes produced in 1970, the country thereafter became the leading player in production levels, although output has subsequently plummeted considerably.

However, this country has not been among the top 10 providers since the preceding year. China, the world’s largest producer, and consumer will lead the top ten gold-producing nations in 2020. Russia and Uzbekistan both produce.

On the other side, gold prices rose in turbulent trading on Monday, bolstered by a weaker dollar, although gains were limited by some investors shifting to riskier assets in Asia. Despite a mainly positive performance since reaching a three-month low of $1,786.60 per ounce on May 16, gold prices are on track for a second consecutive monthly loss for the first time since March 2021, down roughly 2.4 percent so far.

How To Get Gold Prices From Nasdaq?

You must utilize an API to engage in this company. It’s software that communicates with numerous devices. Several of them are available on the internet. Nevertheless, not all of the works in the same way or have the same functions or information.

To operate in the gold business, you must supply the most reliable information to study price swings over time and stay current with pricing. Nasdaq should provide you with information through an API. Just the NYSE has a larger stock and securities exchange than the Nasdaq.

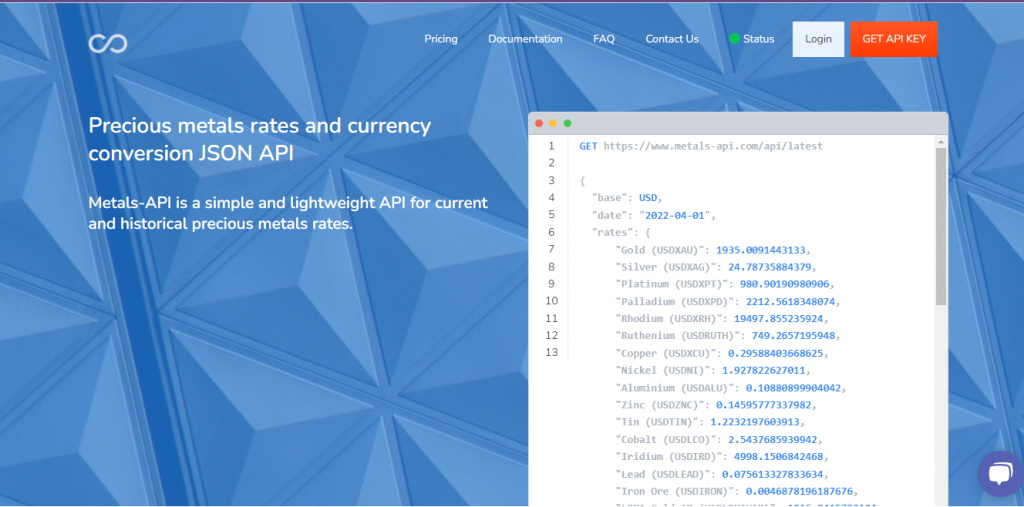

Choose one that offers both history and current gold prices from Nasdaq with the most respected APIs in this instance. Metals-API is a great option for this. It provides real-time statistics on a wide range of items and gathers data from the most reliable sources and key exchange hubs.

This information will be extremely useful in finding the ideal moment to buy by evaluating price variations caused by several events across time. You may also use your network to monitor and report spot pricing. For this purpose, use Metals-API, which collects data from the most credible sources, such as Nasdaq.

To receive it, follow these steps:

- To obtain an API key, complete the form at www.metals-api.com.

- Look up the items you’ll be utilizing in a dictionary, such as currency and gold.

- Moreover, before submitting the API call, use these indications to add metal and currency to the list.

- Finally, click on the “execute” button.

About Metals-API

The Metals-API obtains currency rate data every minute from over 15 credible sources, such as the LME or New York Rates, or ICE. Metals-API only offers data on average currency fluctuations. Metals-API offers accurate Precious Metal exchange rate data in 170 different foreign currencies. It is the most precise and instantaneous API, with no need for you to wait for results.