In the ever-evolving landscape of financial data, the reliance on robust APIs has become paramount. As we delve into the world of financial data APIs and explore an alternative to Bloomberg API like Metals-API, we uncover a realm of possibilities for investors, traders, and financial analysts.

Metals-API – The Rising Star As An Alternative To Bloomberg API

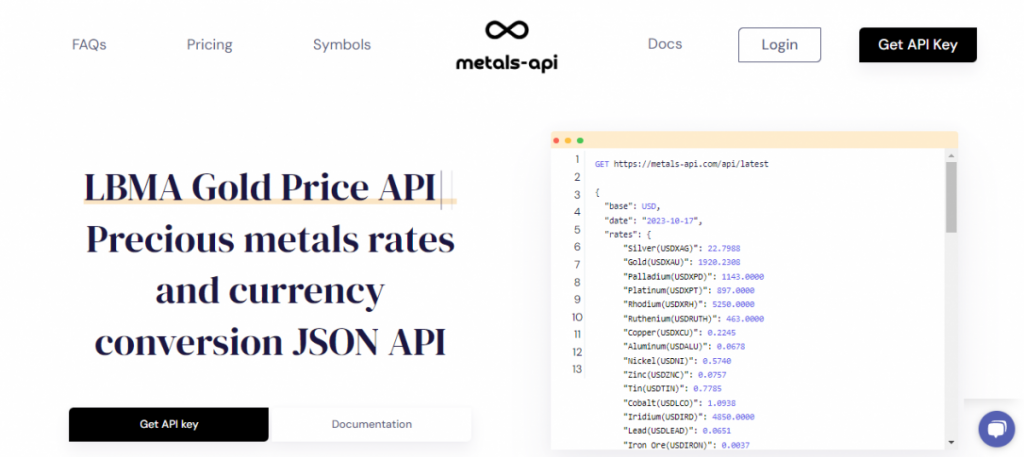

Introducing Metals-API

In a world where access to real-time metals data is crucial, Metals-API emerges as a formidable contender. Offering an extensive range of metals data, including aluminium prices, copper prices, and even precious metals, it’s a one-stop-shop for all things metal-related.

Key Features and Capabilities

- Metals Live Data: Get real-time data feeds, essential for quick decision-making.

- Comprehensive Coverage: Extensive data coverage, from Iridium prices to Iron Ore prices.

- Metals Symbols API: Simplifies data retrieval with a wide array of symbols.

Pricing and Subscription Options

Metals-API offers competitive pricing and flexible subscription plans, catering to both individual investors and enterprise clients.

Use Cases and Industry Adoption

This versatile API finds applications in various industries, including manufacturing, mining, and investment analysis.

Y-DataHub – A Versatile Contender As Alternative To Bloomberg API

Unveiling Y-DataHub

Y-DataHub presents an impressive data hub, encompassing a wide range of data sources, from New York Rates API to ENDEX.

Data Coverage and Sources

Its vast data coverage extends from precious metals to commodities, making it an attractive alternative to the Bloomberg API.

Z-Finance Connect – The Established Player

Z-Finance Connect: An Overview

For those looking for historical data and analytics, Z-Finance Connect stands as a robust alternative to the Bloomberg API.

Historical Data and Analytics

Access historical data with ease, from LBMA rates to LME prices.

Evaluating the Alternatives

When considering a transition from Bloomberg API to alternatives, several factors must be weighed:

- Performance and Latency: Is real-time data truly real-time?

- Data Accuracy and Reliability: Are you receiving accurate data?

- Customization and Scalability: Does the API fit your unique needs?

- Compliance and Security: Is your data secure and compliant?

- Case Studies of Real-world Applications: What success stories can be found?

Making Your Choice

In summary, there’s a world of alternatives to the Bloomberg API, each with unique features and strengths. To make an informed choice, consider your specific needs and priorities. Explore these alternatives, and you may find a better fit for your financial data requirements in 2024.

Why Do We Recommend Metals-API As The Best Alternative?

Metals-API was originally a simple, open-source solution for accessing current and historical precious metals rates. Today, Metals-API has evolved to offer real-time precious metals data via its API, boasting an impressive accuracy of 2 decimal points and an update frequency as rapid as every 60 seconds.

Its capabilities encompass delivering exchange rates for precious metals, facilitating currency conversions, providing time-series data, fluctuation data, and reporting the lowest and highest prices for any given day.

Moreover, Metals-API supplies end-of-day (EOD) historical exchange rates, available at 00:05 am GMT for the previous day.

Where Is The Data Coming From?

Metals-API retrieves exchange rate data from over 15 reputable data sources, updating every minute. These sources include banks and financial data providers.

How Do I Use It?

1 – Register

2 – Look for the symbols that match your search

3 – Make an API call with them, placing your selected metals in symbol, and your preferred currency in base currency.

Furthermore, currency and metals conversion can be accomplished using the same API endpoints. This allows you to convert any amount from one currency to another, from one type of metal to another, or from any currency to any metal.