Bank Data APIs are a type of application programming interface that allows developers to access and use banking and financial data. These APIs can provide a wide range of banking-related data, including account balances, transaction histories, and routing numbers.

Financial data APIs may provide significant benefits to companies and people that wish to access and use financial data. Developers may use these APIs, for example, to construct apps and services that interface with financial systems, providing users with real-time data and improved functionality.

Financial information APIs may also assist firms in improving their operations by providing access to data that can assist them in making better decisions and managing their finances. Banks, for example, may use APIs to provide real-time information about their customers’ accounts and transactions, increasing transparency and customer service.

Overall, banking information APIs are a great resource for enterprises and people seeking financial data access and utilization. By providing real-time information and improved functionality, these APIs may help firms improve their operations, provide better customer service, and remain ahead of the competition.

How Does A Bank Data API Work?

Developers can use banking APIs to access and retrieve data from banking systems and financial institutions. This information is available in real time, providing users with up-to-date information and functionality.

To use a financial information API, a developer must first identify the API they wish to access and obtain an API key or other login credentials. Once approved, the developer may send data requests in the form of HTTP requests via the API.

The API will then process the request and return the needed data to the developer in a format that can be easily incorporated into their application or service. Account balances, transaction histories, and other financial information may be included in this data.

Financial information APIs can also be used to initiate transactions, such as payments or transfers, and maintain accounts, such as updating contact information or configuring notifications.

Overall, banking information APIs enable developers to access and use data from banking systems and financial institutions, allowing them to create apps and services that provide customers with real-time information and enhanced functionality.

Which Bank Data API Provides The Best Service On The Market?

We can state that, after thoroughly researching many market alternatives, we have selected one that, owing to its functionality and ease of use, is one of the finest current possibilities.

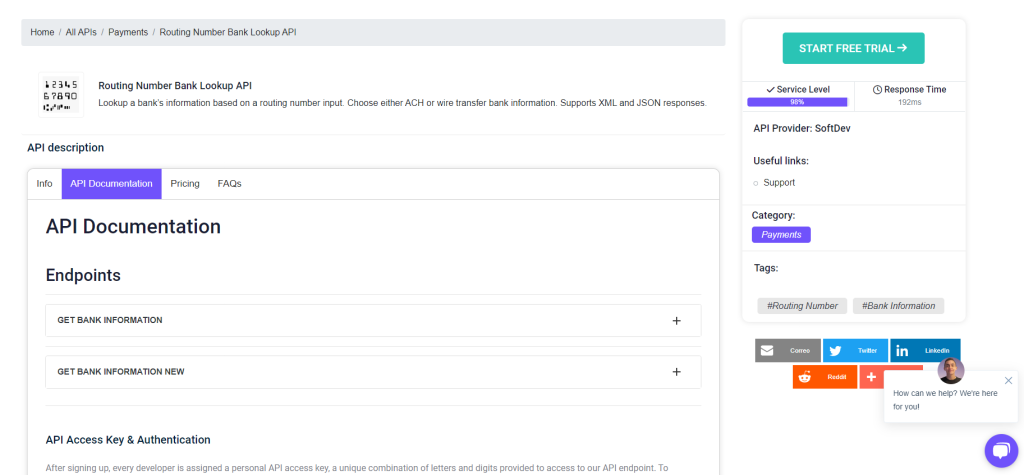

As previously said, the Zylalabs Routing Number Bank Lookup API was chosen since it has served us well and is straightforward to use even if you don’t know anything about it.

Using a routing number, look up a bank’s information. Choose whether to utilize ACH or wire transfer banking information. It takes XML or JSON responses.

For example, if you enter the routing bank number “121000248” into the endpoint “Get Bank Information,” you will obtain the following response:

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}

How Do I Obtain the Routing Number Bank Lookup API?

- To get started, go to Routing Number Bank Lookup API and click the “START FREE TRIAL” button.

- After signing up for Zyla API Hub, you’ll be ready to utilize the API!

- Make use of the desired API endpoint.

- When you’ve arrived at your endpoint, make the API call by clicking the “test endpoint” button and watching the results on your screen.

Related Post: A Quick Introduction To Banking Information APIs