Did you know that using a Taxes API has many use cases for both citizens and companies? These services available on the web seek to help anyone who needs help calculating their taxes. Nobody wants to have problems with taxes. More info in this post.

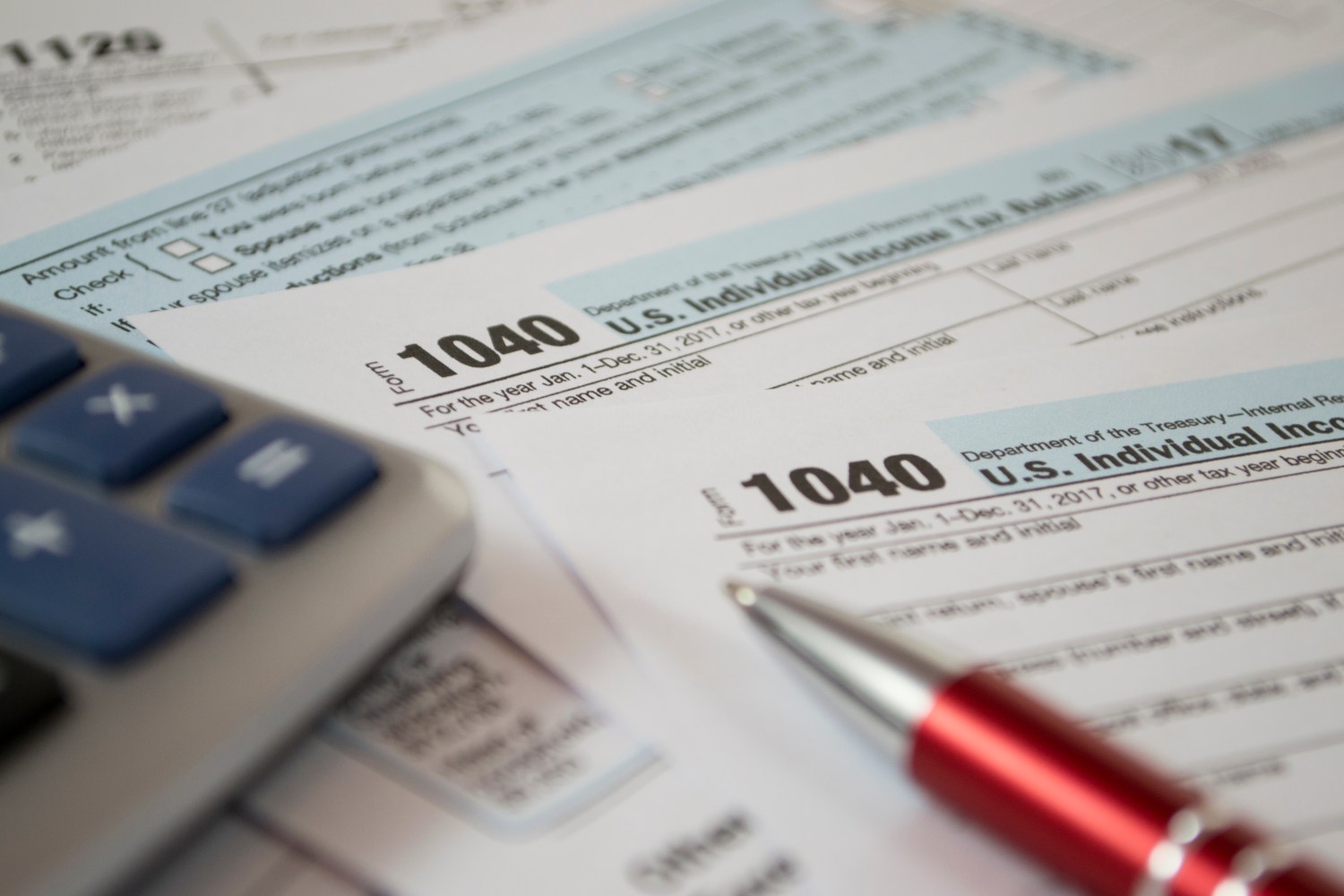

Paying taxes in the US is crucial for funding public services like education, healthcare, and infrastructure. Taxes support social welfare programs, public safety, and defense. They help bridge income gaps and promote economic equality. Taxes empower the government to address national challenges and invest in the nation’s future. Complying with tax obligations ensures citizens contribute to the well-being of society.

Tax revenue aids disaster relief efforts and supports research for scientific advancements. It fosters a stable economy and enables government assistance for the vulnerable population. Paying taxes is a civic duty that strengthens the fabric of the nation and fosters collective progress. Responsible taxation sustains a functional society and upholds the values of democracy and shared responsibility.

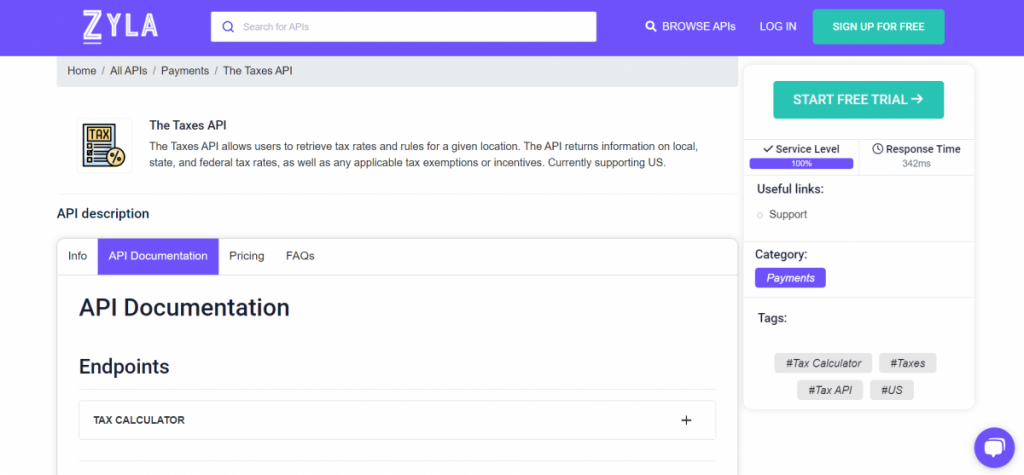

However, calculating taxes for an entire year can be a tedious task for anyone or any company. Fortunately, there are APIs that will help you calculate taxes depending on the state where you live. One of the most popular APIs on the market is The Taxes API, as it has many use cases. You will find all the details in this article.

The Most Common Usage Cases For The Taxes API!

The Taxes API from Zyla Labs caters to both companies and ordinary citizens, providing valuable solutions for diverse use cases.

For Companies:

-Tax Calculation: Companies can effortlessly calculate accurate taxes using real-time data, minimizing errors and ensuring compliance.

-Reporting: The Taxes API simplifies tax reporting, streamlining the process for businesses to meet regulatory requirements efficiently.

-Custom Integration: Seamless integration with existing systems enables companies to customize tax solutions as per their needs.

-Scalable Solution: As businesses grow, the API scales to handle increased tax processing demands effectively.

For Ordinary Citizens:

-Individual Tax Calculations: The API assists citizens in calculating their taxes accurately, maximizing returns, and minimizing burdens.

-Tax Insights: Real-time tax updates help citizens stay informed about the latest regulations, ensuring compliance.

-Simplified Filing: With the API’s assistance, citizens can streamline tax filing, making the process more manageable.

Both companies and ordinary citizens benefit from the versatility and reliability of The Taxes API. It optimizes tax management, saving time and resources while promoting accurate calculations and compliance. By providing up-to-date tax insights and custom integration, the API enables businesses to adapt to evolving tax regulations and scale effortlessly. Its strong data security ensures the protection of sensitive information, instilling confidence in users.

Watch this video and find out how to calculate taxes with this API:

In conclusion, The Taxes API from Zyla Labs offers a comprehensive solution for a wide range of tax-related use cases. Its user-friendly interface, real-time data, and secure environment make it a valuable asset for companies and ordinary citizens alike.

Take a look at this article: Benefits Of Using The Tax Calculator API