In today’s digital age, financial transactions have become increasingly complex, making it crucial for businesses and individuals to ensure the accuracy and legitimacy of financial information. The rise in financial fraud and the need for secure transactions have led to the development of advanced tools and technologies, such as application programming interfaces (APIs), to validate financial data. Among these APIs, one of the most essential is bank routing number verification APIs, which play a significant role in fraud detection and prevention.

Financial institutions and businesses face a constant battle against fraudulent transactions, which can lead to significant financial losses, reputational damage, and legal consequences. Fraudsters employ various techniques to exploit vulnerabilities in the banking system, including using incorrect or invalid bank routing numbers. This poses a significant risk, as incorrect routing numbers can result in misdirected funds, delayed transactions, or even funds falling into the wrong hands.

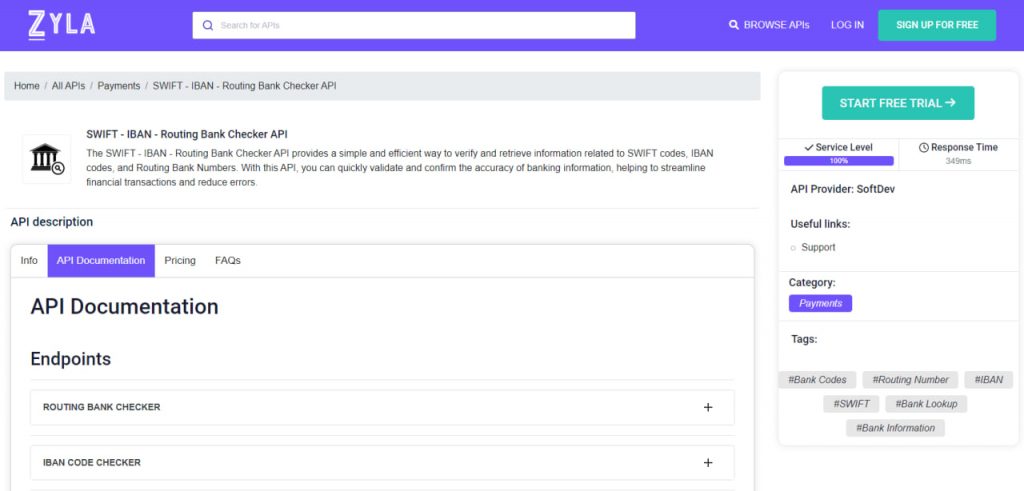

Bank routing number verification APIs provide a powerful solution to combat fraudulent transactions by ensuring the accuracy and validity of bank routing numbers. This type of API allows businesses, financial institutions, and developers to integrate a secure and efficient method of validating routing numbers directly into their systems and applications. We recommend Zyla’s SWIFT – IBAN – Routing Bank Checker API, as it allows organizations to perform real-time checks on routing numbers and identify potential discrepancies before processing any financial transactions, thereby being an incredible shield against fraud.

What Are The Benefits Of This API?

SWIFT – IBAN – Routing Bank Checker API can be seamlessly integrated into existing systems and applications. It can be used to enrich CRM systems, accounting software, mobile applications, and other financial tools. With it’s flexible integration capabilities, businesses can create a unified view of their customers’ financial landscape, allowing for a more comprehensive analysis of financial data.

It provides businesses with several benefits when it comes to fraud prevention, such as:

- Enhanced Accuracy: The API acts as a gatekeeper, preventing incorrect or invalid routing numbers from entering the transactional flow. By validating routing numbers in real time, errors can be detected early on, ensuring accurate and reliable transactions.

- Fraud Detection and Prevention: Fraudulent activities can be detected by cross-referencing the provided routing numbers with trusted databases. Suspicious or blacklisted routing numbers can be flagged, allowing businesses to mitigate potential risks and prevent financial losses.

- Compliance and Risk Mitigation: Financial institutions are subject to strict compliance regulations. Utilizing a bank routing number verification API helps organizations meet regulatory requirements by ensuring the legitimacy of transactions and minimizing the risk of involvement in money laundering or other illicit activities.

- Customer Trust and Satisfaction: By implementing a robust fraud detection system, businesses demonstrate their commitment to protecting their customers’ financial information. This fosters trust, enhances customer satisfaction, and strengthens the reputation of the organization.

How Does This API Work?

SWIFT – IBAN – Routing Bank Checker API is designed to be easy to use. With simple API requests, you can quickly retrieve information about SWIFT codes, IBAN codes, and routing bank numbers.

To provide an example of this API in action, here’s the endpoint resulting from a call to the API where the 9-digit routing bank number is provided:

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}How Can I Get This API?

As financial transactions continue to evolve in complexity, it becomes increasingly vital for businesses and financial institutions to implement robust fraud detection measures, such as bank routing number verification APIs. SWIFT – IBAN – Routing Bank Checker API offers a powerful solution, enabling organizations to validate bank routing numbers in real-time, detect potential discrepancies, and prevent fraudulent transactions. You can try this powerful tool by following these instructions:

1- Go to “SWIFT – IBAN – Routing Bank Checker API” and simply click on the button “Start Free Trial” to start using the API.

2- Employ the different API endpoints depending on what you are looking for.

3- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.