The insurance industry is undergoing a profound transformation, largely driven by the data revolution. Vehicle data, in particular, has emerged as a cornerstone of this evolution. Insurance companies now rely on comprehensive vehicle information to refine risk assessment, expedite claims processing, and enhance customer engagement. In this article, we unveil the must-have vehicle data API that is revolutionizing the way insurance companies operate.

How Vehicle Data Transforms Insurance

A. Risk Assessment and Pricing

Vehicle data empowers insurance companies to perform precise risk assessments by considering factors such as vehicle specifications, safety features, and accident history. With access to vehicle data, insurers can develop personalized pricing models that reflect individual driver behavior, vehicle usage patterns, and real-time risk factors.

B. Claims Processing and Fraud Detection

Vehicle data facilitates rapid claims processing by providing instant access to accident reports, vehicle condition, and repair history, expediting settlements. Insurance companies can deploy vehicle data to detect and prevent fraud, ensuring that claims are legitimate and saving costs.

C. Customer Engagement and Retention

Leveraging vehicle data, insurers can offer personalized policies tailored to individual driving habits, providing better coverage at competitive rates. By utilizing real-time telematics data, insurance companies can offer risk mitigation services, such as safe driving tips and maintenance reminders, fostering customer loyalty.

Key Features of the Must-Have Vehicle Data API

The API must provide detailed data on the make, model, and year of vehicles to support accurate risk assessment. Also, the API should seamlessly integrate with insurance company systems and workflows for streamlined data access and utilization. Customization options should be available to tailor data access and reporting to the specific needs of the insurer.

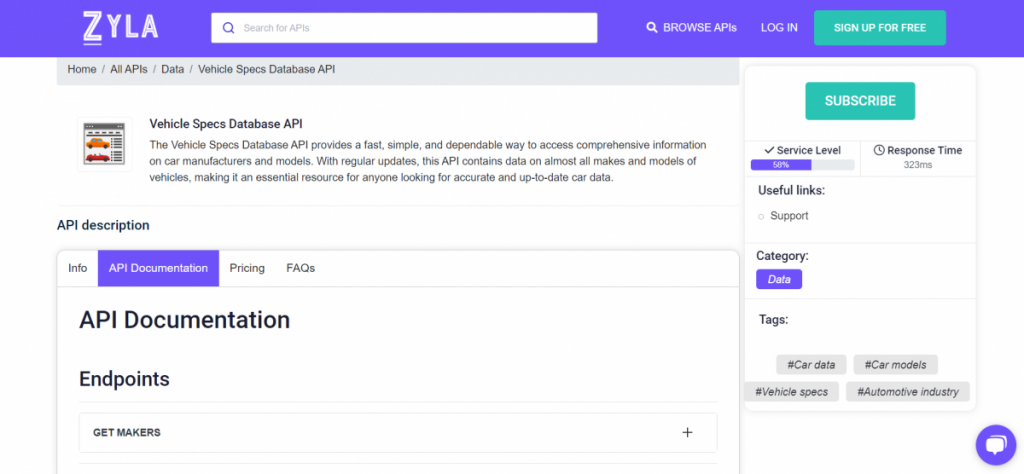

Use Vehicle Specs Database API!

The Vehicle Specs Database API from Zyla Labs is the best API for insurance companies. It provides comprehensive and up-to-date information on car manufacturers and models, making it easy for insurance companies to assess risk and price policies accordingly.

Here are some of the benefits of using the Vehicle Specs Database API for insurance companies:

-Accurate risk assessment: The API provides detailed information on car specifications, such as make, model, year, mileage, and safety features. This information can be used by insurance companies to accurately assess the risk of insuring a particular vehicle.

-Competitive pricing: The API can help insurance companies price their policies more competitively. By knowing the exact specifications of a vehicle, insurance companies can avoid overpaying for coverage.

-Improved customer service: The API can help insurance companies provide better customer service. By having access to accurate car information, customer service representatives can answer questions quickly and easily.

-Reduced fraud: The API can help insurance companies reduce fraud. By verifying the specifications of a vehicle, insurance companies can identify fraudulent claims.

-Increased efficiency: The API can help insurance companies improve their efficiency. By automating the process of gathering car information, insurance companies can free up staff time to focus on other tasks.

Watch this interesting video:

Overall, the Vehicle Specs Database API is the best API for insurance companies. It provides accurate, up-to-date information that can be used to assess risk, and price policies, improve customer service, reduce fraud, and increase efficiency. Visit the Zyla Labs website for more info.

Read this article: How To Look For American People Information With An API