If you need to obtain the most accurate information about metals, you must try with the help of an API like the one that we recommend here.

In the upcoming months, experts are laying out their predictions for the metals trades. The fall in Chinese demand as well as the power crisis in Europe will have an impact on the need for iron ore. The iron ore market is likely to remain volatile in the short and long term due to the European energy demand, dropping global GDP, growing global inflation, and issues with logistics worldwide.

European steelmaking will decrease this quarter. This is due to profits at production facilities will keep shrinking over the upcoming months. It is because of the decline in demand and the expensive input costs.

The metal industry was impacted by the conflict. The three minerals that have been most impacted by the violence in Ukraine are nickel, aluminum, and copper, according to a comparison of their values over time. The cost of iron ore has decreased by 33% since that time.

The Russian invasion of Ukraine undoubtedly played a direct role in the spike in nickel costs, but iron ore is a different story. Due to a drop in sales in China, its valuation has decreased.

Ukraine exported 1.5% of the planet’s iron ore last year. The nation transported 438,000 tons of the material in September, an enhanced engagement (132%) compared to the same month the preceding year, despite severe operational obstacles brought on by the conflict and the stoppage of output at factories in 2022.

However, the sharp decline in marine exports was brought on by a new administration tariff of 50% on all shipments of iron ore from India. Since 2021, shipments from the three countries with the greatest export volumes—Australia, Brazil, and South Africa—have generally been flat. Heavier-than-expected rains in Australia seem to have served as the lone exception.

Regarding imports, China purchased 69% of the world’s iron ore exports in 2017. Industry watchers draw attention to the fact that these figures are far lower than the Asian giant had projected. In particular, systemic issues in the housing industry and the upkeep of stringent anti-corruption measures have slowed down Economy steel demand. COVID-19 guidelines

Apply An API

You’ll see that this year’s situation for metal production and use has grown more intricate. The metals industry is impacted by several variables. Additionally, other commercial activities have an impact on it, including those that create metals and those that purchase them to transform them into chips for devices, for example.

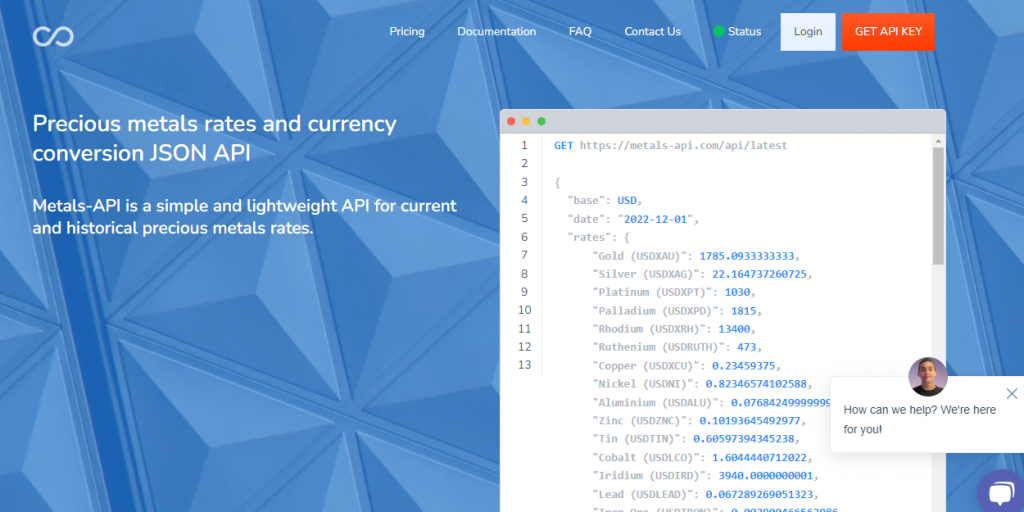

They are so crucial on a worldwide scale because of this. According to this structure, if you engage in this industry, you need to stay current on metal costs. To save you time seeking and comparing prices throughout the globe, we here suggest Metals-API.

About Metals-API

Developers like the Metals-API. Integrate it into web pages and programs using the full documentation provided in the programming language of your choice. Additionally, it integrates information from the most considerable financial markets worldwide.

The World Bank and LBMA are part of it. You will be capable of comparing current metal data with historical data and price swings, and you will also have real-time metal data updated in the currency that most concerns you.