Uncertainty has long veiled the world of commodities trading. With market fluctuations dictating fortunes and leaving even seasoned traders scrambling for footing. But amidst this volatility, a citrusy ray of sunshine has emerged: the Orange Juice Prices API. This seemingly unassuming tool is revolutionizing the way we understand and interact with the complex world of commodity prices, and its impact extends far beyond the realm of just your morning OJ.

From Cloudy To Crystal Clear

The Orange Juice Prices API acts as a window into the very soul of the orange juice market. It grants instant access to a wealth of real-time and historical data, revealing price trends, seasonal shifts, and the intricate web of factors that influence them. Gone are the days of relying on gut instinct or murky market whispers; with this API, traders are armed with precise, actionable data, empowering them to:

- Make informed investment decisions: Real-time price fluctuations illuminate opportune buying and selling points. Allowing traders to capitalize on market movements with laser-sharp precision.

- Develop data-driven strategies: Historical data serves as a training ground for backtesting and refining trading strategies. Equipping traders to navigate even the most turbulent price cycles.

- Hedge against risks: Understanding price volatility becomes a shield against potential losses, enabling traders to strategically hedge their orange juice-related investments with other commodities or financial instruments.

Beyond the Pulp: A Ripple Effect On Commodities

The impact of the OJ Prices API extends beyond a single beverage, influencing the broader commodities trading landscape. Its benefits include enhanced market transparency, boosted industry resilience, empowered consumers, and facilitating data-driven research and policy decisions.

A Tangy Taste of the Future: The success of the Orange Juice Prices API sets the stage for a future where similar APIs empower the trading of various commodities. Imagine a world where market data flows freely. Traders are armed with precision tools, and consumers actively engage in the dance of supply and demand. This is the future the OJ Prices API is helping to usher in, transforming commodities trading into a well-orchestrated tango between data, insight, and opportunity.

Harnessing The Power Of Commodities-API

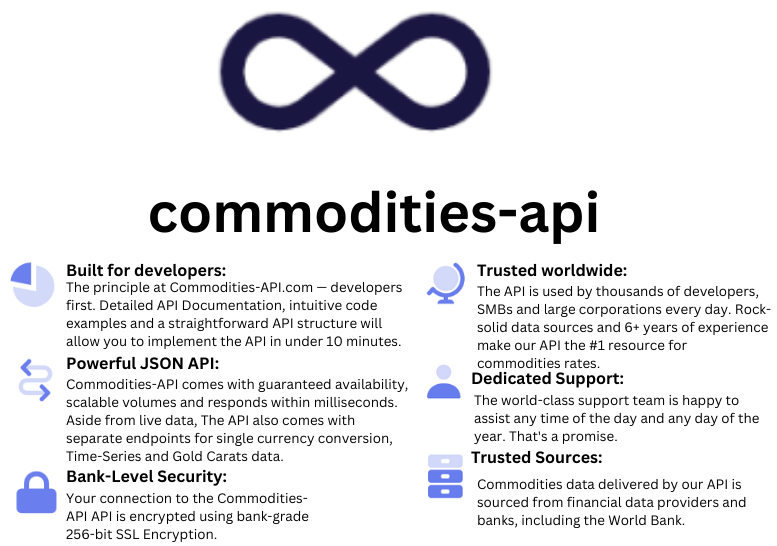

Commodities-API amplifies the influence of the Orange Juice Prices API. Powered by 10+ exchange rate data sources for commodities prices, it offers multiple endpoints catering to diverse use cases. This platform enhances market efficiency, transparency, and empowerment for all players.

Getting Started

- Register: Visit www.commodities-api.com and sign up for free access to the platform.

- Retrieve API Key: Obtain your key for authentication.

- Make API Calls: Utilize diverse endpoints for Orange Juice prices.

- Explore Documentation: Detailed guides and code examples are available for seamless integration.

Example

Endpoint: Latest [request the most recent commodities rates data] – Orange Juice

- INPUT

- Base Currency: USD

- Symbols (Code): OJU22

- API Response:

{"data":{"success":true,"timestamp":1705157100,"date":"2024-01-13","base":"USD","rates":{"OJU22":0.0032862306933947},"unit":{}}}Conclusion

The Orange Juice Prices API, coupled with Commodities-API, reshapes the commodities trading landscape. As you sip your morning OJ, raise a toast to this unsung hero, leaving a legacy of greater efficiency, transparency, and empowerment for all players in the game.

For more information on Commodities-API read my blog: Who Can Benefit From The Rough Rice Prices API?