In today’s fast-paced global economy, international transactions have become increasingly prevalent. As businesses strive for accuracy, efficiency, and security in their cross-border dealings, the integration of advanced technologies becomes essential. One such cutting-edge solution is the implementation of an International Transaction API for validation. This article explores how this API empowers businesses to stay at the forefront of international transactions, enabling seamless and reliable validation processes. Furthermore, by harnessing the power of this technology, businesses can unlock a world of opportunities and overcome the challenges associated with global transactions.

Prominent Advantages Of Using International Transaction API For Validation

In the ever-evolving landscape of international transactions, staying ahead of the curve is imperative. By adopting an International Transaction API for validation. Businesses gain a competitive edge, ensuring seamless communication, enhancing accuracy, and optimizing transactional workflows. Additionally, the API empowers businesses to mitigate risks, build trust, and unlock global opportunities. As the cutting edge of international transactions, this Bank Lookup API propels businesses towards success in an interconnected and rapidly changing global economy.

Streamlining Communication And Data Exchange

At the heart of international transactions, efficient communication and data exchange is vital. APIs act as the connective tissue between various systems, enabling smooth interaction and information flow. By leveraging bank lookup API for validation, businesses can establish seamless connections between their internal systems and external entities. Connecting financial institutions, and regulatory bodies. This streamlines the process of sharing crucial data and facilitates real-time validation, significantly further enhancing transaction efficiency.

Enhancing Accuracy and Reliability

The accuracy and reliability of international transactions depend on robust validation processes. An API designed specifically for validation brings a new level of precision to this critical aspect. By incorporating intelligent algorithms and leveraging real-time data, businesses can ensure the authenticity of transactions, reduce errors, and prevent fraud. The API’s ability to cross-reference and verify vital information, including bank codes, routing numbers, IBANs, and SWIFT codes, strengthens the foundation of international transactions, instilling confidence and trust in the process.

Seamless Integration and Workflow Optimization

Integrating an API for validation seamlessly into existing workflows unlocks a host of benefits for businesses. By doing so, organizations can optimize their transactional processes, eliminating manual and time-consuming tasks. The API automates verification procedures, minimizing human errors and speeding up the validation cycle. Businesses can customize the API to align with their unique requirements, ensuring a tailored and efficient workflow that meets compliance standards and regulatory obligations.

Real-Time Insights and Risk Mitigation

International transactions carry inherent risks, such as incorrect recipient information or potential regulatory violations. Leveraging an API for validation equips businesses with real-time insights into critical transactional data, enabling them to make informed decisions swiftly. By accessing accurate information about banking details, businesses can mitigate risks effectively, identify suspicious activities, and prevent fraudulent transactions. The API acts as a vigilant gatekeeper, ensuring compliance with regulatory frameworks and safeguarding businesses from potential penalties and reputational damage.

Unlocking Global Opportunities

Implementing an API for validation expands businesses’ horizons and unlocks new global opportunities. The seamless validation process allows organizations to engage confidently in cross-border transactions, expanding their market reach and enhancing international partnerships. By leveraging the API’s capabilities, businesses can seamlessly navigate the complexities of international regulations, currency conversions, and banking standards. This positions them at the forefront of global transactions, enabling them to seize opportunities swiftly and capitalize on emerging markets.

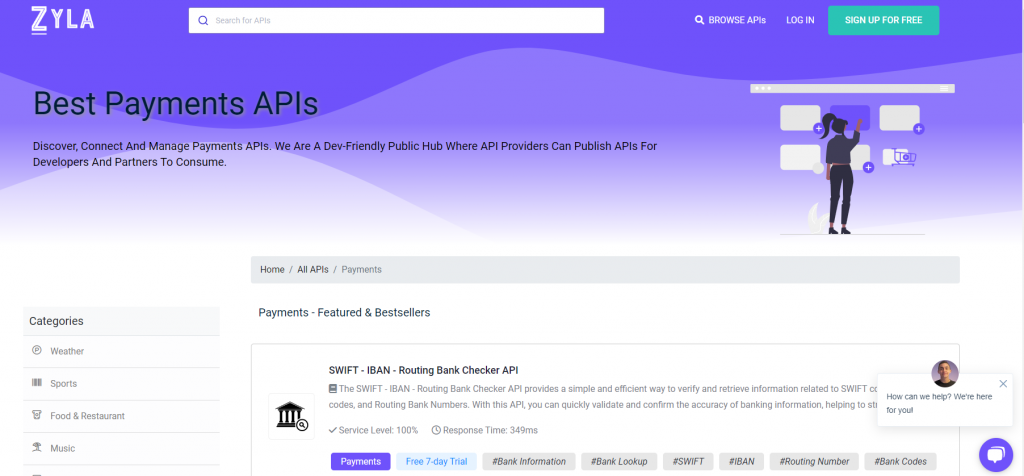

Streamlining International Transactions: The Power of the SWIFT – IBAN – Routing Bank Checker API

The implementation of the SWIFT – IBAN – Routing Bank Checker API represents a state-of-the-art technology that empowers businesses to enhance the accuracy, efficiency, and security of their international transactions. This cutting-edge API offers a straightforward and streamlined approach to verifying and accessing information about SWIFT codes, IBAN codes, and Routing Bank Numbers. By leveraging this advanced API, businesses can expedite the validation process and ensure the precision of banking information, thereby optimizing financial transactions and minimizing errors.

To explore the API, visit www.zylalabs.com and navigate to the Categories menu, select the Payments option. This will take you to the page featuring the Best Payment APIs, where this API is located. By clicking on the API, you will be directed to the API’s dedicated page. Here you can access detailed information and documentation. This documentation provides a list of available endpoints.

To get started, take advantage of the free 7-day trial, allowing you to experience the API’s functionality. Additionally, you can choose a suitable plan based on your monthly call requirements from the available options.

Getting Started.

To start using SWIFT – IBAN – Routing Bank Checker API you need to navigate to the API dedicated page as described above. Then by clicking on the start free trial option on the upper right side of the screen, you need to register after selecting the plan, then you can start your 7-day free trial. You can send API requests using different endpoints based on your interest. Once you select your needed endpoint, make the API call by pressing the button “run” and get the API response.

Example

Routing Number (INPUT) – 121000248

Below is the API response (OUTPUT)

{

"status": 200,

"success": true,

"message": "Routing Bank 121000248 is valid",

"data": {

"routing_number": "121000248",

"date_of_revision": "091012",

"new_routing_number": "",

"bank": "WELLS FARGO BANK, NA",

"address": "255 2ND AVE SOUTH",

"city": "MINNEAPOLIS",

"state": "MN",

"zip": "55479",

"phone": "(800) 745-2426"

}

}