In the realm of modern financial transactions, where digital payments have become the norm, the security and accuracy of data validation are paramount. Enter the Credit Card Validator API, a powerful tool that instills confidence in online merchants and service providers by ensuring that each credit card transaction is not only seamless but also secure. In this article, we delve into the intricacies of the Credit Card Validator – BIN Checker API, exploring how it stands as a beacon of trust in the digital landscape.

A Glimpse into Credit Card Validator – BIN Checker API: The Best Bank API In The Market

At the heart of this technological marvel lies the BIN (Bank Identification Number) Checker API, a sophisticated solution meticulously crafted to verify and validate credit card data. The primary purpose of this Bank API is to analyze the initial digits of a credit card, known as the BIN, which contain essential information about the card issuer, the card type, and even the geographic location of the issuer. By tapping into a comprehensive database of BIN information, the API can swiftly confirm the authenticity of the card, thus minimizing fraudulent activities.

By cross-referencing the provided BIN against a repository of legitimate BINs, this Bank API effectively detects inconsistencies, potential risks, and dubious activities. This meticulous validation process ensures that every transaction is conducted with cards that are not only valid but also in the hands of their rightful owners.

Beyond Validation: Unleashing the Potential

The Credit Card Validator – BIN Checker API transcends the boundaries of conventional validation. Its utility extends to a myriad of applications beyond transaction security. Businesses can utilize the API to gather insights into customer behavior by analyzing the distribution of card issuers or types. Moreover, this API can aid in crafting personalized user experiences by tailoring offerings based on geographical trends. This multi-dimensional functionality positions the API as a versatile tool for businesses aiming to glean insights from the vast ocean of credit card data.

Also, in the grand scheme of digital commerce, trust acts as the cornerstone for successful transactions. For consumers, knowing that their sensitive financial information is shielded by a state-of-the-art validation process breeds confidence. On the other side of the spectrum, businesses can trust the Credit Card Validator API to safeguard their interests by preventing chargebacks resulting from fraudulent transactions. This symbiotic relationship between trust and technology is precisely what makes this API indispensable in the digital age.

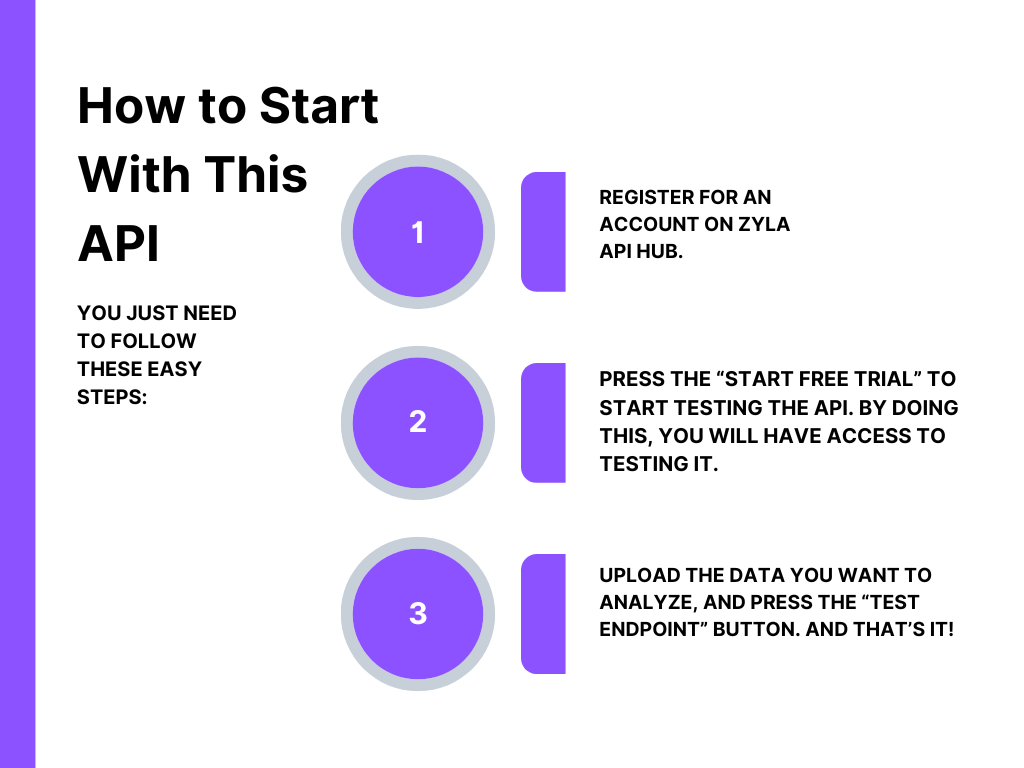

Start To Use This API By Following These Steps

After putting the card’s BIN, 448590, in the test endpoint, you can see the country code, IP city, kind of card, and even category in the response:

The Credit Card Validator API – BIN Checker API stands as a testament to the remarkable synergy between technology and security. Its ability to swiftly and accurately validate credit card data ensures that transactions are not only seamless but also devoid of fraudulent activities. This API serves as a guardian of trust, fostering confidence among consumers and businesses alike. As digital transactions continue to shape the modern economy, the Credit Card Validator API remains a stalwart companion, upholding the values of security, accuracy, and reliability in every transaction it touches.