It’s very easy to obtain copper spot prices with this API that we suggest in this post. Keep reading to learn more about it.

Regardless of the best situation for copper production, when mines can finish their schedule, there could still be a 6 million tonne metal shortage, based on several sources. Cash flows have increased as the normal material quality for copper mines has decreased.

There is a social and political push in several copper-mining countries to stop mining or restructure it. Given that demand is anticipated to rise, miners must make supply-related investments and work to address these challenges.

The switch to renewable energy will play a significant role in driving up copper consumption during the next 2 decades, particularly in the transportation and electricity sectors. Copper is an important metal for decarbonization because of its thermal and electrical properties.

Despite the modest increase in global output, new factories can emerge. To avoid a supply constraint, greater recycling infrastructure will be necessary on the path to net-zero pollution.

Some predictions predict that between 2022 and 2040, the annual demand for refined copper would rise by 53% to 39 million metric tons. The primary forces behind this increase will be the modernization of mobility and the construction industry.

Copper Prediction

From its present level of 53% in 2021, China’s share of the global demand for refined copper may fall to 44% by 2040. This indicates a rise in demand coming from the traditionally slow-growing markets of the United States and Europe.

By 2040, there will be a significant shortfall in the production of primary copper if extra funding does not become available. Prices may rise for an extended period if there is a prolonged supply deficit. The spread and adoption of clean technologies would be hampered by rising building costs and a scarcity of raw resources.

A possible crisis is approaching the world’s major economies. Although a downturn can slow the rise of copper consumption, it could also spur increased capital in production after the crisis.

Use An API To Find Spot Copper Prices

We can already see from what has been shown that there are a lot of considerations to make when making a copper investment. Anything from the state of the world economy to the choices each nation makes, particularly if it has a big role in the utilization of this metal.

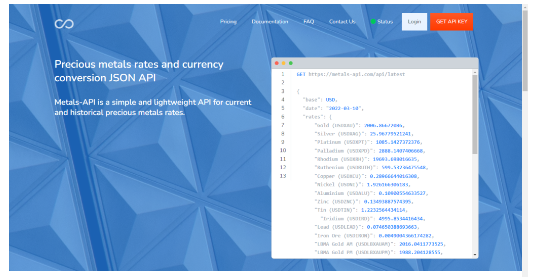

We believe you must have access to the most recent copper prices because of this. You’ll have more information to consider when deciding how to invest as a result. You may access all the most recent data from trustworthy sources via an API. Therefore, we suggest Metals-API, whose reply reads as follows:

Why Metals-API?

Weather derivatives, volatility information, and data on recent and past prices are all provided by Metals-API. It offers extremely thorough documentation to notice many kinds of trade data for metals.

You’ll have all to make investments in this sector and encourage others to do the same this way. By doing this, you will establish yourself as a dependable source of data on this sector.

Your website and apps may include the data in the desired currency. Because you can utilize the API in several programming languages, you won’t experience any integration issues.